XRP Price Prediction: Ripple must hold above this support level to fully recover

- XRP price had a solid profitable day yesterday, bouncing off a strong support level.

- The reclaim of $0.6263 is pushing the Ripple back lower again.

- The global glut in cryptocurrencies looks to have found its bottom and should be set for a recovery soon.

XRP price has not had the best series of numbers in the past few days. With the push to the downside and monthly pivots each time broken to the downside, Ripple is fishing in the bottom for some support.

XRP price is going sideways, awaiting the tailwind to move higher

With the global muted price action in cryptocurrencies this week, many investors take the time to reflect and look for solid entry points to go forth on for their strategy.

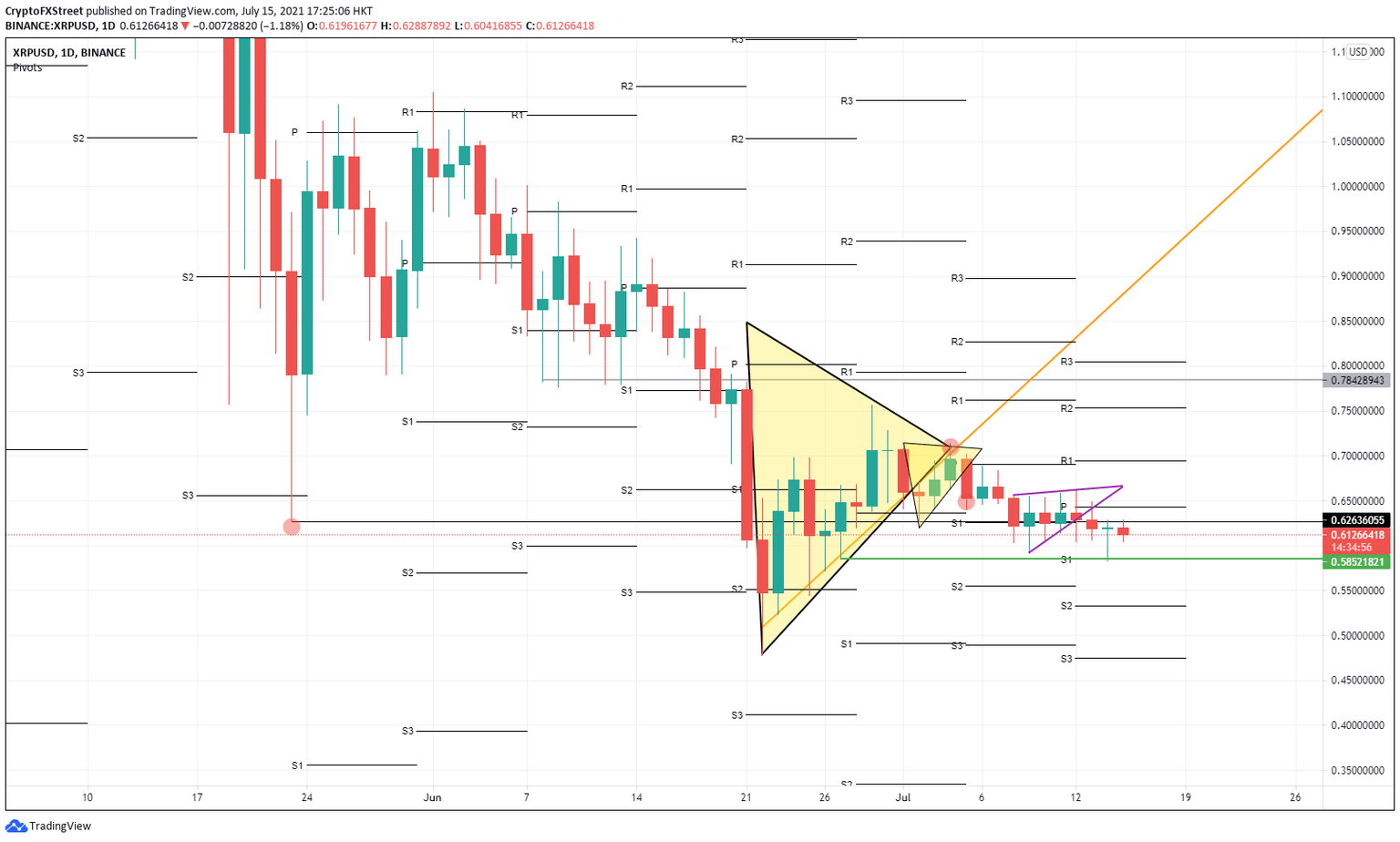

XRP price was in favor of that approach yesterday, with an entry point revealing itself at $0.5852. The entry point fell in line with the monthly Support S1 and was the low of the trading session on June 27. Look at it as one of the first lines of defense before Ripple can talk about $0.50.

The level looks to be holding up for now. The candle itself from yesterday looks healthy as well and almost qualifies for a “hammer”. The body on the upside is not thick enough, but it looks solid enough to allude to a change in sentiment. That got confirmed by the reclaiming of the $0.6263 level.

XRP price is creating a double top and higher lows, so the squeeze from buyers against the sellers is taking place.

Should Ripple break above $0.6263, then expect further upside potential toward $0.70.

If XRP price is squeezed to the upside, it will be essential to see if it can close above $0.6263 by the end of this week. A weekly close above there would be crucial for any further upside potential, confirming that buyers have taken over the price, and a more solid upside is in the cards.

On the flip side, failing to consolidate above could lead to further sideways price action with a retest of the barrier at $0.5852. If that breaks, expect XRP price to move toward $0.55 that falls in line with previous months' S2 support and June 25 low.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.