XRP Price Prediction: Ripple momentum weakens as bears contemplate 15% decline

- XRP price dropped below a crucial support level on November 26, possibly unraveling a bearish forecast.

- The governing technical pattern suggests that Ripple could see a decline of 15%.

- To avoid the pessimistic outlook, XRP would need to climb above $1.07.

XRP price fell below an essential line of defense on November 26, opening up the possibility of a further decline for Ripple. The cross-border remittance token is now struggling to tag higher levels as selling pressure increases.

XRP price faces minor sell-off

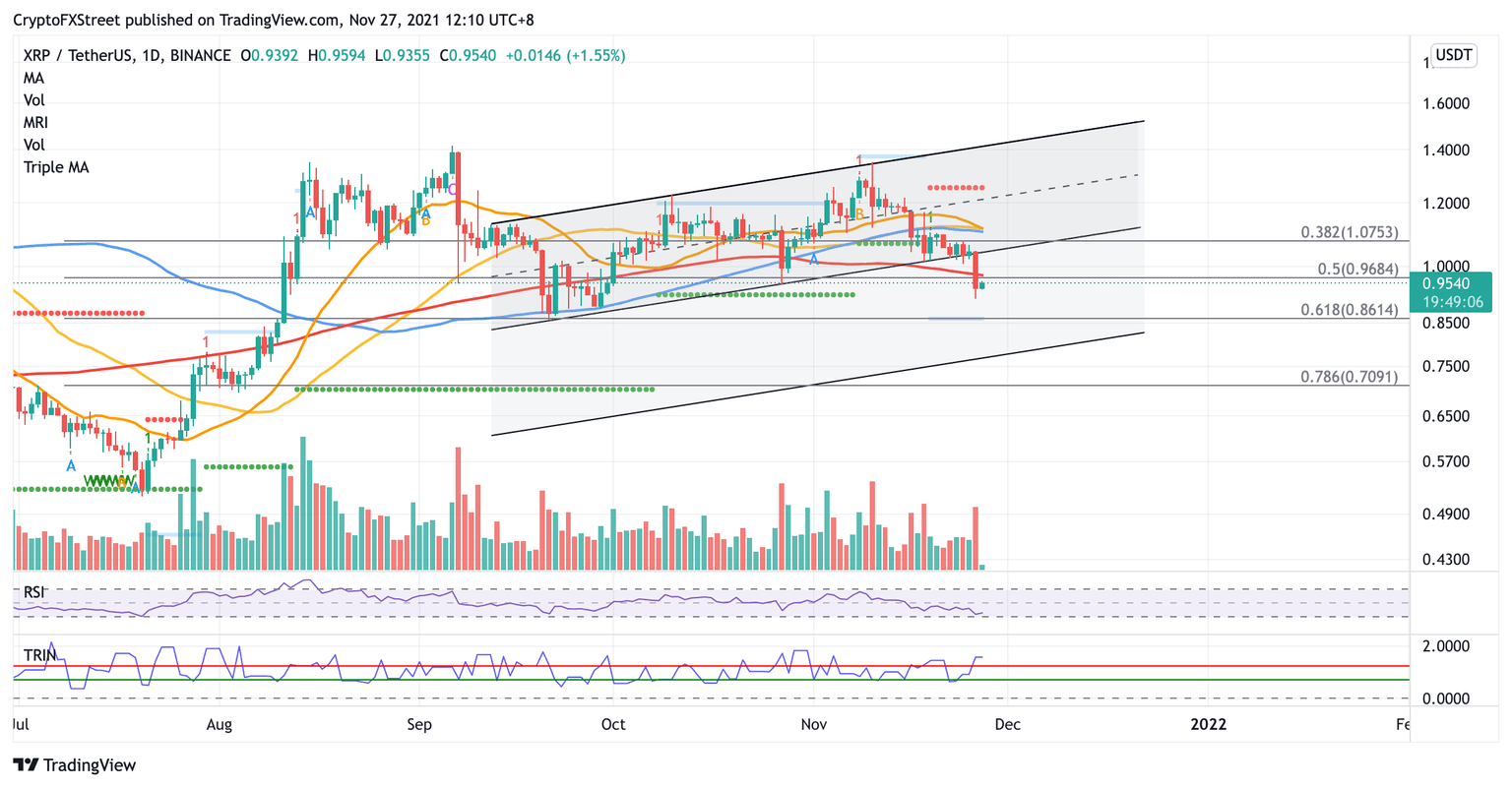

XRP price has sliced below the lower boundary of the ascending parallel channel pattern on the daily chart, unraveling a bearish outlook. The prevailing chart pattern suggests a 22% decline from the downside trend line from $1.03.

XRP price may discover its first line of defense at $0.92, where the support line given by the Momentum Reversal Indicator (MRI) sits. The next foothold will emerge at the 61.8% Fibonacci retracement level at $0.86. If investors continue to engage in profit-taking, Ripple may drop lower to tag the bearish target at $0.79, resulting in a 15% descent.

If a massive spike in sell orders occurs, XRP price may drop even lower, exceeding the aforementioned target, reaching the 78.6% Fibonacci retracement level at $0.70, corresponding to the July 30 low.

The Arms Index (TRIN) which gauges overall market sentiment suggests that there are substantially more sellers than buyers in the market.

XRP/USDT daily chart

If the bulls decide to step in to undo the bearish narrative, XRP price will face immediate resistance at the 200-day Simple Moving Average (SMA) at $0.96, coinciding with the 50% retracement level.

XRP price may have a chance at restoring its uptrend if it climbs back above the downside trend line of the parallel channel at $1.07, corresponding to the 38.2% Fibonacci retracement level. However, a stiff hurdle may appear close by at $1.11, where the 21-, 50- and 100-day SMAs intersect.

An acceleration of interest in Ripple may see XRP price ascend higher toward the middle boundary of the prevailing chart pattern at $1.25.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.