XRP Price Prediction: Ripple may retrace before advancing 30%

- XRP price is approaching a supply barrier extending from $1.09 to $1.18.

- Ripple might retrace to the support level at $0.84 before it resumes an uptrend.

- On-chain metrics indicate no immediate threat to the optimistic outlook but reveal more room to the upside.

XRP price shows a slow down of its momentum after the recent impulse wave. Therefore, minor retracement or sideways movement seems likely before Ripple restarts its rally.

XRP price prepares for the next leg up

XRP price saw a 62% upswing to $1.06 from the swing low created on May 23 at $0.65. This massive climb shows signs of slowing down as it approaches the supply zone, ranging from $1.09 to $1.18. Due to the extent of the recent impulse wave, Ripple will likely retrace to support level at $0.84 before continuing its ascent.

Such a move will allow the buyers to recuperate their momentum and enable the remittance token to come back stronger. Under these conditions, XRP price is likely to rise to $1.32.

If the buying pressure continues to maintain at high levels beyond the said level, XRP price may soar another 18% to test $1.56.

Clearing these obstacles will allow Ripple a path to retest the supply barrier created in 2018.

XRP/USD 6-hour chart

Supporting this optimistic hypothesis is Santiment’s 30-day Market Value to Realized Value (MVRV) model. This fundamental index is used to determine the profit/loss of investors that purchased XRP in the past month.

At the time of writing, this metric was in the ‘opportunity zone’ at -22.22%, suggesting that the short-term holders are panic-selling and allowing the long-term holders to accumulate more. Thus, MVRV portrays a bullish outlook for Ripple.

XRP 30-day MVRV chart

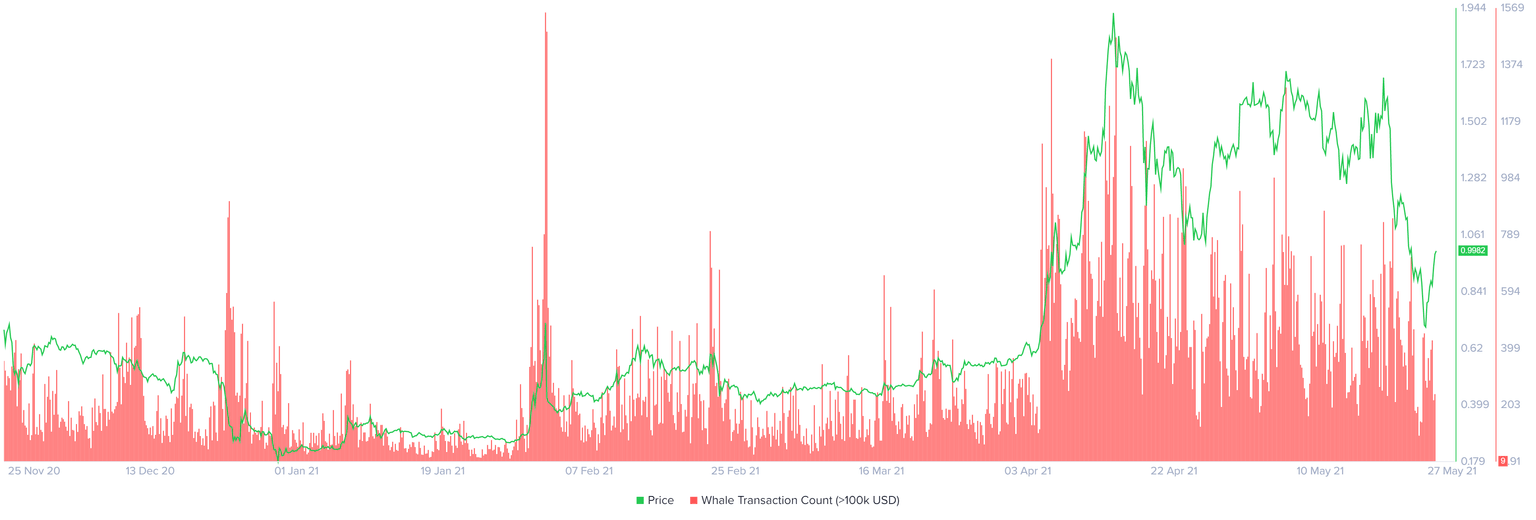

Furthermore, the whale transaction count, a metric that tracks transfers worth $100,000 or more. A spike in this metric indicates that whales are either looking to book profits or reallocate their funds, which is a bearish signal.

Such transfers are currently hovering around 15, a 48% decrease from the recent uptick on May 24, suggesting no immediate threats despite the recent rally.

XRP whale transaction count chart

Investors should note that if the bullish thesis explained above depends on the fact that XRP price recoils from the support level at $0.84. However, a breakdown of this barrier will suggest an increased selling pressure and invalidate the optimistic narrative.

Under these conditions, Ripple may retrace toward the recent swing low at $0.65 or tag $0.642, the upper boundary of the demand barrier below it.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.