XRP Price Prediction: Ripple edges closer to a 23% breakout

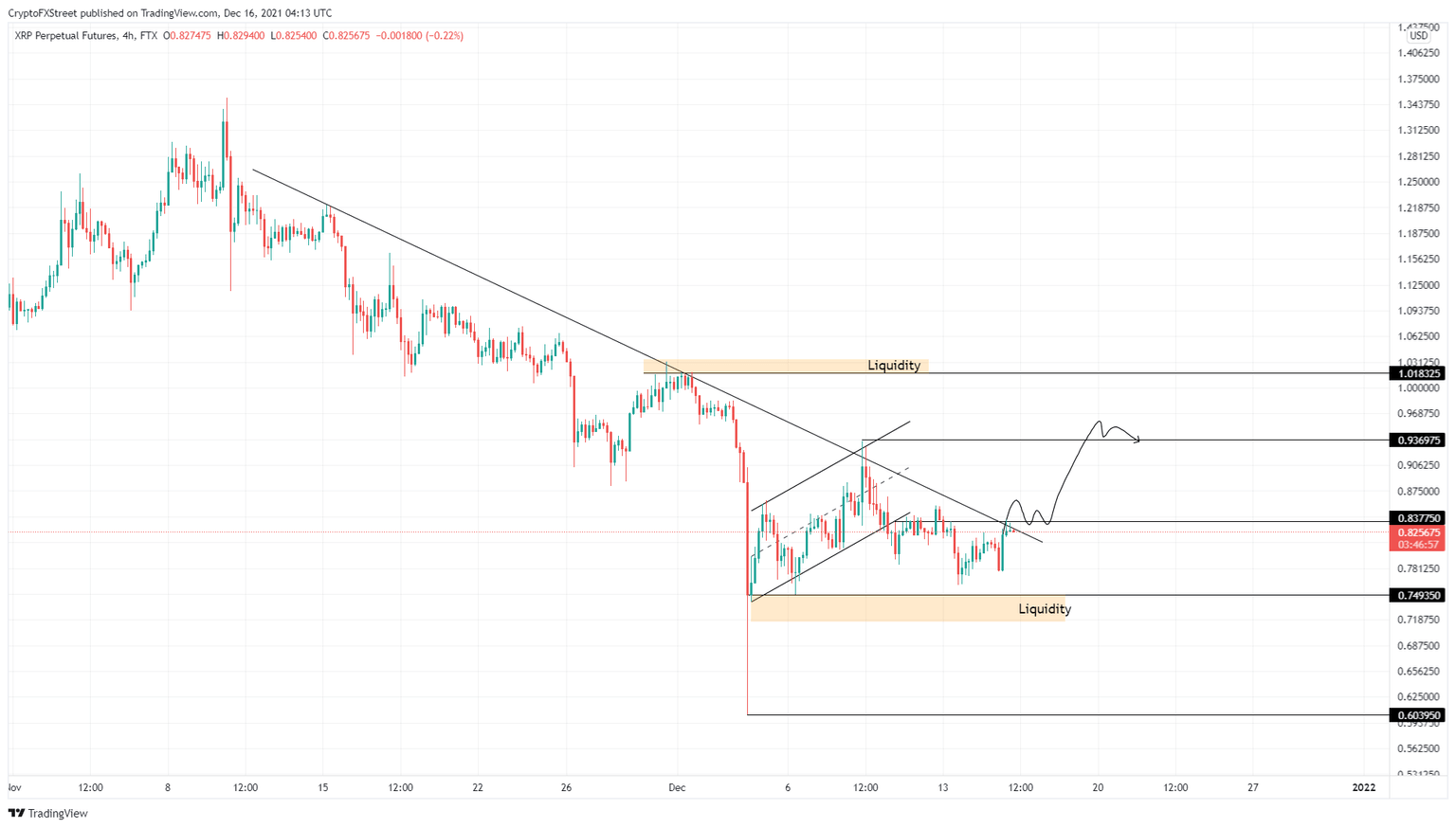

- XRP price is slithering close to breaching the declining trend line and triggering a full-blown upswing.

- A decisive close above this hurdle will allow Ripple to revisit $0.956 and $1.030 levels.

- If the remittance token produces a lower low below $0.688, it will invalidate the bullish thesis.

XRP price is stuck in a downtrend for roughly a month but is slowly marching toward an inflection point. A breakout from this hurdle could trigger a massive uptrend for the remittance token.

XRP price resurgence likely

XRP price has been stuck under a declining resistance level for more than a month. So far, every attempt from the bulls has failed to breach this hurdle. However, the recent uptick in buying pressure seems to have propelled XRP price to retest this barrier.

A decisive close above $0.900 will indicate a breakout from this ceiling and confirm the start of an uptrend. In this situation, XRP price will aim for a retest of the $0.950 hurdle. Clearing this area will open the path to revisit the $1.030 resistance level and collect liquidity resting above it.

In total, this upswing for XRP price would indicate a 23% ascent from the current position - $0.828. While retesting $1.030 could be a short-term target, an increase in bullish momentum could allow XRP price to extend its climb to $1.100, revealing a 33% gain.

XRP/USDT 4-hour chart

On the other hand, if XRP price fails to breach the declining trend line, it will indicate a weak buying pressure. If the sellers wish, they could knock the remittance token down to $0.688. A swing low below this level will invalidate the bullish thesis for XRP price and potentially crash it to $0.612.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.