- XRP price stalls at the psychologically important $2.

- Coinshares launches XRP exchange-traded product.

- Securities and Exchange Commission (SEC) war on Ripple losing basis.

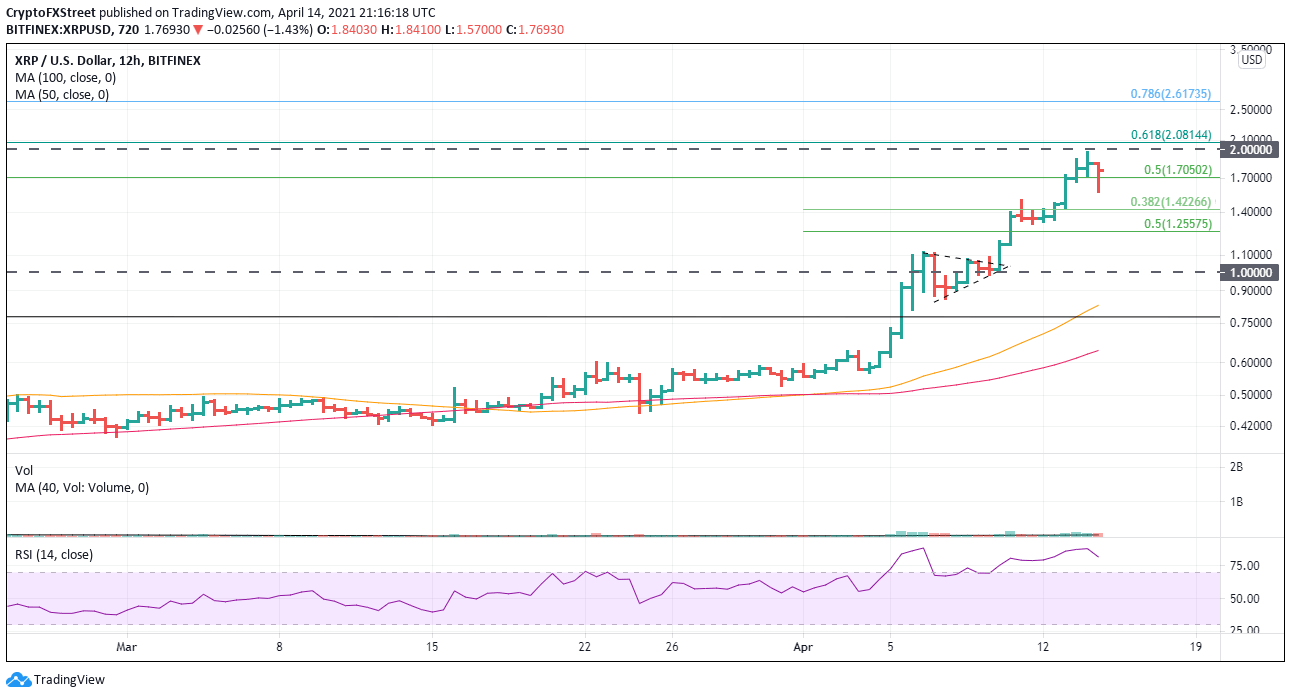

XRP has climbed over 360% over the last five weeks, from the low to its high, and is on pace to close with the second-best month since inception with a current gain of 200%, and it is up over 700% from the lowest price level this year. With all the euphoria that has followed the price action and the underlying deterioration in the SEC case against Ripple, it is easy to overlook the charts. Still, they are arguing for at least a short-term consolidation.

XRP price supported by multiple large transfers of the coin

Coinshares, a digital investment firm, announced yesterday that it would launch an exchange-traded product (ETP) following the performance of XRP. The new product will be listed on the government-regulated SIX Swiss Exchange and will be physically backed as each unit will be worth 40 tokens at the beginning. The ETP will carry a total expense ratio of 1.50%, and the base currency will be the USD.

It is a bullish statement by Coinshares considering the lingering legal battle with the SEC. This once again shows that Ripple resonates with companies and investors outside of the United States. Townsend Lansing, head of ETPs at CoinShares, concurs when he remarked, “once we determine that a professional-caliber product is feasible, and it appears that demand exits to make a liquid market for trading the product, we bring the product to fruition.”

At today’s high, Ripple’s daily chart is showing that the Relative Strength Index (RSI) did not confirm price, creating a mild bearish momentum divergence. On a weekly basis, the RSI is near the reading registered at the November 2020 highs.

If the weakness today evolves into a consolidation or even a correction, it should garner heavy support at the 38.2% retracement of the rally beginning on April 1 at $1.42. Weakness below that level would dampen the bullish outlook and delay a successful break of $2 into May or later.

XRP/USD 12-hour chart

As noted, $2 will be an obstacle just like $1, but with the 61.8% retracement in close vicinity at $2.08, it may prove more challenging. The next upside target is the 78.6% retracement at $2.62.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.