XRP price must smash through these obstacles before the bulls send Ripple above $1

- XRP price will face multiple obstacles ahead before the token could return to $1.02.

- Ripple will need to slice through the stiff hurdles ahead before reaching the optimistic target with a 31% ascent.

- An increase in selling pressure may incentivize the bears to target the 200 three-day SMA next at $0.67.

XRP price has seen its momentum shift slightly to the downside after recording its swing high on February 9 at $0.91. Ripple may be looking to discover critical levels of support before targeting higher levels. The cross-border remittances token may be confronted with a series of challenges before its return to $1.02.

XRP price plans return to $1.02

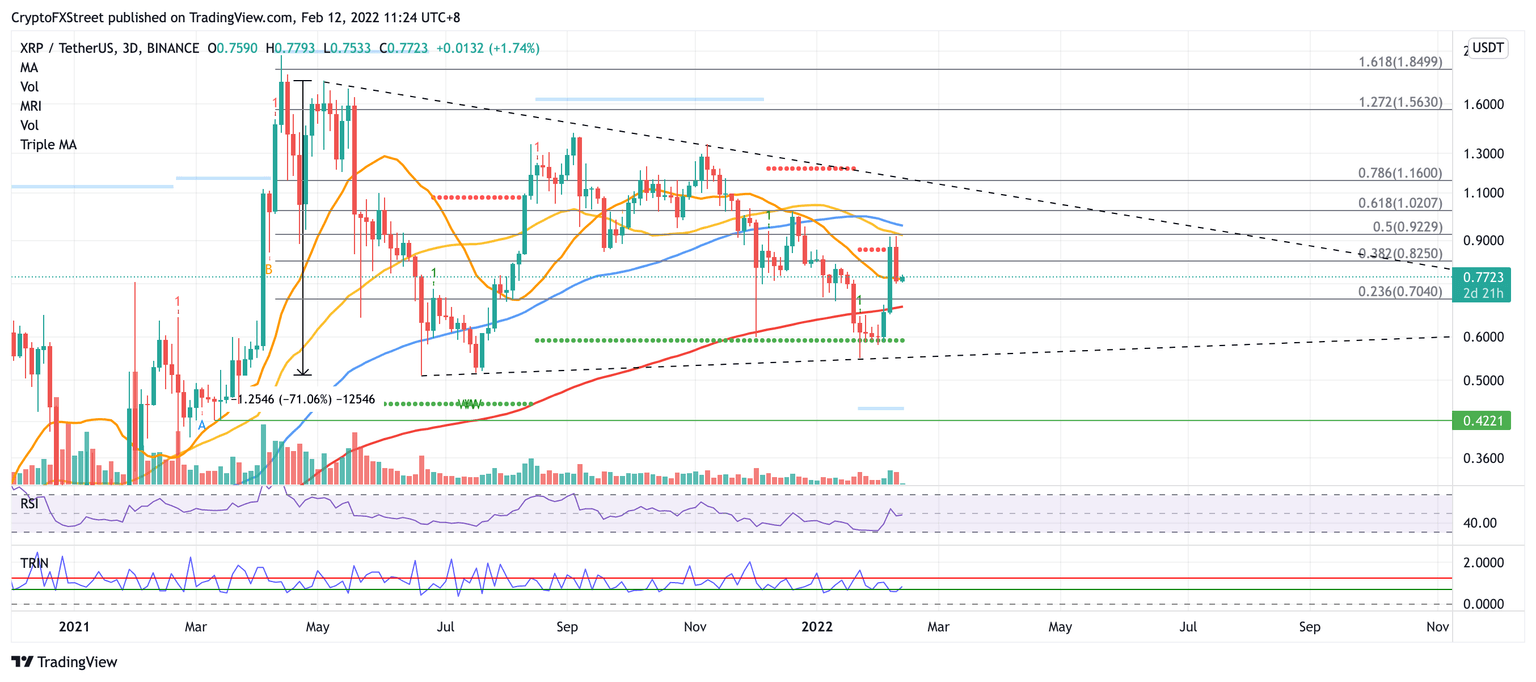

XRP price has formed a symmetrical triangle pattern on the 3-day chart, suggesting that Ripple may continue to consolidate and move sideways within the foreseeable future. After a shift in momentum, the token is sliding lower to explore critical levels of support before its next rally.

If bullish sentiment rises, XRP price could aim for the upper boundary of the governing technical pattern at $1.02, coinciding with the 61.8% Fibonacci retracement level. However, a few challenges may arise before Ripple manages to tag the aforementioned optimistic target.

The first line of resistance may emerge at the 38.2% Fibonacci retracement level at $0.82, then at the 50 three-day Simple Moving Average (SMA) at $0.92, intersecting with the 50% retracement level.

Additional buying pressure push XRP price higher, but Ripple may be confronted with a hurdle at the 100 three-day SMA at $0.95 before reaching the bullish target at $1.02.

XRP/USDT 3-day chart

However, if a spike in sell order occurs, XRP price will find an immediate foothold at the 21 three-day SMA at $0.76. An additional line of defense will appear at the 23.6% Fibonacci retracement level at $0.70, then at the 200 three-day SMA at $0.67.

A further increase in bearish sentiment may see XRP price fall toward the support line given by the Momentum Reversal Indicator (MRI) at $0.59 before Ripple drops toward the lower boundary of the prevailing chart pattern at $0.55.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.