XRP price is on the verge of a 40% move, but it all depends on two crucial levels

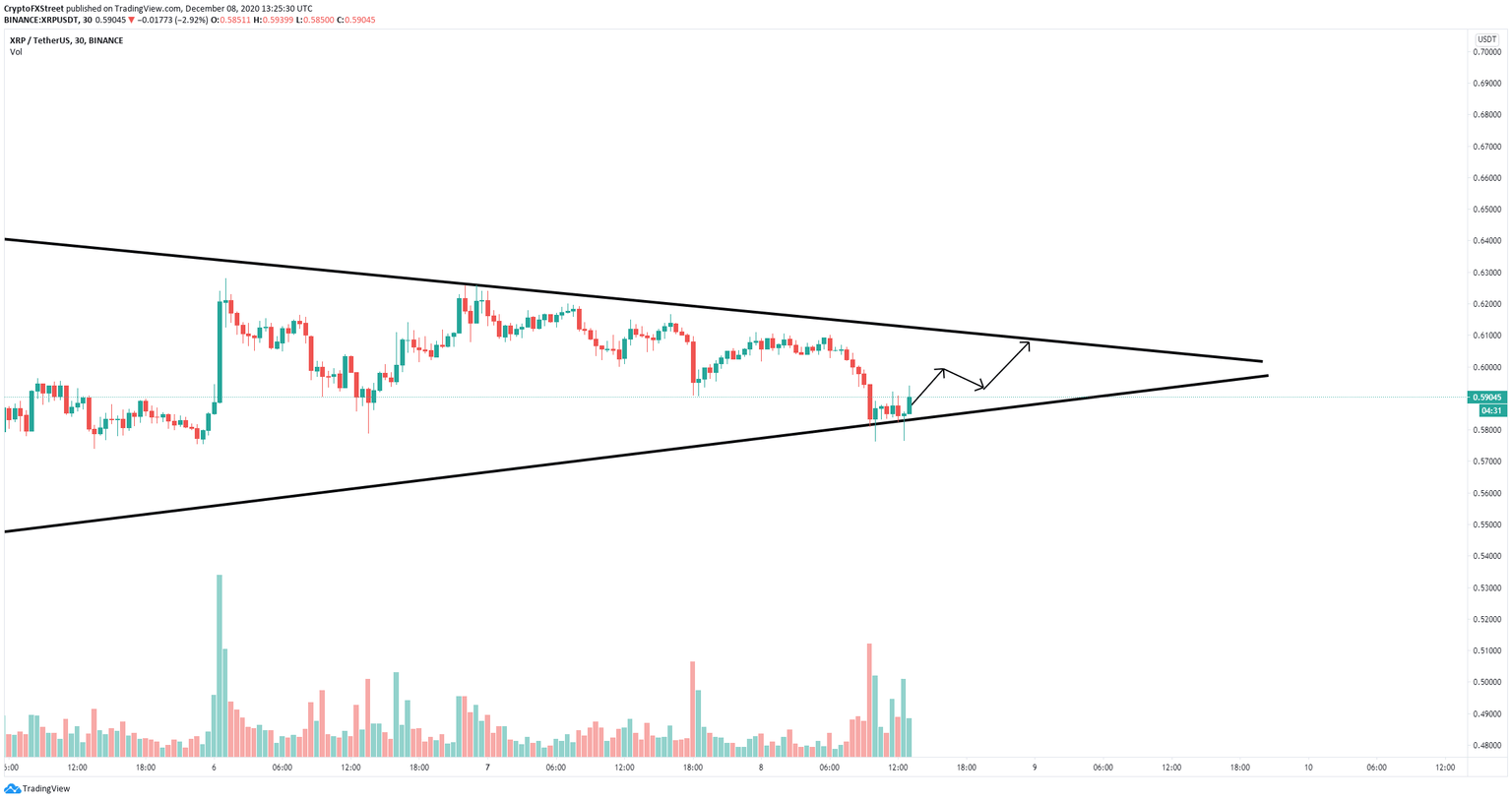

- XRP price is currently bounded inside a symmetrical triangle pattern on the 30-minute chart.

- The digital asset is on the verge of a breakout or breakdown within the next 24 hours.

XRP is currently trading at $0.59 and awaits a clear breakout or breakdown in the short-term from a massive symmetrical triangle formed on the 30-minutes chart. The upper and lower trendlines are the most significant resistance and support levels at the time.

XRP price on the cusp of a massive move

Ripple has established a symmetrical triangle pattern on the 30-minute chart, which is on the verge of a massive breakout or breakdown. The price has just rebounded from the lower trendline at $0.58, and the digital asset is now trading at $0.59.

XRP/USD 30-minute chart

Bulls aim for an initial price target of $0.60, the middle of the triangle, and eventually a rebound towards the upper boundary of the pattern. A decisive breakout above $0.61 would be a clear bullish signal capable of pushing XRP price towards $1 in the long-term.

On the other hand, if XRP cannot rebound higher and the lower trendline support at $0.57 fails to hold, bears will take control and drive XRP price towards $0.33 in the long-term if they can get enough follow-through.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.