XRP price defends critical support as Ripple lawyer anticipates ‘clever Super Bowl Bitcoin Spot ETF’

- Ripple price continues to consolidate horizontally, hinting at a possible move soon as markets tend not to wait for so long.

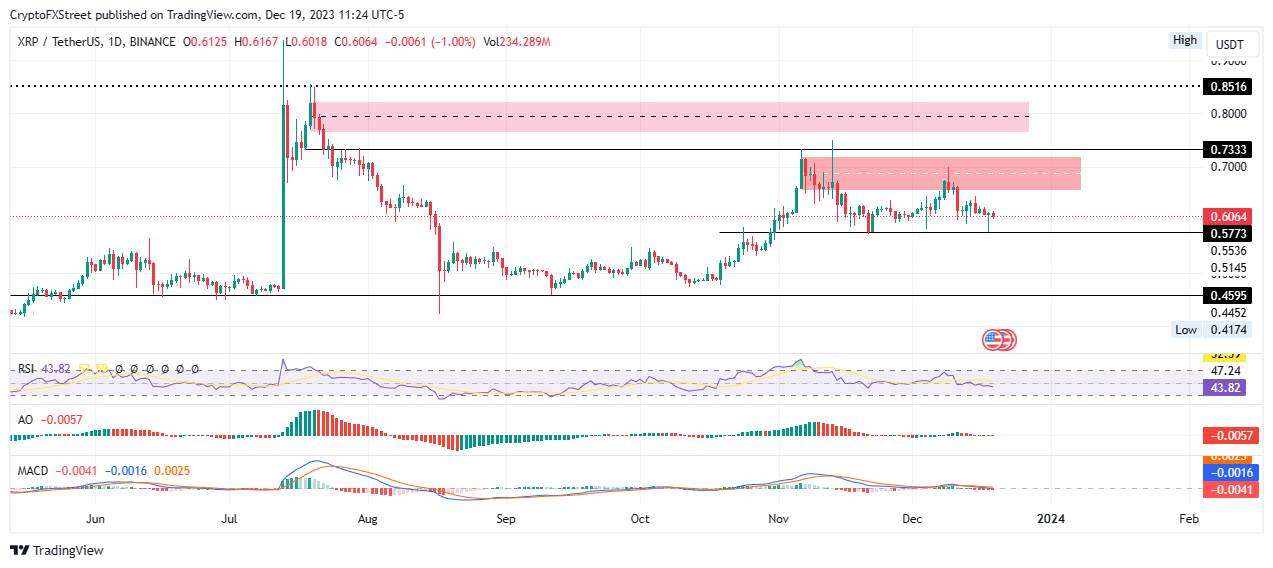

- From a technical standpoint, XRP could rise drop 5% to lose the $0.5773 support, unless bulls push 15% north.

- A daily candlestick close above $0.6880 would invalidate the bearish thesis, bringing the next supply order block into focus.

Ripple (XRP) price is moving horizontally, lacking directional bias as the market anticipates the holidays. Nevertheless, the XRP community remains broadly optimistic, as indicated by the social sentiment chart. It comes as the countdown for spot Bitcoin exchange-traded funds (ETFs) continues to close in and Ripple attorney John E. Deaton has an opinion on the narrative.

Also Read: Ripple joins crypto firms in $78 million initiative to support pro-crypto candidates in US elections

Ripple lawyer anticipates ‘clever Super Bowl Bitcoin Spot ETF’

Ripple lawyer John Deaton says that once the US Securities and Exchange Commission (SEC) approves spot BTC ETFs, the marketing teams of individual applicants will try to outdo each other, effectively leading to one breaking out with a super bowl Bitcoin ETF.

Exactly what we discussed on @Crypto_TownHall. Once these ETFs are approved watch the marketing teams try and outdo each other. Who will break out with the clever Super Bowl #Bitcoin Spot ETF? Fidelity, BlackRock? https://t.co/RK6kDVOQca

— John E Deaton (@JohnEDeaton1) December 18, 2023

As reported, there is a theory that the SEC has decreed a 'do cash creates or wait' order, with several players in the race already bending the knee. Among them, Valkyrie, Invesco, Fidelity Investments, Ark Invest, 21Shares, and BlackRock.

Despite the capitulation, the instututions continue to hold out hope for in-kind creates, with BlackRock noting in its S-1 ammendment, "Subject to the in-kind Regulatory Approval, these transactions may also take place in exchange for bitcoin."

Meanwhile, Ripple (XRP) market remains broadly optimistic, according to social sentiment data, flashing green at the five index as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) remain borderline impartial under the 2.5 index.

Ripple Social Sentiment

Ripple price outlook from a technical standpoint

If the supply barrier extending from $0.6544 to $0.7195 holds as a resistance order block, Ripple price could extend the fall, losing the immediate support at $0.5773. A break and close below this level would spell doom for the bulls.

Based on the outlook of the Relative Strength Index (RSI), momentum is falling, which coupled with the negative position of the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD), the odds favor the downside.

If the $0.5773 level breaks, the Ripple price could slip through, with a possible revisit of the $0.4595 support floor. Such a move would denote a 25% drop below current levels.

XRP/USDT 1-day chart

On the flip side, with the market sentiment flashing bullish, Ripple price could pull north, foraying into the supply zone that extends from $0.6544 to $0.7195. Such a move would constitute a 10% climb above current levels. To confirm the uptrend, however, the gains must extend for XRP price to overcome the midline of the supply zone at $0.6880. This would mean a 5% extension above the aforementioned level.

In a highly bullish case, the gains could extend for Ripple price to flip this supply zone into a bullish breaker above the $0.7333 level, paving the way for a continuation of the trend to the next supply barrier between $0.7651 and $0.8234.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.