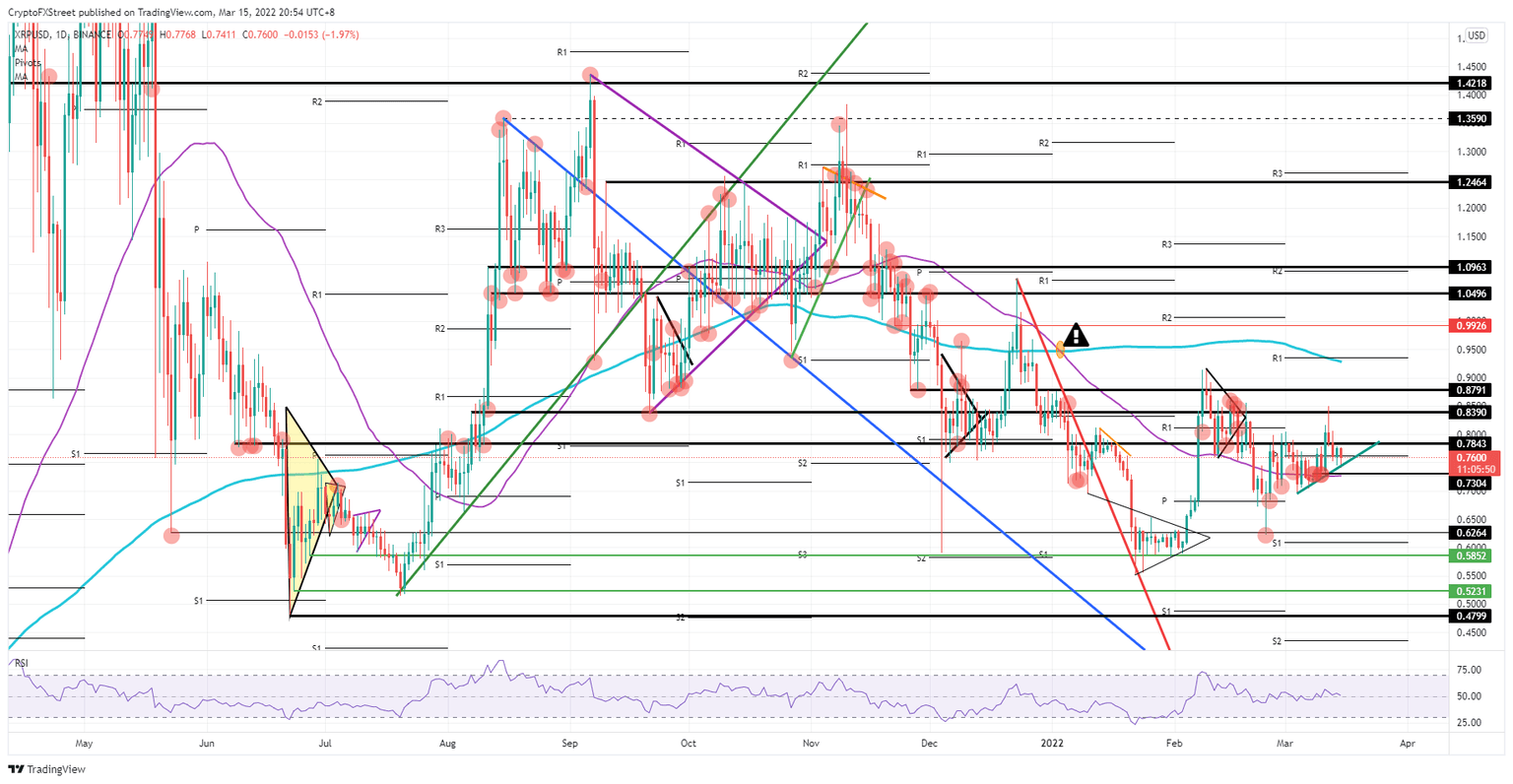

XRP price forms bull trap before 16% correction

- XRP price action caught bulls in a bull trap at the weekend.

- Ripple price action saw a bullish breakout followed by a sharp retracement to the downside.

- Expect to see an accelerated move lower as bulls switch sides to get out of their losing positions.

Ripple (XRP) price action is on the cusp of breaking its short-term uptrend as bulls got trapped over the weekend in their attempt to break above $0.8390. In the wake of that break, price action dropped around 11%, saddling bulls with significant losses. Some traders are ignorant as to what to do next as global markets are getting more nervous by the day with several yield curves predicting a recession around the corner. Expect $0.7304 to hold for now supported by the 55-day Simple Moving Average and a short-term floor, but once bulls pull the plug on their losses, expect to see a triggered drop towards $0.6264, the low of February.

XRP price set to retest the lows of February

XRP price action was an outlier on Saturday as a bullish pop or breakout pushed the price above $0.8390 but got cut short by bears jumping on the window of entry and pushing price action back to the pivot level at $0.7590. Although a relatively bullish triangle has formed, this weekend's early breakout has trapped plenty of bulls in the process who could now start swinging to the sell-side. That could add volume to offers and see buyers being overthrown with just too much supply in XRP.

XPR price action could, in a first phase, drop to $0.7304, the short-term bottom from the beginning of March and the 55-day Simple Moving Average (SMA) just below. More selling could follow as the Relative Strength Index is still quite elevated and still has plenty of room to drop before becoming oversold. That opens the door for a gap drop towards $0.6264 or $0.6000, with the first a historic level from May 23 and the monthly S1 support level, before XPR price action will be spun around back up for a bullish inflow.

XRP/USD daily chart

With the Nasdaq on the front door this morning, it could well be that a bounce off the short-term green ascending trend line will unfold for today. Expect to see an attack at $0.7843. A pop above would open the door for more gains going into Wednesday and Thursday, putting $0.8390 back on the docket and seeing bulls carefully building up more of a stake in the price action in order not to get trapped yet again. A jump towards $0.9300 could be a bit too far fetched but could make sense as the 200-day SMA and the monthly resistance pivot at R1 could work like a magnet for offloading long positions. This is also a level where bears might take on some short positions to defend room above the 200-day SMA and preserve the death cross.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.