XRP Price Forecast 2023: Ripple gears up for a bright future if it wins legal battle with SEC

- Ripple continues aggressive defense in court against the charges from the US Securities and Exchange Commission.

- XRP price primed for massive breakout targeting $1.7648 level by Q1 2023, once it breaks out of falling wedge.

- On-chain metrics showing signs of massive accumulation by whales point at a bullish outlook in 2023.

Ripple’s cross-border settlement token XRP price has been on a roller coaster ride since the beginning of the Securities and Exchange Commission (SEC) vs Ripple lawsuit in December 2020. Payment giant Ripple made strides through several partnerships and developmental updates in its ecosystem, boosting XRP’s utility and driving the altcoin’s adoption. The outlook on XRP price remains bullish for 2023.

SEC v. Ripple lawsuit recap and what to expect in 2023

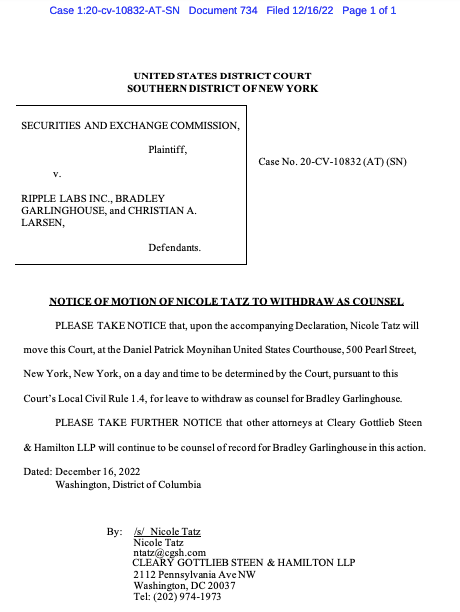

The latest update in the SEC v. Ripple lawsuit is that attorney Nicole Tatz, from Ripple CEO Brad Garlinghouse legal counsel, has applied to withdraw as the co-defendant’s counsel in the ongoing lawsuit.

Attorney Tatz submitted the motion to withdraw as counsel on December 16, saying that other lawyers at the US law firm Cleary Gottlieb Steen & Hamilton LLP will “continue to be counsel of record for Bradley Garlinghouse in this action.” The attorney made it clear that she would no longer be associated with the law firm, starting December 31.

Nicole Tatz’s motion to withdraw as attorney of Brad Garlinghouse

XRP holders have watched the SEC v. Ripple lawsuit closely since December 2020 for two reasons:

- Ripple is the largest public holder of the altcoin XRP.

- SEC v. Ripple lawsuit resulted in mass delisting of XRP across crypto exchange platforms.

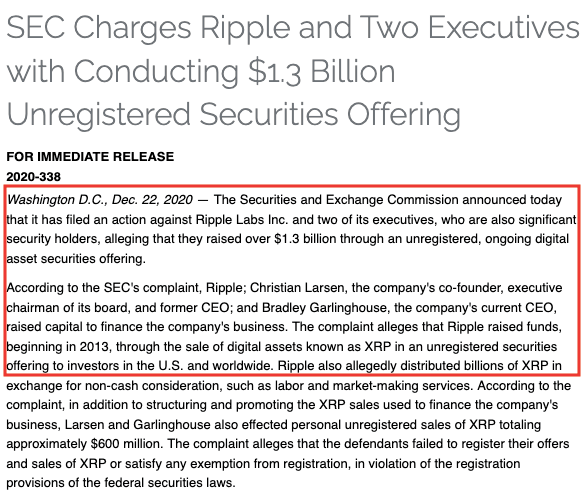

The United States financial regulator brought charges against cross-border payment settlement firm Ripple and its executives in December 2020. The US Securities and Exchange Commission alleged that Ripple and its executives’ sale of the XRP token constituted an offering of “unregistered securities” worth over $1.38 billion. Ripple’s executive chairman Chris Larsen and CEO Brad Garlinhouse were listed as co-defendants.

SEC filed action against Ripple Labs Inc. on Dec 22, 2020

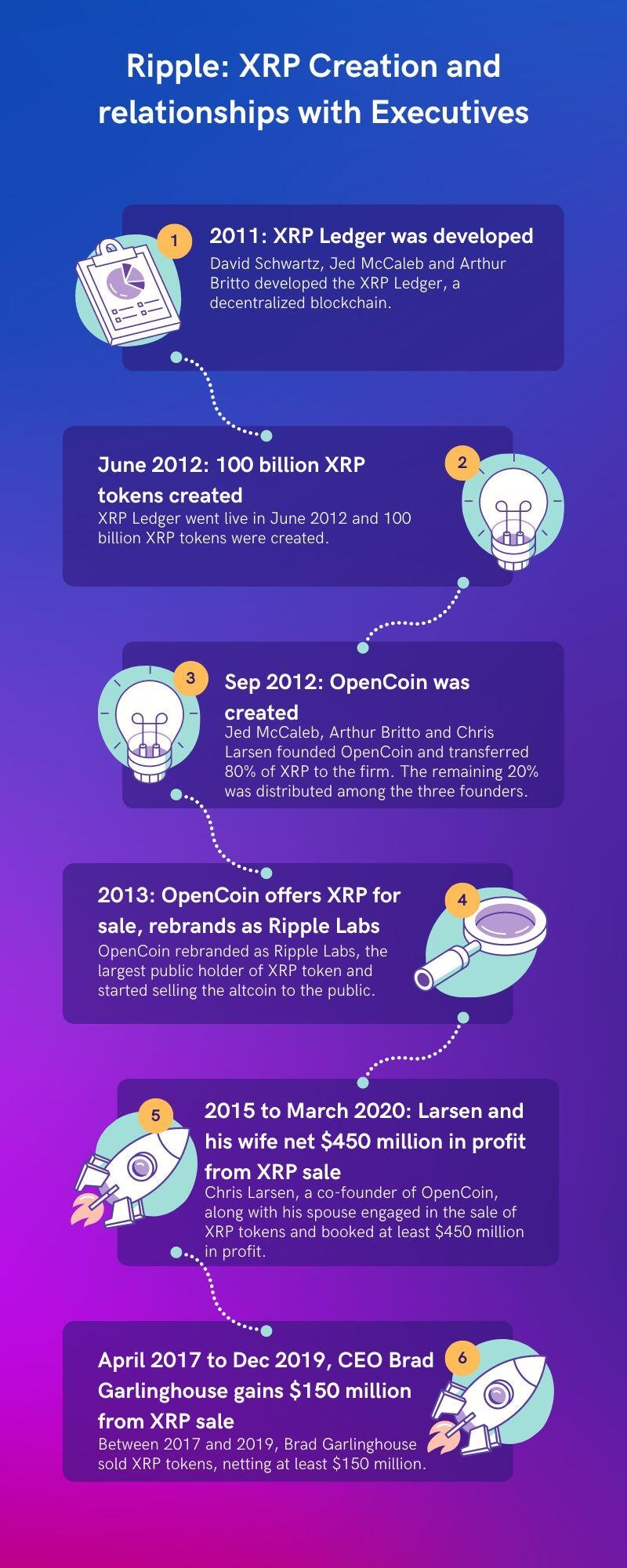

The following infographic sheds light on the timeline of creation of the third-largest altcoin by market capitalization, XRP. It reveals the interconnectedness of XRP sale with executives named in the lawsuit and reasons why the US SEC filed legal action against the payment giant.

Ripple’s creation and sale by OpenCoin and executives

The nature of the SEC charges against Ripple become clearer when looking at the period from 2013 to December 2019. The United States financial regulator’s lawsuit garnered the attention of leading cryptocurrency exchanges and, as a consequence, the XRP token was delisted by Coinbase, Kraken and Binance US among other platforms. In January of 2021, a total of 26 crypto trading platforms, market makers, and trading firms had delisted XRP as the altcoin’s price nosedived after news of the SEC v. Ripple lawsuit.

Find a detailed list here:

Crypto exchanges: Bitstamp, Abra, eToro, Coinbase, Beaxy, OSL, OKCoin, Ziglu, iTrustCapital, Eobot, Stex, BinanceUS, CrossTower, Crypto.com, Bittrex

Market maker: B2C2, Jump Trading, Galaxy Digital

Crypto wallet: Swipe

Asset manager: 21shares, Sarson Funds, Bitwise

Crypto payments: Simplex, Wirex,

Brokers: Genesis Trading, Bitcoin Suisse

The SEC’s case against Ripple stands on the grounds that XRP is a security according to the Howey Test.

US SEC insists XRP is a security and passes the Howey Test

The US Securities and Exchange Commission charged Ripple claiming that the cross-border remittance firm and its executives engaged in the sale of a security: XRP. A security is a traded financial instrument representing ownership in a corporation or similar entity but has no utility. Since XRP tokens were used to fund Ripple’s platform Ripple Labs Inc, formerly OpenCoin, the SEC considered it a security.

The following is the legal definition of a security:

The United States SEC v. Howey, a landmark Supreme Court case in 1946 aids in determining whether a transaction falls within the Securities Act of 1933’s definition of an investment contract.

According to the Howey test, the investor’s control over the profit is a key factor in determining whether or not an investment contract is a security. It is typically considered a security if the investors have no influence over the asset.

Did XRP meet the requirements of the Howey Test?

XRP meets requirements of The Howey Test

The US financial regulator requires securities to be registered with it and financial information to be publicly reported. The purpose is to protect investors’ interests while combating fraud. The SEC determined that XRP satisfied the Howey test’s requirements because:

- Ripple Labs sold $1.38 billion worth of XRP to investors

- Investors purchased the altcoin assuming they were investing in a joint venture

- Ripple’s marketing efforts and supply manipulation pushed XRP price higher, therefore the companies activities increased the value of the token

Based on the points stated above, the US SEC believes that XRP is a security and passes the Howey Test.

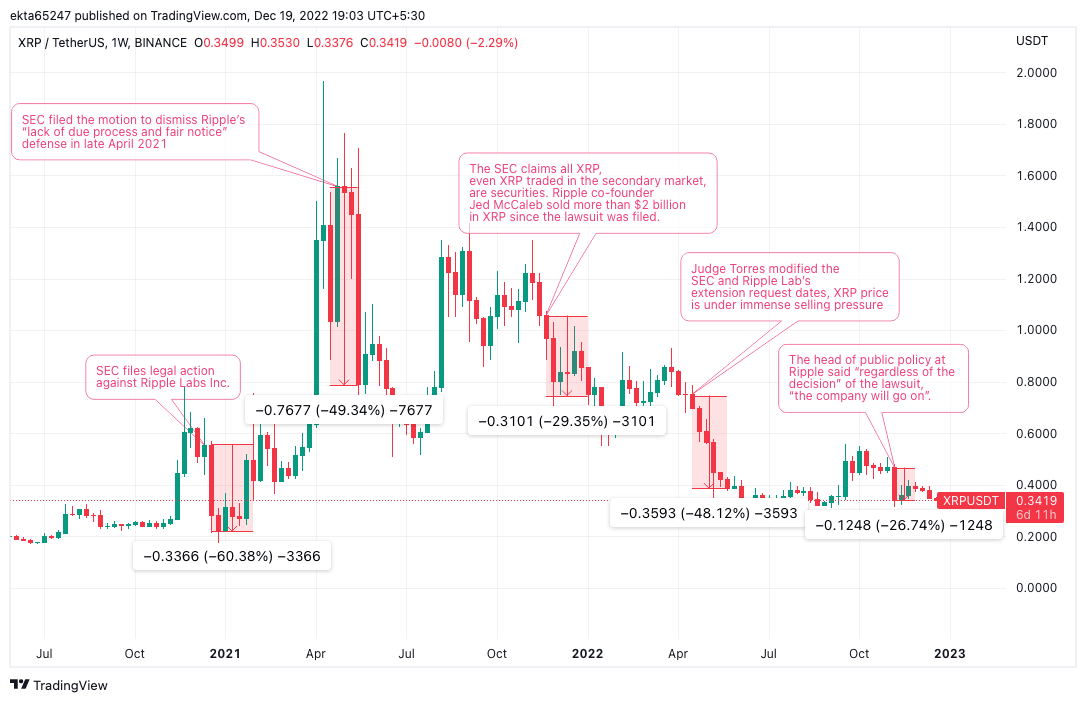

The SEC v. Ripple lawsuit negatively influenced XRP’s price over the last two years.

XRP/USDT price chart with SEC v. Ripple lawsuit updates and drawdowns in the altcoin

Experts predict a positive outcome of the lawsuit for Ripple

The final verdict in the ongoing SEC v. Ripple lawsuit is undoubtedly the most highly anticipated in the crypto ecosystem. Experts predict significant movement in XRP price with a positive outcome in the court case.

Roslyn Layton authored a controversial post in Forbes in August 2022 pointing out that since 2017, the SEC’s Crypto Assets Unit has been involved in 200-odd lawsuits. Layton believes that this figure suggests that instead of coming up with clear crypto regulation to ensure compliance, the regulator would rather engage crypto firms with lawsuits and “regulate by enforcement.”

January Walker, a US politician and congressional candidate, recently highlighted the importance of Ripple potentially defeating the United States Securities and Exchange Commission in the ongoing litigation. Walker argues that a settlement would spell a loss for the Web3 ecosystem.

Walker is known for her advocacy in favor of blockchain and cryptocurrencies. The politician and pro-crypto congressional candidate voiced her support for Ripple as the payment giant is embroiled in its legal tussle with the US financial regulator.

If Ripple settles it will be a loss for the whole world & WEB3.

— January Walker (@UtahPolitician) December 12, 2022

Ripple partnerships and developmental progress over 2022

Ripple published its quarterly XRP Markets Report to voluntarily provide transparency and regular updates on the company’s views on relevant XRP-related announcements and commentary on market developments over the previous quarter.

Q3 2022

Ripple announced the following:

- Balmain Thread, an NFT project by French Fashion house, was built on the XRP Ledger, in partnership with mintNFT.

- Ripple announced the second wave of NFT creators eligible for its $250 million program to nurture digital art and collectibles on the XRP Ledger.

- Developers proposed XLS-20, native NFT support for XRP Ledger in Q1 2022, this was accepted by the community and amended on the mainnet.

- The payment giant partnered with Travelex and launched On-Demand Liquidity (ODL) in Brazil, the Latin American region is key to the firm’s growth.

New and existing partners announced their use of ODL for treasury flows, including FOMO Pay, a Singapore-based institutional digital payment solution provider, and iRemit, one of the largest non-bank remittance service providers in the Philippines.

XRPL’s interchain operability expanded in Q3 as Poly Network integrated XRPL into its cross chain bridging system. This is the third large scale bridge to add XRP Ledger after both Allbridge and Multichain integrated it in early 2022.

Q2 2022

The remittance firm unveiled a partnership with FLUF World, an NFT player with an active community of over 100,000 members, to build Root Network. The blockchain network was integrated into the XRP Ledger and XRP was used as the gas token.

List of Ripple’s partners as of August 2022, not exhaustive

The cross-border payment settlement business partnered with FINCI, a Lituanian money transfer provider to deliver instant and cost-effective retail remittances using ODL. This partnership marked the firm’s first steps in Lithuania.

Q1 2022

The XRP Ledger saw key cross-bridge integrations with Multichain and Allbridge, both of which allowed XRP holders to move their XRP to 12 different blockchains, including Avalanche, Fantom and Solana, as well as move the top coins from these chains onto the XRP Ledger. This was a key milestone for XRP traders as it boosted the interoperability of the token.

Find an exhaustive list of all firms in the XRP ecosystem here.

Will XRP price make a comeback to $1 in 2023?

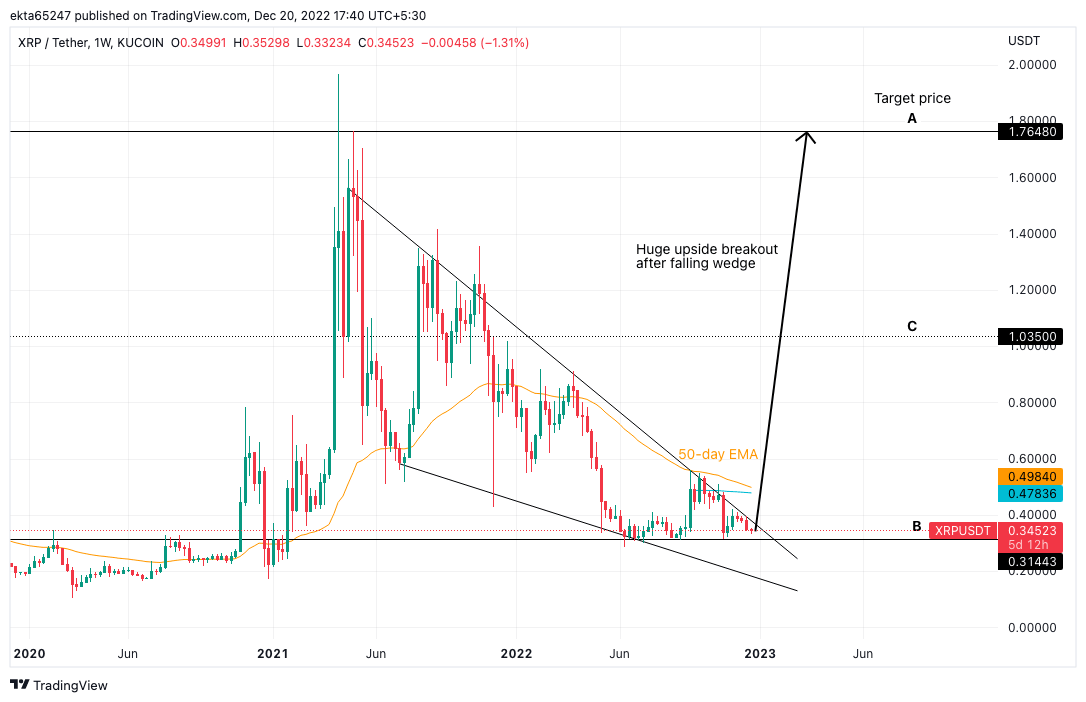

XRP holders consider the $1 level a key psychological level for the altcoin. The third-largest altcoin by market capitalization has kept within a falling wedge throughout 2022. XRP price touched the trend lines more than five times making it a validate chart pattern.

The falling wedge is a chart pattern that occurs when the asset’s price is moving in an overall bullish trend before it corrects lower. The consolidation part typically ends when price action bursts through the upper trend line or the wedge’s resistance.

XRP/USDT 1W price chart

As seen in the XRP/USDT 1W chart above, XRP price is currently pressing up against the top of the falling wedge and a decisive close above the upper trend line could signal a breakout and the possible start of a new uptrend.

The 50-day Exponential Moving Average (50-day EMA) is acting as resistance at $0.498290 and the target for the breakout from the falling wedge is $1.764800. While a breakout from a falling wedge can be in either direction, patternsite.com explains it is upward 68% of the time. Once XRP price closes outside either of the trendlines, a breakout will be confirmed. For bullish breakouts, the highest peak in the pattern – in XRP’s case the $1.764800 level – is the price target.

Using the measure rule, it is clear that a bullish breakout’s first target would be $1.035000, and the final one is located at $1.764800.

Bullish developments like a positive outcome in the SEC v. Ripple court case and a growing number of partnerships and developmental updates could trigger a breakout in XRP Ledger’s native token.

Three on-chain metrics paint bullish picture for XRP in 2023

On-chain metrics analysis also portrays some good bullish potential for XRP, Ripple’s cross-border settlement token. In this section, we look at three key indicators:

Supply Distribution by balance of addresses

Crypto intelligence platform Santiment’s supply distribution by balance of addresses represents the sum of all tokens of the addresses that hold between 1,000,000 and 10,000,000 XRP tokens. This metric is an indicator of accumulation by large wallet addresses. Based on the chart below, XRP whales have been accumulating the altcoin since the beginning of the legal tussle between the SEC and remittance firm Ripple.

%2520%5B21.03.23%2C%252019%2520Dec%2C%25202022%5D-638071461277162244.png&w=1536&q=95)

XRP supply distribution by balance of addresses

Balance of whales holding between 1,000,000 and 10,000,000 XRP is up from 3.37 billion tokens to 3.98 billion, an increase of nearly 20% within two years. It's important to note that whale accumulation was consistent throughout most periods of XRP price decline, as large wallet investors scooped up the native token of the XRP Ledger at a steep discount.

On higher timeframes, it became clear that whale accumulation does have a direct impact on an asset’s price. Large wallet investors typically shore up the asset before bullish breakouts in the cryptocurrency, followed by mass profit-taking and selling. Currently, whales are accumulating, and have been consistently gathering XRP, indicating that a bullish breakout is nearing.

Rise in supply held by these whale wallets, therefore, supports the bullish thesis for XRP price breakout in 2023.

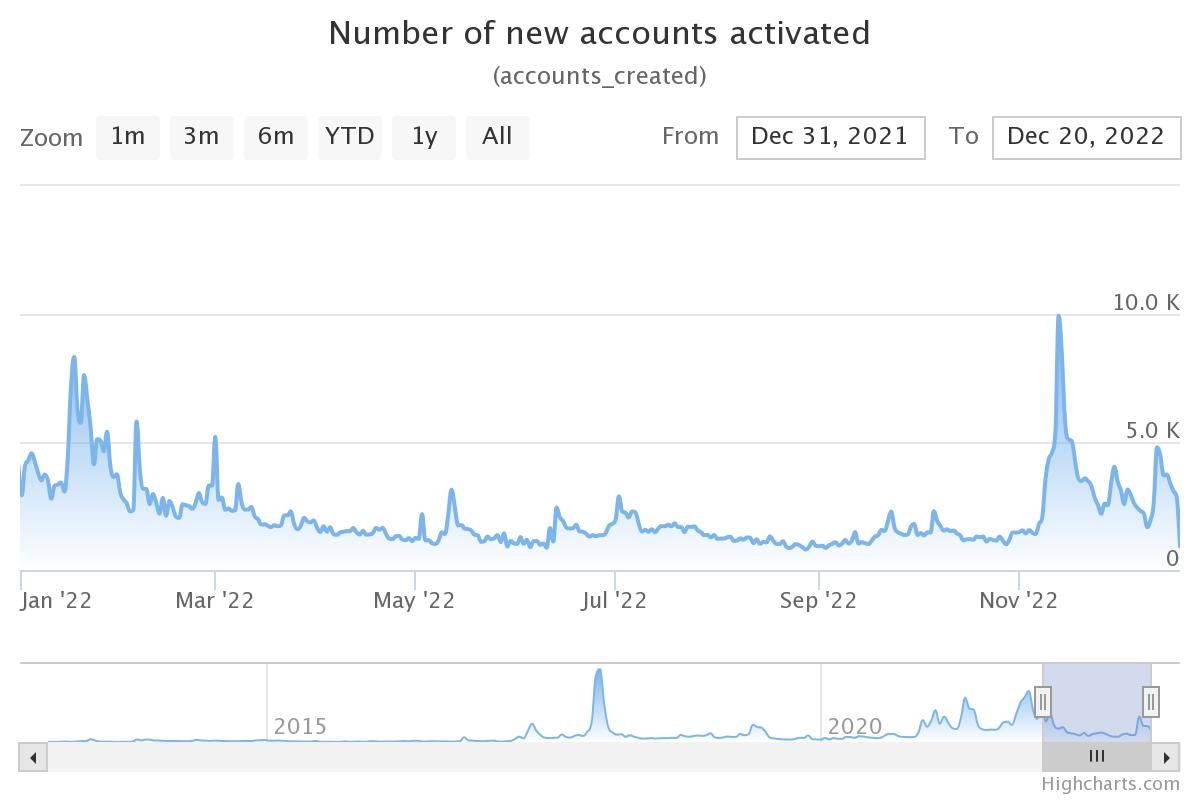

Network growth signals rising XRP adoption

Network growth is a metric that tracks the number of new addresses being created on the cryptocurrency’s network each day. It illustrates user adoption over time and can be used to identify whether a project is gaining or losing traction.

Based on the chart below, XRP adoption increased throughout 2022, hitting a peak in November 2022 as the year draws to a close and investors expect a favorable outcome in the legal battle between the US SEC and Ripple.

%2520%5B21.34.57%2C%252019%2520Dec%2C%25202022%5D-638071461821085573.png&w=1536&q=95)

Network growth of XRP

This metric implies that, despite XRP’s de-listing across several cryptocurrency platforms, the token’s adoption has increased and it continues to gain traction as we enter 2023.

XRP social media dominance is on the rise

The fourth-largest cryptocurrency by market capitalization – after Bitcoin, Ethereum and Binance Coin – recently witnessed an increase in its mentions on social media platforms, compared to the top 50 cryptos.

%2520%5B21.53.50%2C%252019%2520Dec%2C%25202022%5D-638071462369829151.png&w=1536&q=95)

XRP price v. social dominance

In the last quarter of 2022, XRP witnessed several social dominance peaks. The metric points towards sustained mentions of altcoin across social platforms. The consistent dominance indicates that XRP is in most conversations in the crypto community. The altcoin is relevant, as its adoption and utility is growing. Spike in social dominance can be perceived as a bullish sign when coupled with the increase in number of new XRP wallet addresses.

Number of new XRP addresses created on the network

The number of new XRP addresses peaked close to periods of high social dominance for XRP. These two metrics support the thesis of the altcoin’s bullish breakout in 2023.

Potential threats to XRP price growth in 2023

An unfavorable outcome for Ripple in its court battle with the US Securities and Exchange Commission could dampen XRP investor sentiment and lay waste to its On-Demand Liquidity operations in the United States. A defeat in the SEC v. Ripple case could rain on the firm’s parade to roll out its ODL service to leading banks. The United States market is one of the most important financial markets for the cross-border remittance firm.

If US banks are not on-board with Ripple’s ODL, it could weaken the potential for adoption of its Central Bank Digital Currency (CBDC) infrastructure. Since the company has launched several corridors for its On-Demand Liquidity service, there is an existing demand for XRP, and this would likely cushion the blow of the loss to some degree.

XRP token holders are at a risk of going underwater in the event of mass sell-off by whales. Large wallet investors could dump their holdings if Ripple loses its legal battle to the US financial regulator. In week 3 November 2022, whales reduced their XRP holdings and realized losses. The largest XRP whale cohort with 10 million to infinity coins on Santiment dumped around 1 billion tokens in the last 10 days. This supports the thesis that whales are at risk of dumping their holdings in the event of a negative outcome for Ripple.

Closing thoughts on XRP price and 2023 targets for the altcoin

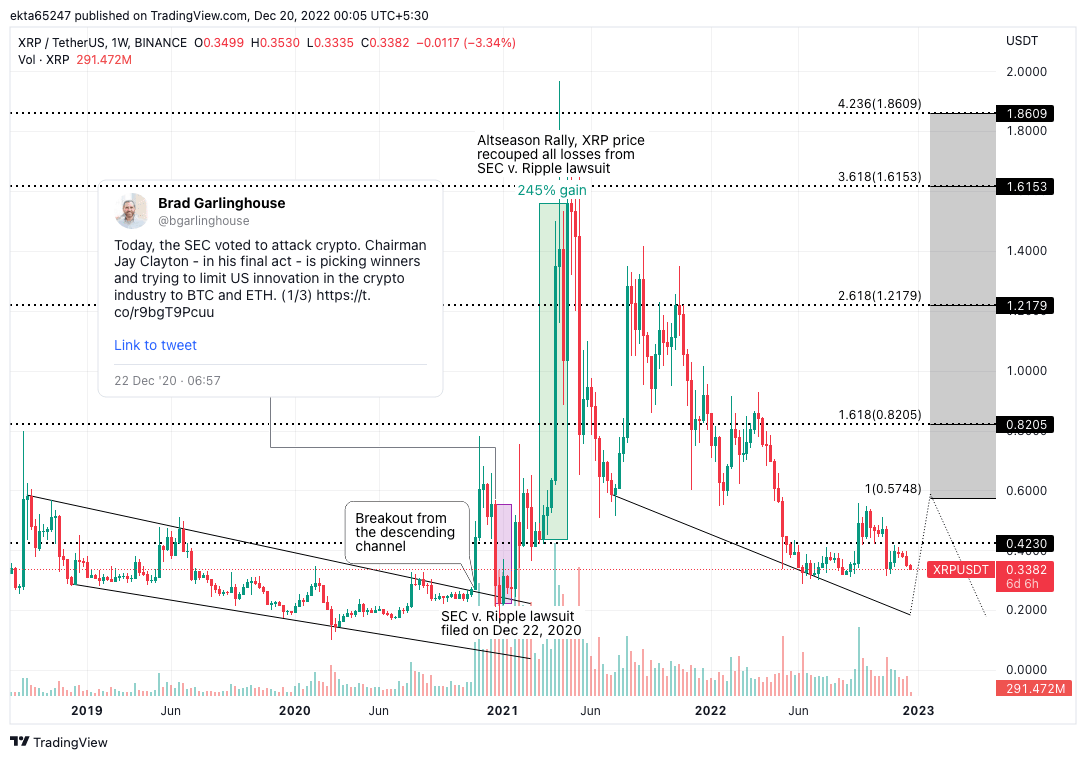

XRP price is primed for a bullish breakout in 2023 and technical analysts at several crypto firms have predicted a rally in the altcoin. The chart below marks the key price levels to watch out for in 2023.

XRP/USDT 1W price chart

As seen in the XRP/USDT chart above:

- The years 2019-2021 have a similar structure as the present setup, hinting at a bullish thesis for XRP price in 2023.

- The breakout from the descending channel in November triggered a massive rally that came to a grinding halt with the SEC’s lawsuit against Ripple on December 22, 2020.

- If XRP price climbs above the 61.8% Fibonacci extension at $0.423000, the altcoin could test resistances at $0.574800, $0.820600, $1.217900, $1.615300 and $1.8609.

- In March 2021, XRP price started a 245% climb, recouping its losses from the SEC v. Ripple lawsuit alongside Ethereum and other cryptocurrencies. This represents the altcoin season of 2021.

Technical experts at instant crypto exchange Changelly have gathered an average prediction of $0.409959 for XRP price in December 2022 and a maximum of $0.699300 in 2023. Finder’s panel of experts believe that the altcoin could hit a high of $0.900000 in December 2022, however defeat in the SEC court case could result in a bloodbath, with a bearish target of $0.24.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.