XRP Price faces threat of fall below $0.50 as XRPLedger AMM amendment is uncertain

- An XRPLedger Automated Market Maker amendment is facing criticism in the community and currently lacks the support for go ahead.

- Major XRPL validators Vet and Daniel Keller have rescinded their support for the amendment citing a minor but significant bug.

- XRP price is nearly unchanged in the past 24 hours, the altcoin is trading at $0.5133 on Wednesday.

XRP price is $0.5133, yielding nearly 2% weekly gains for holders. The native token of the XRPLedger is holding steady despite the status of the Automated Market Maker (AMM) amendment proposal.

Validators are critical of the amendment and some notable ones have pulled support citing concerns regarding a significant bug.

Also read: Ethereum price poised for gains as Dencun upgrade goes live on the testnet

Daily Digest Market Movers: XRPLedger amendment for AMM in jeopardy

- The XRPLedger (XRPL) is currently faced with a major hurdle as the proposal for Automated Market Maker amendment has dropped below the required 80% consensus threshold.

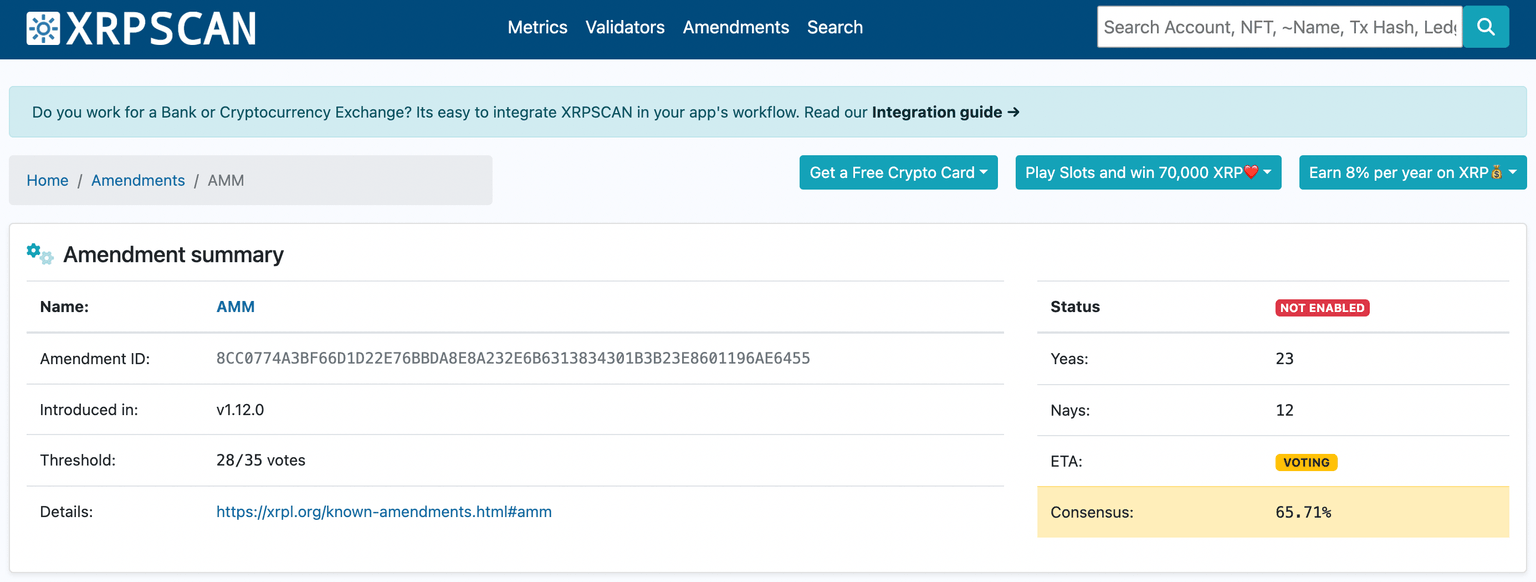

- On Thursday, the consensus is 65.71%, notable validators have pulled support for the amendment citing their concerns.

- This is a setback for XRPLedger as the amendment previously secured an 85.7% approval rate and was well on its way to be finalized.

XRPL AMM Amendment consensus on Thursday. Source: XRPScan

- Validator Vet stated that allowing the AMM proposal to go through would damage the XRP community’s image and XRPL’s reputation. There is room for improvement in the Ledger before rollout of a key feature like AMMs, according to the validator.

(Daily ) Heads up!

— Vet ☠️ (@Vet_X0) February 7, 2024

XRP Ledger AMM vote is pulled!

Join to learn more about the circumstances:https://t.co/89AxbtJNUC

- The developments in the SEC v. Ripple lawsuit continue to influence the community of XRP holders.

- Ripple’s lawyers have asked for a deadline extension for the remedies-related discovery phase stating that SEC’s request for more information includes large volumes of data from the cross-border payment remittance firm, which will take time to compile.

Technical Analysis: XRP price likely to decline further

XRP price is in a downtrend since the beginning of 2024. The altcoin’s price sustained above the $0.50 psychological level, however further correction is likely due to signals from two key indicators.

The Moving Average Convergence Divergence (MACD) indicator is flashing green, however the momentum is likely not enough to push XRP price into recovery.

The Relative Strength Index (RSI), a momentum oscillator, reads 40.50, down from 41.29 on Wednesday. As RSI dips and moves away from the neutral level, there is room for a correction in XRP price.

XRP price is likely to sweep support at $0.4968, just below the psychologically important level of $0.5000 before rebounding to R1 at $0.5272. In the event that XRP price sees a daily candlestick close above this level, price could rally towards R2, at $0.5625, that coincides with the 50% Fibonacci Retracement of the decline between January 3 and January 31.

XRP/USDT 1-day chart

A daily candlestick close below support at $0.4968 could invalidate the recovery thesis and the January 31 low of $0.4850 is likely to come into play for XRP price.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.