XRP price hit a three-year low against Bitcoin as fears of Spot BTC ETF rejection span the market

- Ripple price was one of the most affected by the recent market crash as the Matrixport report triggered massive liquidations.

- XRP dropped almost 20% when it had not risen like the rest of the market in the first place.

- With the ADX indicator gaining strength however, the payments token could soon pull north as XRP approaches the oversold region.

Ripple (XRP) price suffered by association as the broader market reacted to speculation that the US Securities and Exchange Commission (SEC) would reject spot Bitcoin exchange-traded funds (ETFs). Unlike other altcoins, however, Ripple price’s reaction came despite the token not having gone up previously like the rest of the market.

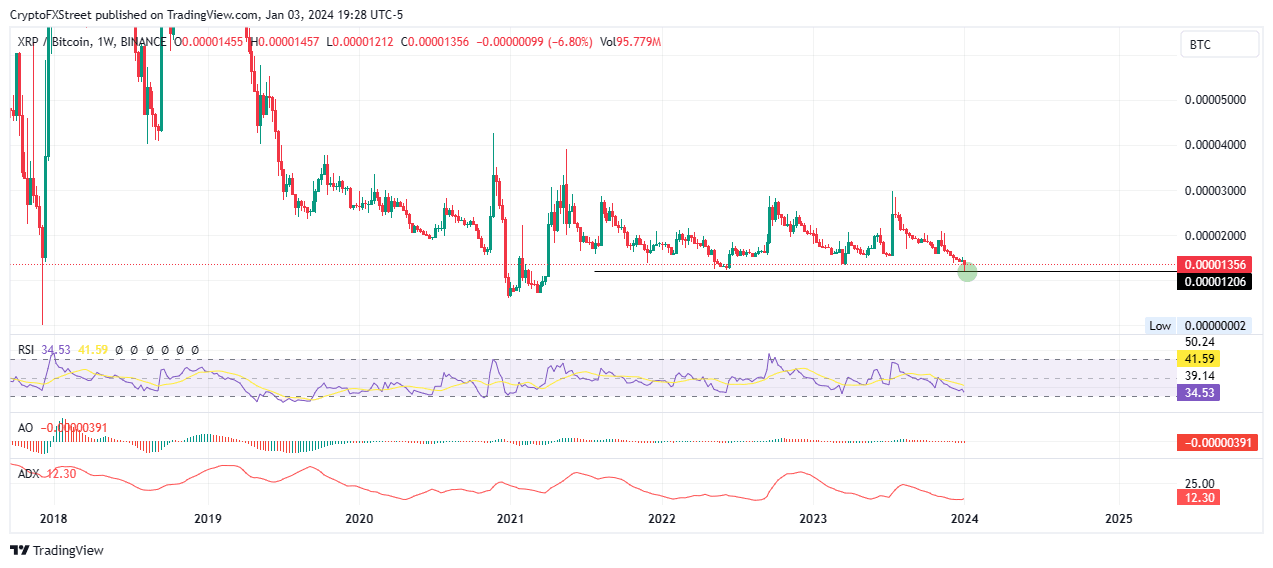

XRP records a three-year low against Bitcoin

Ripple (XRP) price recorded a three-year low against Bitcoin when the market reacted to the Matrixport report. It went as low as $0.5000, levels last tested when the SEC filed a lawsuit against XRP saying it was a security.

XRP/BTC 1-week chart

In the execution of a rising wedge pattern, Ripple price dropped 20% during the January 3 trading session to find support at $0.4973, reinforced by an ascending trendline. With this buyer congestion level holding, XRP price could push north soon.

Ripple price could recover soon as XRP shows signs of bottoming out

For starters, the Average Directional Index (ADX) indicator, which quantifies trend strength, is deflecting to the north, evidence of buying pressure. The Relative strength Index (RSI) has also deviated away from its previous southbound motion, also accentuating the bullish push thesis.

If the bullish momentum increases, Ripple price could reclaim above the lower boundary of the rising wedge pattern above the $0.6000 psychological level. Further north, the gains could see XRP clear above the upper boundary of the wedge, potentially going as high as the $0.7000 psychological level. Such a move would constitute a 20% climb above current levels.

XRP/USDT 1-day chart

On the flip side, if selling pressure increases, Ripple price could extend the fall, reclaiming the January 3 lows of $0.5000. A break and close below this level would open the drains for XRP price, with the remittances token likely to extend a leg lower to the $0.3562 range low.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.