- Nexo, a lending platform, is named a defendant in a class-action case filed by XRP users.

- The plaintiffs seek redress for the harm resulting from Nexo’s intentional and unjustified suspension of XRP on December 23, 2020

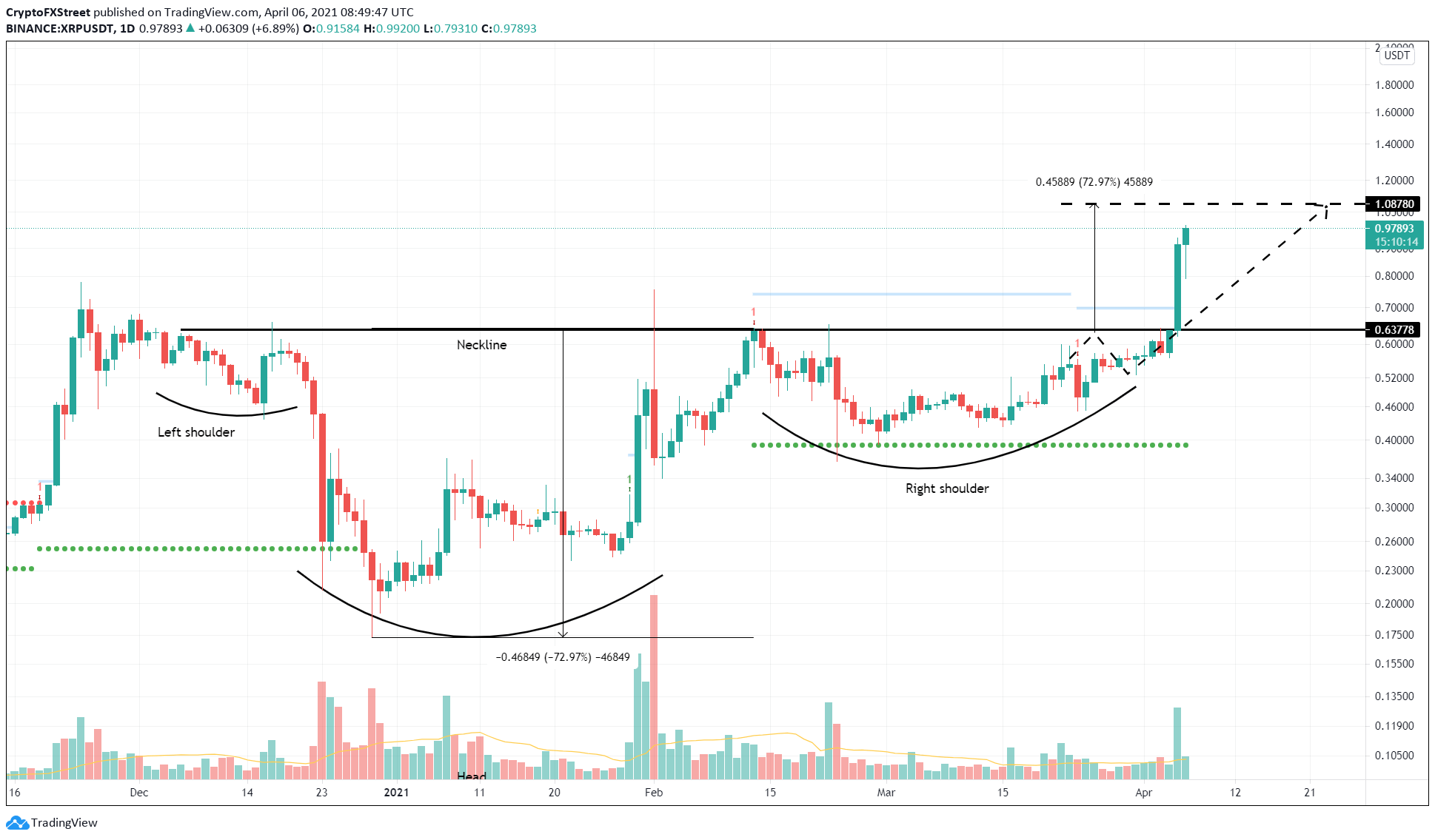

- XRP price broke out of an inverse head-and-shoulders pattern, moving ever so closer to the $1 target.

A group of users who suffered losses due to the sudden halt of XRP on various exchanges filed a lawsuit against the Nexo platform. This move comes after the Ripple price surged nearly 65% in the last 24 hours.

Class-action lawsuit against Nexo

The Securities & Exchange Commission’s (SEC) securities fraud case against Ripple has caused many platforms to cease XRP-centric services. However, Nexo seems to be one of the first companies to face a class-action lawsuit for halting XRP-related transactions.

Nexo is a cryptocurrency lending company whose users are mounting a backlash for wrongfully suspending XRP as a payment option. This move allegedly liquidated its customers, who are now seeking $5 million as retribution.

The legal documents filed by Junhan Jeong, a California resident, is responsible for initiating the case against Nexo.

Nexo’s intentional and unjustified suspension on December 23, 2020, of a critical repayment option on its platform has resulted in liquidation of the collateral of hundreds of Nexo customers, causing well over $5 million in damages.

However, Nexo responded to the lawsuit in a blog published on April 5, stating that it was among more than 30 leading platforms to halt XRP-related services.

Regarding the “intentional and unjustified suspension” allegation, Nexo responded:

The reason XRP repayments – as a particular transaction type – were temporarily suspended is that repayment, by its nature, constitutes a type of exchange service offered by Nexo.

The blog further mentioned that the customers could have used other Nexo-approved cryptocurrency assets in lieu of XRP to repay their loans.

XRP price edges closer to $1

The XRP price broke out of an inverse head-and-shoulders pattern after more than three months. This technical formation consists of two distinctive swing lows of almost the same height and forms the shoulders. The central valley is much deeper than the others and creates the head.

The peaks between these steep price actions face rejection at $0.63, a horizontal resistance level known as the neckline. As of Monday, a spike in buying pressure pushed the XRP price to blast through this level, signifying a breakout toward the target at $1.08.

This move is determined by adding the distance between the head’s lowest point and the right shoulder’s peak to the neckline at $0.63. At the time of writing, the XRP price needs a 10% upswing to tap the said target at $1.08.

XRP/USDT 1-day chart

If the bullish momentum wanes, the remittance token could see a 25% drop to the Momentum Reversal Indicator’s breakout line at $0.74.

A breakdown of this level could see this pullback extend to $0.70.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Avalanche Price Forecast: AVAX bulls aim for double-digit rally amid increase in bullish bets

Avalanche (AVAX) price extends its gains by 7%, trading above $21 on Monday after rallying almost 9% the previous week. On-chain metrics suggest a bullish outlook as AVAX’s long-to-short ratio reached its highest in over a month.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP consolidate before a potential breakout

Bitcoin (BTC) hovers around $85,600 on Monday after recovering 4.25% last week. Ethereum (ETH) and Ripple (XRP) also followed in BTC’s footsteps, hovering around their key levels after recovering almost 7% each the previous week.

Ethereum Price Forecast: ETH sees increased buying pressure as Pectra upgrade draws closer

Ethereum (ETH) trades above $1,900 on Friday following investors stepping up their buying pressure in March. The top altcoin could be set for a recovery if the Pectra upgrade proves to be a strong price catalyst.

Coinbase in $5B talks to acquire Deribit, World’s largest BTC and ETH Options trading platform

Coinbase is in advanced negotiations to acquire Deribit, the world’s largest platform for Bitcoin and Ethereum Options trading, according to a Bloomberg report.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.