XRP price defends key level and gains strength while buyers aim for $0.90

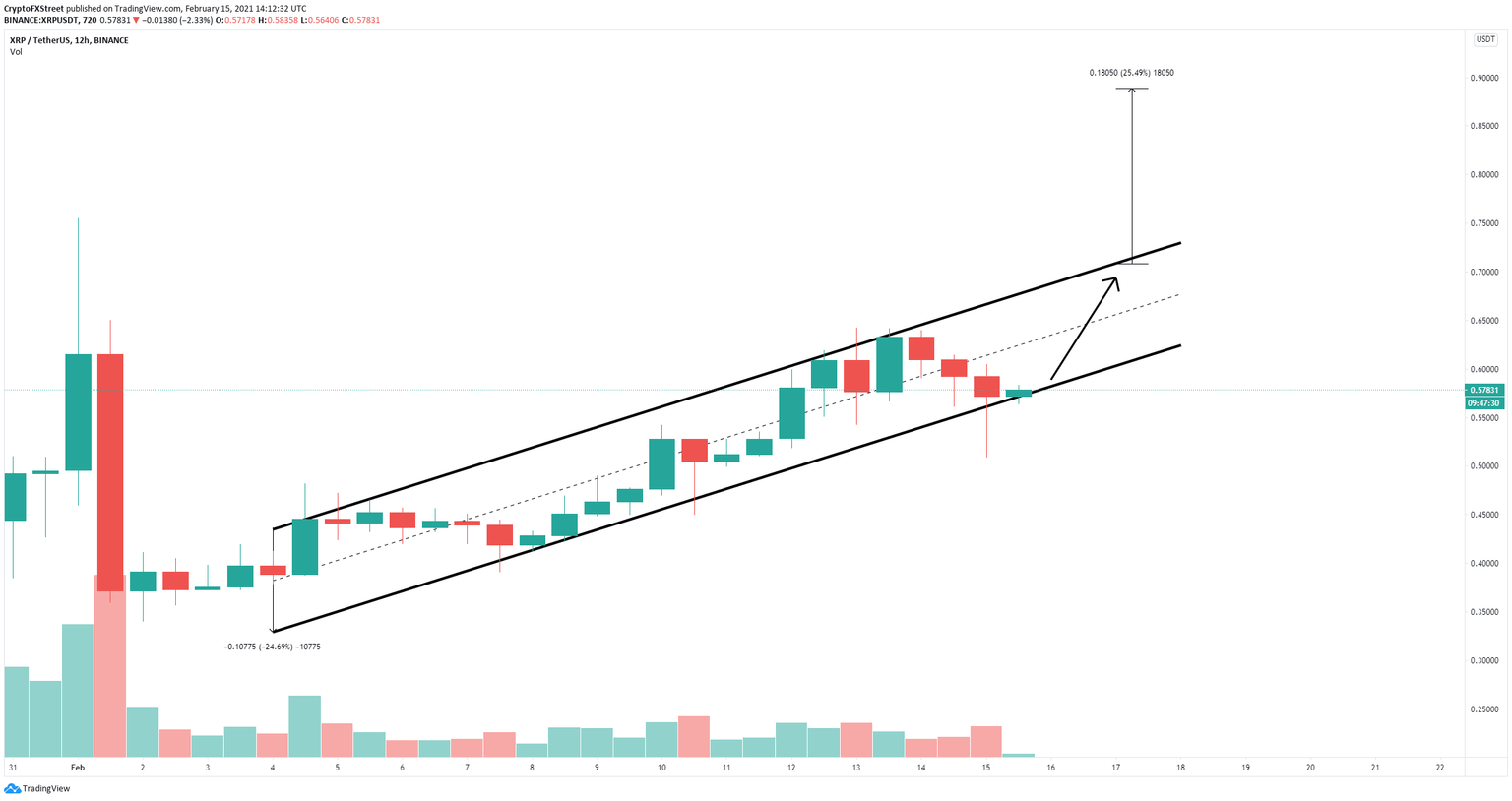

- XRP price is currently contained inside an ascending parallel channel on the 12-hour chart.

- The digital asset has just defended a key support level and aims for a rebound.

- It seems that investors are interested in XRP again, despite the current lawsuit against Ripple.

XRP price has been trading inside a robust uptrend since February 5, gaining new strength and establishing several support levels on the way up. XRP bulls have just defended a key support level and target a significant rebound towards $0.7.

XRP price can climb towards $0.90 if bullish momentum persists

On the 12-hour chart, XRP price has just defended the key support level of $0.57, which is the lower support trendline of an ascending parallel channel. A rebound from this point can quickly push XRP price towards the upper boundary at $0.7.

XRP/USD 12-hour chart

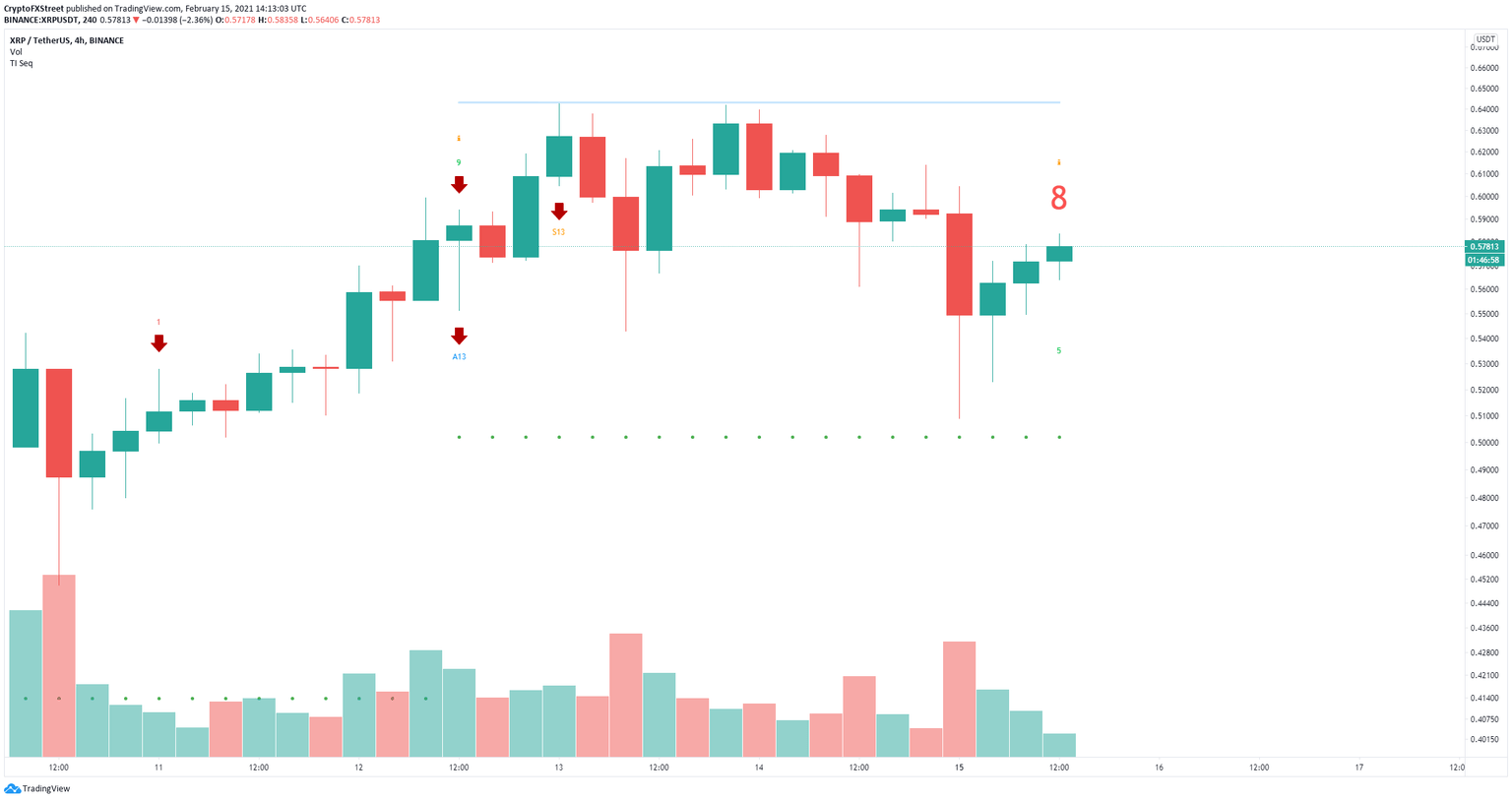

The most critical resistance level is $0.7, the upper trendline. A breakout above this level can easily push XRP price to $0.90 as there are no significant resistance levels on the way up. On the 4-hour chart, the TD Sequential indicator has presented a red ‘8’ candlestick.

XRP/USD 4-hour chart

This type of candlestick will usually transform into a buy signal, giving credence to the bullish outlook above. However, XRP price needs to see a significant rebound for any of this to happen.

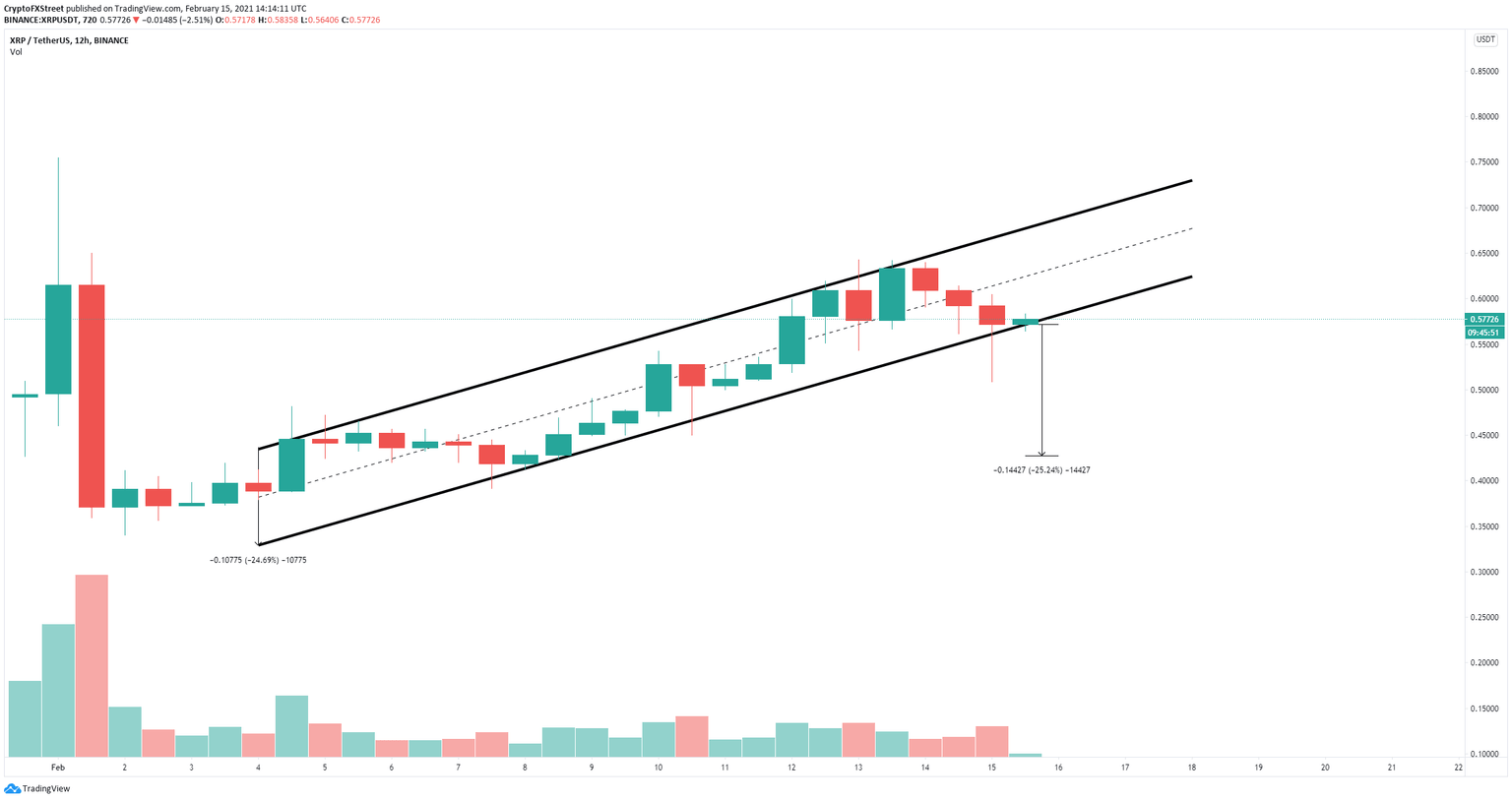

XRP/USD 12-hour chart

Losing the lower boundary of the ascending parallel channel at $0.57 and closing below it, would send XRP price down to $0.42, a 25% move calculated by using the height of the pattern as a reference point.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.