- Ripple price came down 20% since the beginning of this week.

- With some upside today, bulls stand to face a bull trap that could get quite painful.

- A better entry point at $0.78 looks to be more promising for bulls.

Ripple (XRP) price could not withstand the correction that has gone through the cryptocurrencies this week. Several significant cryptocurrencies and alt-currencies were on the downside, with prices retreating to fundamental support levels. The bulls in XRP seem to have jumped the gun, not waited for any support level, and just caught a falling knife. A possible wash-out of buyers could happen as sellers are still very much in control.

XRP price is still in favor of sellers

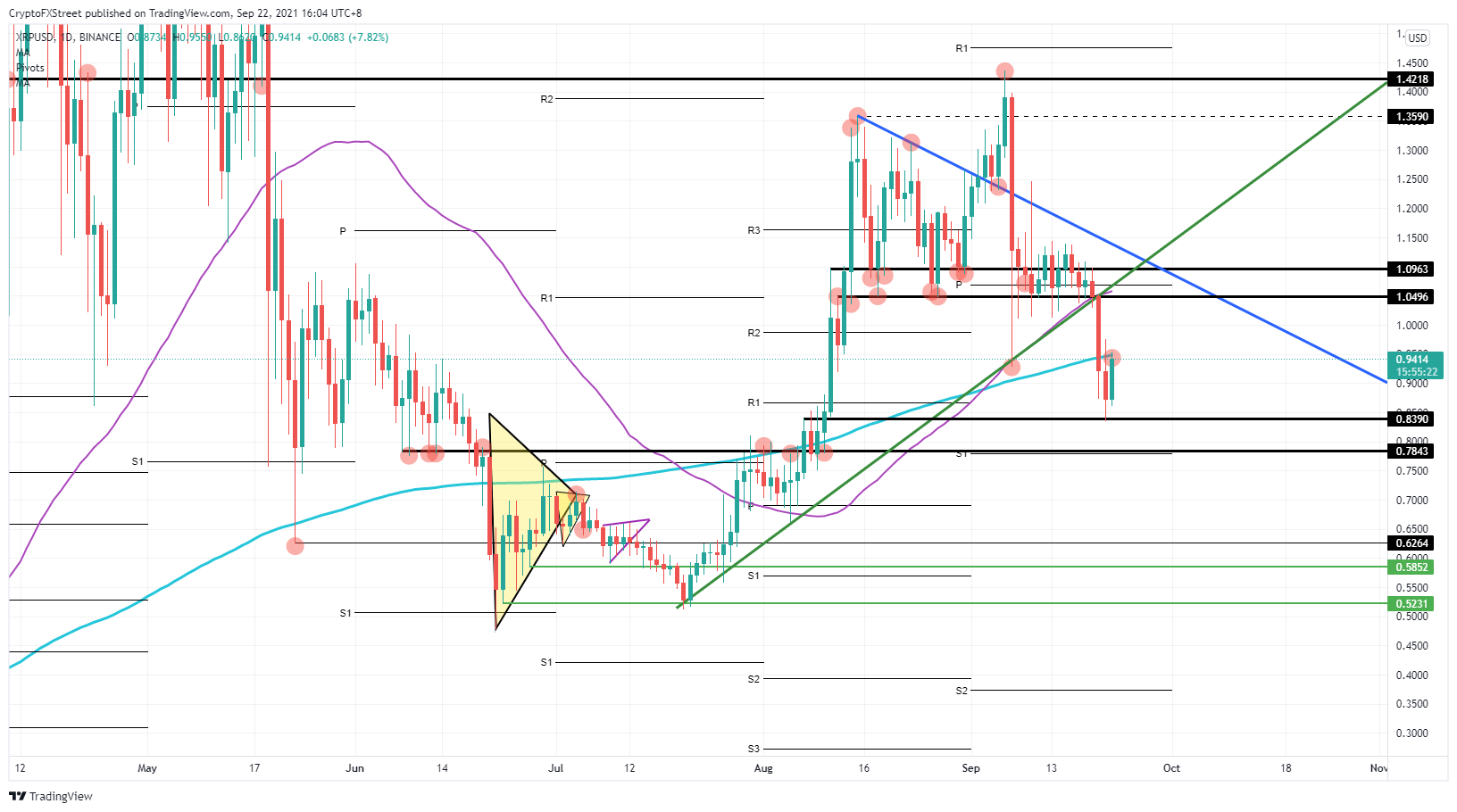

This week, Ripple price has felt the weight of a downturn with a break of a significant green ascending trend line that has kept the bull run going throughout the summer. With the break of that trend line, sellers are very much in control, and bulls are looking for some good entry levels. With the reversal already today, that might have been just a tad too soon. The entry at $0.84 only goes back to August 6 and has not withstood any past tests or cannot give any proof of importance. It looks as if buyers have caught a falling knife, and the false break on the 55-day Simple Moving Average (SMA) at $0.95 could spell trouble for buyers that went in long in full conviction and full size.

XRP price risks turning into a bull trap now with buyers not able to push beyond that 55-day SMA. Price will reverse, and sellers will push XRP another leg lower toward $0.78. That might be a more exciting level. From the chart in XRP, the $0.78 level holds more importance than the $0.84 level. Originating from June 7, his level has shown quite a few tests from both upside and downside, making it a better historical element to keep in mind and could act as a better entry point for bulls to go in for a long.

XRP/USD daily chart

Ripple price thus looks to be heading first for another leg lower toward $0.78, before bulls really can take over from sellers and ramp up price action again in the cross-border currency. A kick-back to $1.05 looks to be the first port-of-call in the next bull run to unfold.

In case Ripple stays in the disfavor of investors, expect a forceful push lower toward $0.60. That brings XRP back to the region suitable for a fade-in over the longer term before price action will choose the upside again.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Tether mints another $1,000,000,000 USDT on Justin Sun’s Tron blockchain: TRX traders could profit

Tether, the world’s largest stablecoin issuer, has minted another $1 billion worth of USDT on the Tron blockchain according to Whale Alert data published Friday.

XRP Price Prediction: XRP back above $2 liquidating $18M in short positions, will the rally continue?

Ripple (XRP) seeks support above $2.0020 on Thursday after gaining 14% in the past 24 hours. The token trades at $2.0007 at the time of writing, reflecting growing bullish sentiment across global markets.

Avalanche Octane update goes live on mainnet, slashes transaction fees significantly

Avalanche (AVAX) Octane update, live on mainnet on Thursday, introduces a dynamic fee mechanism to the C-Chain. This mechanism reduces transaction costs during high network activity by adjusting real-time fees, as per ACP-176.

Dogecoin soars as 21Shares files S-1 for DOGE ETF

Dogecoin (DOGE) rallied nearly 12% on Wednesday after asset manager 21Shares filed an S-1 application with the Securities & Exchange Commission (SEC) to launch the 21Shares Dogecoin exchange-traded fund (ETF).

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.