XRP price could deteriorate with Ripple’s request for deadline extension in SEC lawsuit

- XRP price observed nearly 2% weekly losses and slightly declined to $0.5031 on Wednesday.

- Ripple has requested the court for a one-week extension of the February 12 deadline.

- Experts weigh in on whether Ripple’s On-Demand Liquidity corridor has traction in the US and Asia.

XRP price sustained above the psychologically important level of $0.50 even as payment giant Ripple requested to push the deadline for remedies-related discovery in the SEC lawsuit. The cross-border payment remittance firm seeks to push the deadline from February 12 to 20, according to a court filing.

Also read: CYBER Price Forecast: Rally to $8 likely as CyberWallet crosses 900,000 deployments

Daily Digest Market Movers: Ripple requests deadline extension, experts speculate whether ODL is relevant

- Ripple is currently faced with two major obstacles, the ongoing SEC lawsuit and On-Demand Liquidity corridor’s utility and relevance in the US and Asia.

- The latest development in the SEC v. Ripple lawsuit is the payment remittance firm’s application to push the deadline to February 20, according to the court filing below.

#XRPCommunity #SECGov v. #Ripple #XRP @Ripple requests a one-week extension of the deadline for remedies-related discovery, from February 12, 2024 to February 20, 2024. pic.twitter.com/xjIZQuY7jQ

— James K. Filan (@FilanLaw) February 6, 2024

- If the request is accepted, the deadline will be extended further and the lawsuit will go on for longer than expected by market participants.

- Ripple’s On-Demand Liquidity (ODL) corridor is a key product for banks and financial institutions, experts are now weighing in on whether this is as relevant as the ecosystem.

- Crypto expert and founder of dizercapital observed in a recent tweet on X (formerly Twitter) that Ripple had limited traction for their payments/ settlements use case in the US.

- It seems that Ripple’s use case does not have as much traction in Asia either.

- Ripple’s original use case was to serve as a bridge currency to offer institutions a cost-effective way to exchange crypto and fiat. However, bridging assets with XRP carries a risk for institutions, this has discouraged many firms from adopting XRP’s original use case.

- There are several developments on the XRPLedger (XRPL) with little to no traction for its primary use case and this is concerning to market participants.

We knew Ripple had limited traction for their payments/settlements use case in the U.S. But it looks like even in Asia, that traction is not much better.

— Yassin Mobarak (@Dizer_YM) February 6, 2024

I hope this is wrong and simply just FUD, but unless I see evidence to the contrary, it seems XRP's future is in all the… https://t.co/5qL9jD0ZL4

Technical Analysis: XRP price is at risk of correction

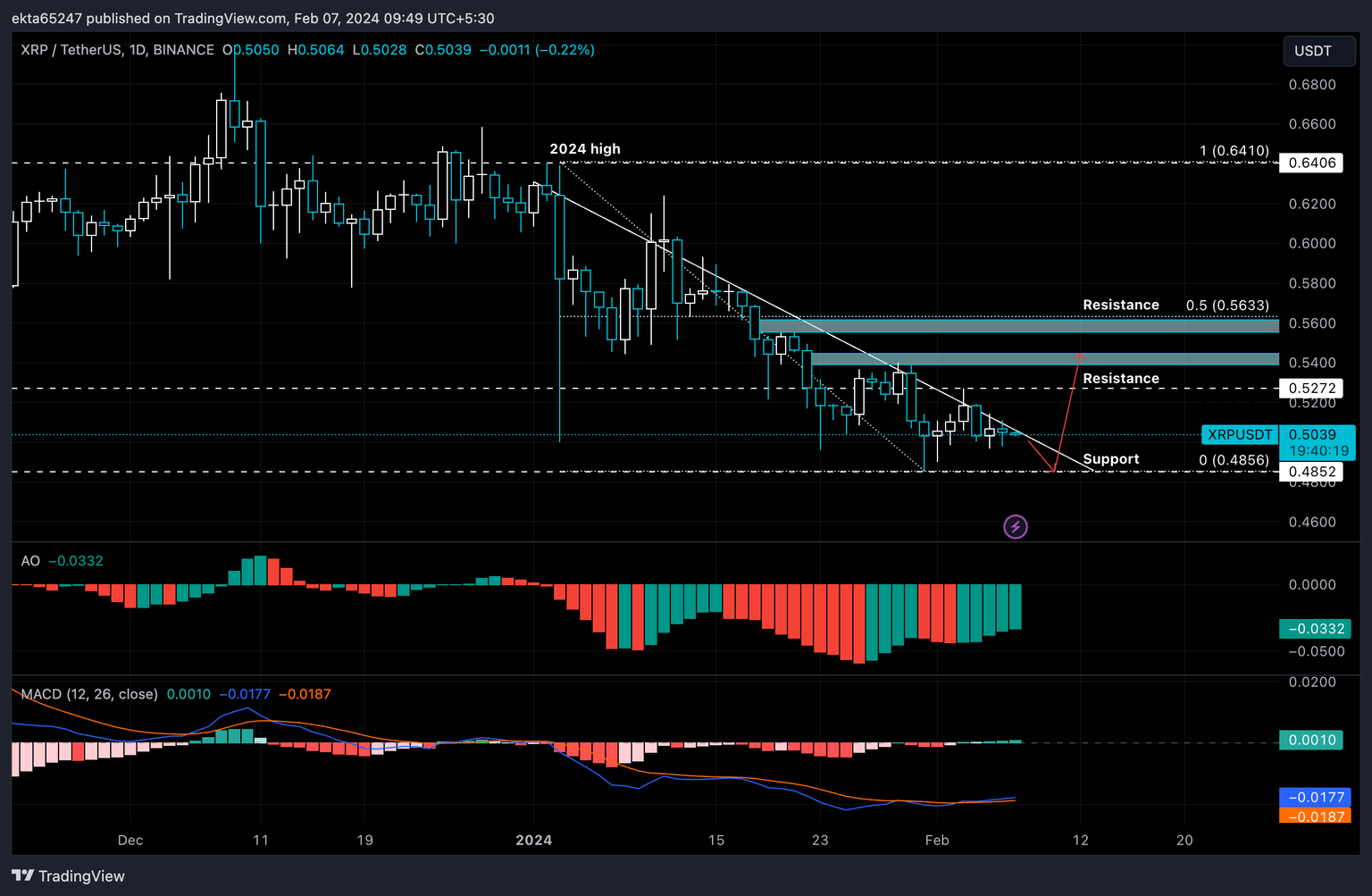

XRP price is currently in a downtrend, as seen in the price chart below. The altcoin opened 2024 at a peak of $0.6410, since then XRP price has formed lower highs and lower lows. XRP price could plummet to support at $0.4856 before bouncing towards the bearish imbalance zone between $0.5392 and $0.5445.

Once the gap is filled, XRP could continue its decline. The Awesome Oscillator (AO) is flashing its fifth consecutive green bar however the Moving Average Convergence/ Divergence (MACD) indicator notes little positive momentum. XRP price is therefore at a risk of correction.

If XRP price breaks past the imbalance zone, it could face resistance at the 50% Fibonacci Retracement level, at $0.5633, of its decline between January 3 and 31.

XRP/USDT 1-day chart

A daily candlestick close above the resistance at $0.5272 could invalidate the bearish thesis for XRP price.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.