XRP price poised for recovery on popularity with South Korean traders and SEC lawsuit development

- XRP is the most popular altcoin in South Korea, with 20.7% of Gen Z investors holding the altcoin, according to a recent survey.

- Ripple counsel informed the judge of their availability for a trial in Q2 2024 in the SEC vs. Ripple lawsuit in Q2 2024.

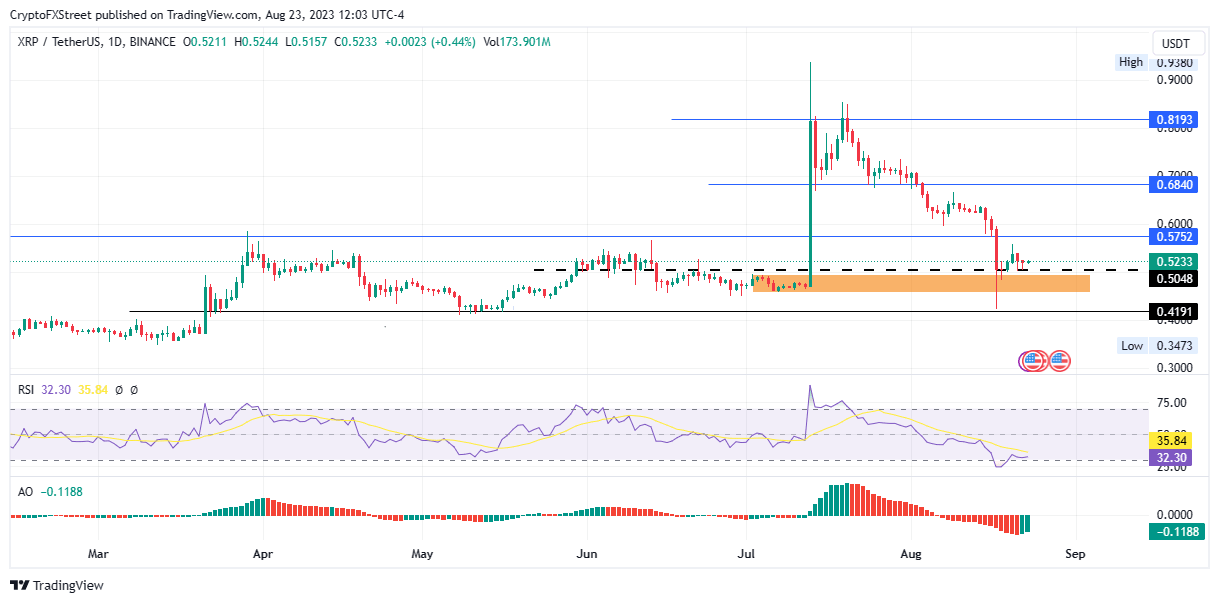

- XRP price faces resistance at $0.5752, on its path to recovery from the recent decline.

XRP price is likely on track for a 55% price rally with two bullish catalysts. South Korean investors' preference for XRP and the latest developments in the SEC vs. Ripple lawsuit. These two catalysts are likely to push XRP price higher in the short term.

Also read: XRP whales expect slight recovery in altcoin after recent developments in the SEC vs Ripple lawsuit

XRP price rallies as the altcoin emerges as favorite among South Koreans

A recent survey in South Korea revealed the altcoin’s popularity among Gen Z. XRP has emerged as a favorite among more than half of South Korea’s copy traders and 20.7% of Gen Z investors. The survey was conducted by News1 Korea, a media agency headquartered in Seoul.

XRP price started its relief rally, yielding 24.5% gains from $0.4259 on August 17 to $0.5316, at the time of writing. The recovery is fueled by the adoption of the altcoin among Korean traders and copy traders, and the developments in the SEC vs. Ripple lawsuit.

Ripple shows readiness for trial in SEC vs. Ripple case

The court approved the Securities and Exchange Commission’s (SEC) motion requesting a filing of an interlocutory appeal in the SEC vs. Ripple lawsuit.

Both parties, the SEC and Ripple have informed the judge of their availability for trial and the XRP holder community is awaiting SEC’s interlocutory appeal filing. This is the next crucial development in the SEC vs. Ripple lawsuit.

The SEC’s stance on XRP and the regulator’s appeal to the court could determine the direction in which the lawsuit is headed, and influence the altcoin’s price in the process.

SEC vs. Ripple Labs filing on August 23

XRP price could rally 55% to $0.8193 target, if this happens

Lockridge Okoth, technical analyst at FXStreet identified that XRP price is currently at a crossroads. The altcoin is split between Bitcoin’s optimism and the negativity from the SEC lawsuit and developments from the regulator’s side.

XRP price faces resistance at $0.5752, a break past this hurdle could push the altcoin to its August high of $0.6840. In order to confirm the uptrend, XRP price needs to break the July 19 high of $0.8193. This marks a 55% rally in the altcoin. Check this post for targets.

The two indicators supporting the bullish thesis are the RSI tipping north and the green bars of the AO histograms that point to the rising momentum.

XRP/USDT one-day price chart on Binance

In the event of a price drop, XRP could find support at $0.5048 before slipping through to test the $0.4191 support level. This move would mark a 20% decline in XRP price.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.