- XRP benefited in 2023 from the landmark and partial victory by Ripple against the US Securities and Exchange Commission.

- Ripple’s potential IPO, Bitcoin’s halving and rising institutional adoption of XRP could catalyze gains in the altcoin in 2024.

- XRP price could rally alongside Bitcoin in 2024, pushing past the $1 psychological barrier.

XRP price action in 2023 was mainly driven by the ruling of the US Securities and Exchange Commission (SEC) lawsuit against Ripple, an enduring saga for the crypto landscape since 2020. In July, XRP went through a pivotal moment as Judge Analisa Torres ruled that Ripple’s token was not a security when sold to the public on an exchange, propelling the altcoin’s value to a peak of $0.94.

While the price spike was short-lived, the ruling – which isn’t final and can be appealed – dealt a blow to the SEC’s effort to regulate crypto markets, providing support to other crypto-related firms that are litigating with the US markets regulator.

Any further developments in the SEC vs. Ripple lawsuit will be key for XRP in 2024. The broader crypto agenda will also be important, from rising capital inflow to crypto funds and the likely approval of a Bitcoin Spot Exchange-Traded Fund (ETF). Moreover, a potential Initial Public Offering (IPO) from Ripple would also catalyze a recovery in XRP price, with some analysts pointing out that the token could exceed the $1 psychological level in a positive scenario.

Also read: XRP price sustains above $0.60 as Ripple roadmap prevents the SEC from circumventing securities law

XRP price performance in 2023

XRP price rallied over 85% year-to-date, from $0.3347 on January 1 to $0.6203 on December 17. The altcoin’s price is largely influenced by the developments in the SEC vs. Ripple lawsuit, regulatory developments in crypto in the US and Bitcoin’s price trends. XRP price is highly correlated with Bitcoin’s, as much as 0.88, according to data from Macroaxis.

The legal battle with the SEC weighed heavily on XRP price throughout the first half of the year. The July 13 ruling provided a welcome relief to the altcoin’s holders as XRP was cleared of the security status in secondary market sales, or transactions on cryptocurrency exchanges.

The ruling was followed by a series of victories for Ripple and gains for XRP, particularly when Judge Torres denied the regulator’s attempt to appeal the ruling or when the SEC decided to dismissed its lawsuit against Ripple executives. The minor wins pushed XRP price above the $0.60 level.

Key aspects of SEC vs. Ripple lawsuit

The US Securities and Exchange Commission (SEC) alleged that Ripple, the cross-border payment remittance firm, engaged in the unregistered sale of securities of XRP and raised over $1.3 billion in 2013. Ripple defended against the SEC’s allegations, and Judge Analisa Torres’ ruling established that XRP was not a security when sold to traders on exchange platforms. Still, the July 13 ruling revealed that the asset may have been a security when sold to institutional investors.

The XRP holder community rejoiced in response to the ruling and the altcoin’s price rallied overnight. The altcoin hit its 2023 peak after the ruling at $0.94.

Two key developments in the SEC vs. Ripple lawsuit are likely to have set a precedent for 2024:

-

Judge Torres’ dismissal of SEC’s appeal against the judgment

The presiding judge in the SEC vs. Ripple lawsuit denied the regulator’s request for an interlocutory appeal. This marks a milestone in the legal battle between the SEC and Ripple, since the regulator planned to challenge Judge Torres’ decision on the secondary sales of XRP which was denied by the Judge.

XRP, therefore, continues to enjoy a “non-security” status in secondary market sales until the final ruling in the SEC vs. Ripple lawsuit, which could still take years.

-

SEC’s dismissal of its lawsuit against Ripple’s executives

The regulator dismissed its lawsuit against Brad Garlinghouse and Chris Larsen, the two individual defendants. While there is a question of the remedies for claims involved in the institutional sales of XRP, the regulator made a voluntary dismissal of the lawsuit and this is likely to help the lawsuit reach a summary judgment faster.

Judge Torres set a lawsuit schedule for the Ripple case for 2024

- February 12, 2024 for completion of remedies-related discovery (exchange of information, pretrial)

- March 13, 2024 for filing briefs with respect to remedies

- April 12, 2024 for defendants (Ripple) to file their opposition

- April 29, 2024 for the plaintiff (SEC) to file their reply

Attorney Fred Rispoli, respected in crypto circles for his opinions, said that no appeal would be issued before mid-2026 by the Second Circuit. This cements Judge Torres’ July 13 ruling, offering regulatory clarity on XRP tokens. Attorney Rispoli said that the ruling by Judge Torres “will be ironclad for a very long time.”

Will the SEC settle with Ripple or pocket a loss?

Pro-XRP attorney John Deaton said a likely outcome of the SEC vs. Ripple lawsuit is a settlement between the two parties.

Deaton argued that the cross-border remittance firm may be interested in a settlement of $20 million or less.

Timeline of key events in SEC v. Ripple lawsuit

XRP/USDT 1-day chart.

Three fundamental catalysts that can drive XRP gains in 2024

Apart from developments in the SEC vs. Ripple legal case, three major catalysts could fuel gains in XRP price: Ripple’s potential Initial Public Offering (IPO), Bitcoin’s fourth halving event, and institutional capital inflow to XRP funds.

While Ripple has not officially endorsed it, the crypto community on X believes a potential IPO will likely be announced in early 2024. Any announcement regarding this matter is expected to have a bullish impact on XRP, supporting price gains in the altcoin.

XRP’s correlation with Bitcoin is 0.88. In lieu of its tight correlation with the largest crypto asset by market capitalization, XRP price is likely to follow that of Bitcoin. Analysts widely expect Bitcoin price to increase after its fourth halving event, to be held in April, and XRP could follow suit.

Moreover, there is a high probability of Spot Bitcoin ETF approval by the SEC, which could have a spillover effect on altcoins and XRP.

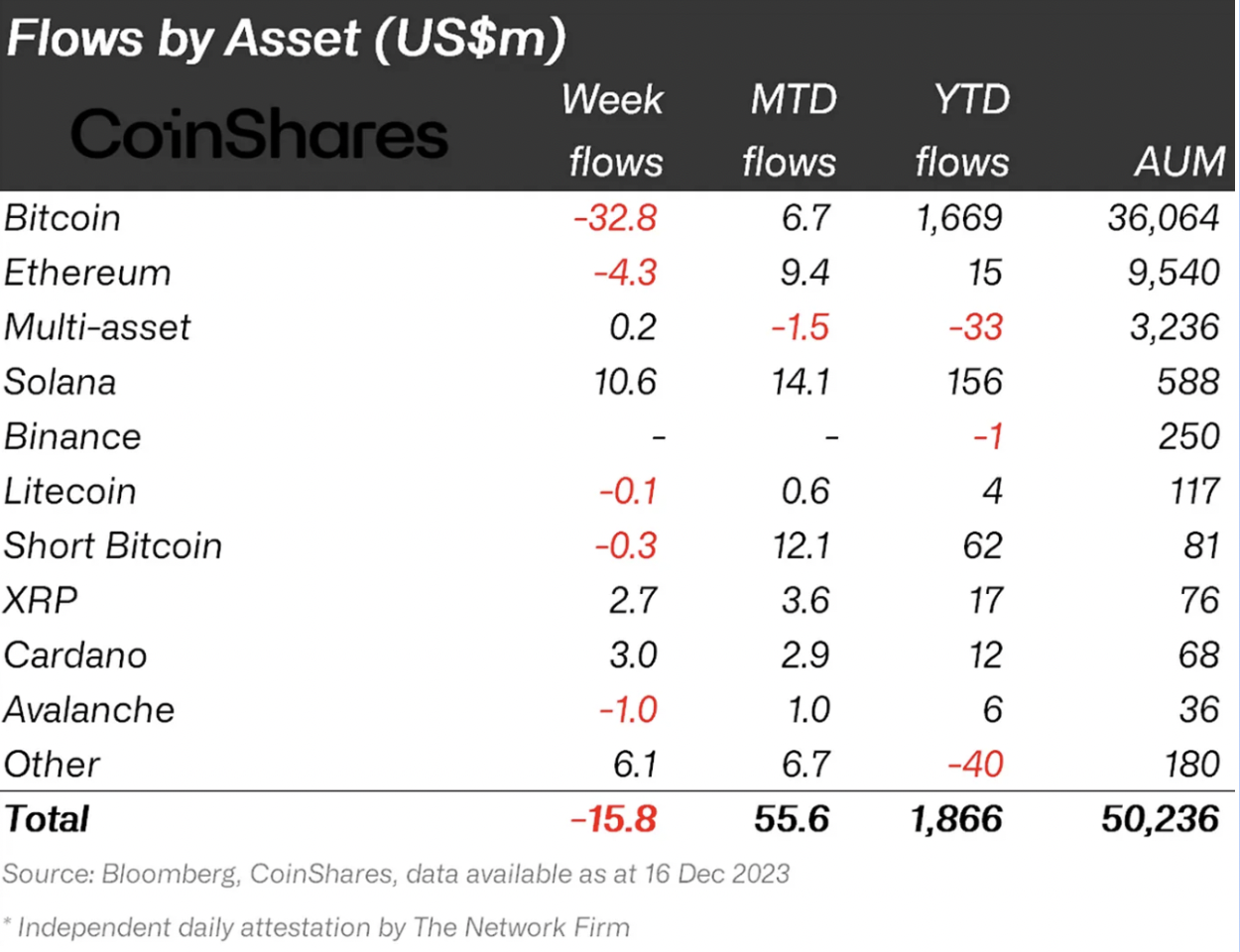

According to a December 18 report from CoinShares, XRP funds have noted $17 million in inflows since the beginning of 2023. The altcoin has gained mainstream attention from institutions since the July 13 ruling, and XRP funds witnessed a heightened capital inflow in 2023 compared to other altcoins.

CoinShares fund inflows by assets (In USD). Source: CoinShares

2024 Technical outlook: Will 2024 be the year of XRP?

After a near closure of the SEC vs. Ripple lawsuit for XRP holders, 2024 is likely to be the year of the XRP. The altcoin holders have a bullish outlook on the asset and expect the altcoin will rally towards a new all-time high with a positive outcome in the SEC vs. Ripple case.

XRP price peaked at $0.94 in 2023, and the altcoin is poised to yield higher gains in 2024. As seen in the 1-week chart below, XRP price formed a symmetrical triangle pattern between March 2022 and December 2023. The altcoin is currently testing the upper boundary of the triangle. This indicates that a bullish breakout is likely, with a target at $1.2413.

This bullish breakout target from the symmetrical triangle aligns with the 50% Fibonacci retracement level of XRP price decline from its April 2021 peak at $1.9659 to June 2021’s low of $0.5167.

XRP/USDT 1-week chart

However, a weekly candlestick close below the lower boundary of the symmetrical triangle at $0.5167 is likely to invalidate the bullish thesis for XRP. This could be followed by a further decline in XRP price, with the altcoin finding support at its June 2022 lows of $0.2912.

Summary

The SEC vs. Ripple lawsuit remains a focal point for XRP holders entering 2024. The developments in the legal battle will likely influence the asset’s price, alongside other catalysts like the spot Bitcoin ETF decision at the beginning of the year by the US SEC and the Bitcoin halving, scheduled for April 2024.

Ripple’s Chief Legal Officer, Stuart Alderoty, bets big on 2024. Alderoty expects a breakthrough in the lawsuit and notes that the battle hindered Ripple’s growth in the crypto ecosystem. Ripple CLO expects the lawsuit’s resolution to pave the way for favorable crypto regulation in the US.

Institutional investors continue to drive demand for XRP funds, fueling a bullish outlook among market participants. In this context, XRP price is likely to continue its upward trend and cross the $1 psychological barrier.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.