XRP plunges as Trump's tariff announcement outweighs RLUSD launch on Ripple Payments

- Ripple announced the launch of its RLUSD stablecoin on Ripple Payments to accelerate cross-border transactions.

- XRP realized losses hit a two-year high of over $710 million.

- XRP risks validating a Head-and-Shoulders pattern following Trump's reciprocal tariffs kick-off on US trading partners.

XRP declined 5% on Wednesday following President Donald Trump's announcement of reciprocal tariffs on all international trading partners. The decline wiped out gains spurred by Ripple's confirmation of integrating the RLUSD stablecoin into its payments solution, Ripple Payments.

RLUSD goes live on Ripple Payments; Trump’s tariffs spark $710 million in XRP realized losses

Ripple announced the integration of RLUSD into its cross-border payments system, Ripple Payments, to boost the stablecoin's adoption.

Ripple stated that select customers, including cross-border payment providers BKK Forex and iSend, are using RLUSD for better international treasury operations.

RLUSD has grown since its launch in December, currently nearing $250 million in market capitalization and $10 billion in trading volume, according to Ripple.

"We're seeing the market cap continue to grow, outpacing our internal projections. In short order, RLUSD is being used for a number of use cases, including use as collateral in both crypto and TradFi trading markets," said Jack McDonald, senior vice president of Stablecoins at Ripple.

Ripple also announced that RLUSD is live on the crypto exchange Kraken, adding to its list of partners worldwide.

XRP rose 2% after the announcement but has since wiped out the gains, trading at a 5% loss in the past 24 hours. The rapid decline saw investors realizing $710 million in losses — the highest level since December 2022.

This shows that some XRP investors are beginning to sell at heavy losses — unlike previous months when its elevated price saw investors realizing mostly profits during market downturns.

XRP realized losses. Source: Santiment

The decline follows Trump's announcement of a 10% tariff on all US imports across the board and reciprocal tariffs based on half of each country's respective rates.

The decision has sparked heavy losses across major cryptocurrencies, with the entire crypto market capitalization plunging over 5%.

XRP could validate H&S pattern following Trump's reciprocal tariffs

XRP faced rising selling activity on Wednesday, declining by 5% and sparking $17.26 million in futures liquidations. The total amount of liquidated long and short positions accounted for $10.67 million and $6.59 million, respectively.

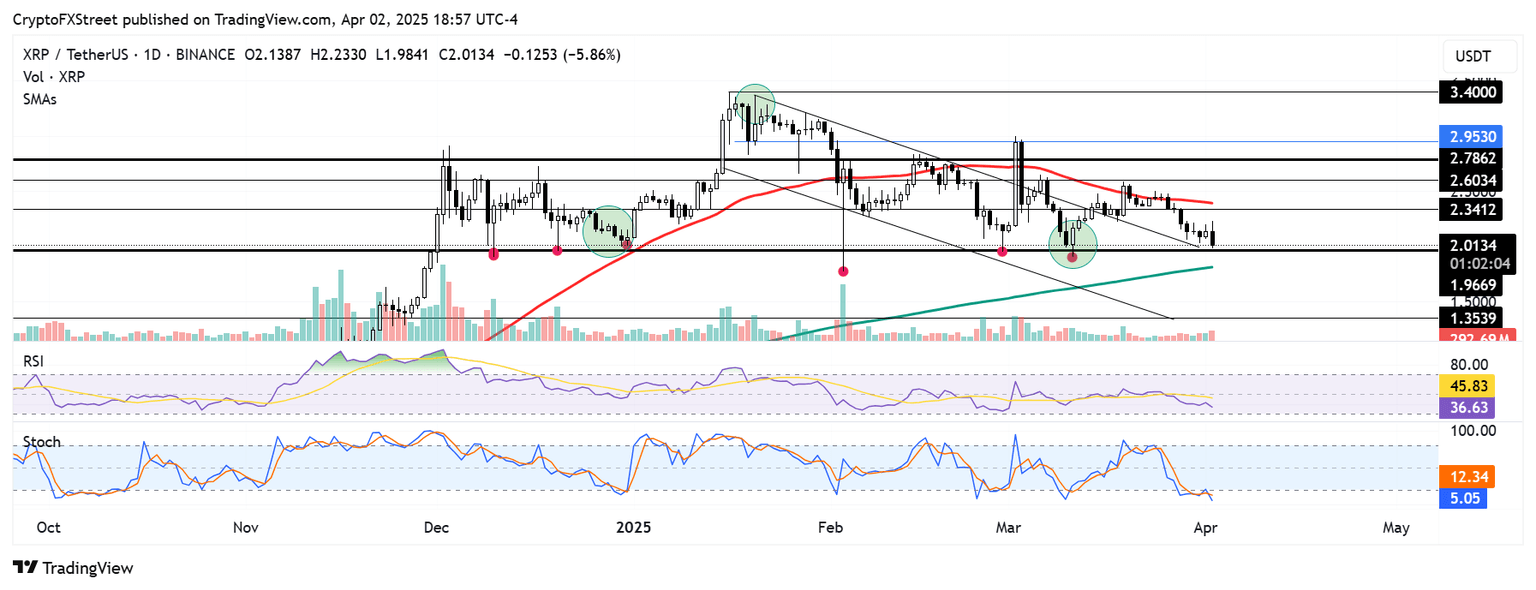

With Trump's announcement of reciprocal tariffs accelerating losses in the crypto market, the $1.96 support is a key level to watch for the remittance-based token. A breakdown below this level and the 200-day Simple Moving Average (SMA) will validate a Head-and-Shoulders (H&S) pattern, potentially sending XRP to find support at $1.35.

XRP/USDT daily chart

The Relative Strength Index (RSI) is below its neutral level, while the Stochastic Oscillator (Stoch) is in the oversold region, indicating dominant bearish momentum.

A daily candlestick close above $2.34 will invalidate the thesis and potentially send XRP to $2.78.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

%2520%5B23.40.21%2C%252002%2520Apr%2C%25202025%5D-638792331371971223.png&w=1536&q=95)