XRP on the verge of a rally to $1.96 as investors maintain bullish sentiment

- Ripple's XRP exchange reserve decline and open interest growth reveal strong bullish sentiment among investors.

- XRP's estimated leverage ratio shows investors are taking high leverage risk, and a correction often ensues when the ratio peaks.

- XRP could rally to $1.96 if it validates the rounded bottom pattern.

Ripple's XRP trades at $1.11 on Wednesday, maintaining its position as the best-performing cryptocurrency in the top 20 cryptos by market capitalization, with over a 50% rise in the past week. On-chain data and technical patterns show that the remittance-based token could continue the uptrend and rally to $1.96 as bullish sentiment remains dominant.

XRP's on-chain data indicates dominant bullish momentum

In the past seven days, investors withdrew nearly 250 million XRP tokens from Korean exchange Upbit, which holds the largest XRP reserve, per CryptoQuant's data. The withdrawals have sent Upbit's XRP reserve to a four-month low of 6.3 billion XRP, as revealed in the chart below. A similar trend is also seen in Binance's XRP reserve, which began trending downwards after hitting a peak on November 12.

XRP Exchange Reserve - Upbit | CryptoQuant

A decrease in an asset's exchange reserve indicates rising buying pressure, which may boost prices.

The dominant bullish sentiment is also visible in XRP's futures open interest, which surged to an all-time high of $1.98 billion on Sunday before settling around $1.84 billion in the early Asian session on Wednesday, per Coinglass data

XRP Open Interest | Coinglass

Open interest is the total number of outstanding contracts in a derivatives market.

Additionaly, XRP's estimated leverage ratio (ELR) shows that investors expect the uptrend to continue. The ratio has been trending upwards, reaching 0.17 earlier on Saturday — its highest level since January. However, investors should be cautious as a sharp price correction often follows when the ELR hits high levels.

XRP Estimated Leverage Ratio | CryptoQuant

ELR shows how much leverage traders use and is obtained by dividing an exchange's open interest by their coins reserve. Increasing values indicate most investors are taking high-leverage risk in the derivatives market.

Ripple technical analysis: XRP could see another spike if rounded bottom pattern is validated

Ripple's XRP trades above the $1.10 level after seeing $9.62 million in futures liquidations. Liquidated long and short positions accounted for $6.23 million and $3.38 million, respectively.

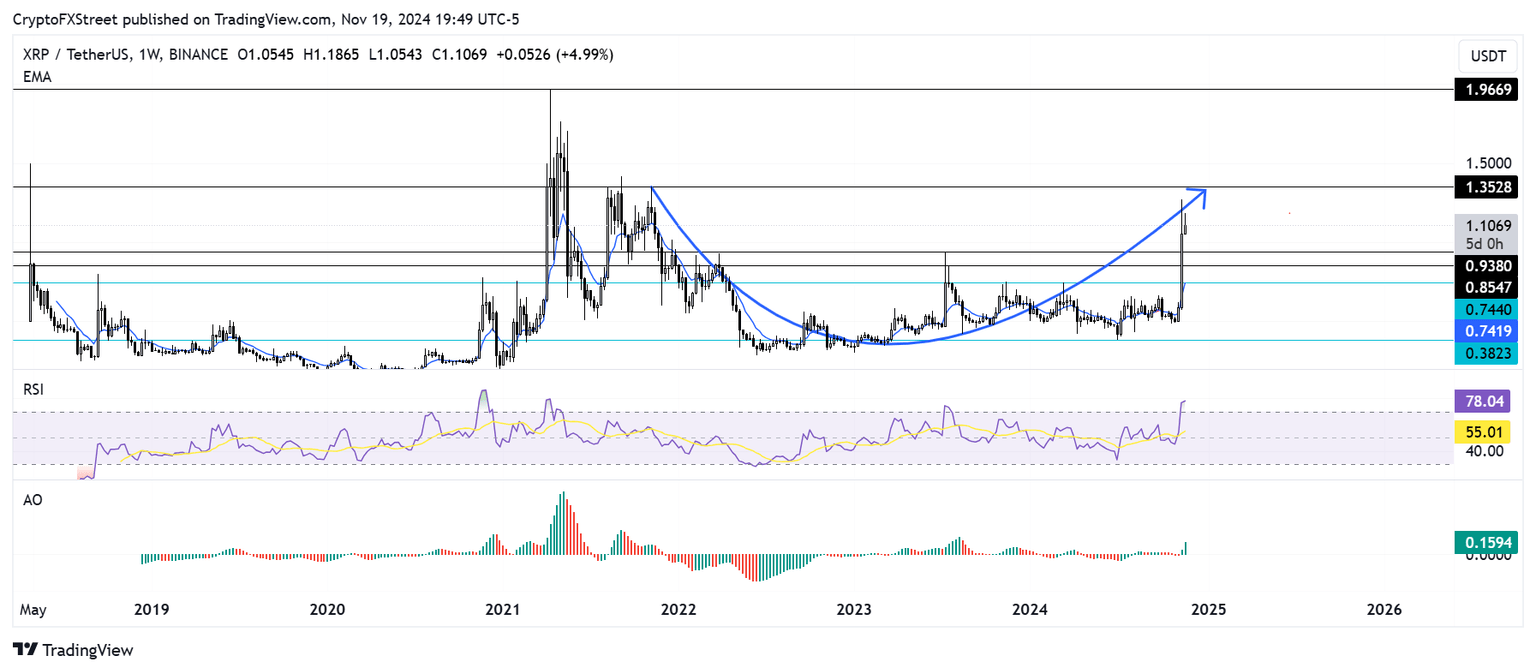

On the weekly chart, XRP is on the verge of validating a rounded bottom pattern following over a 100% surge in the past two weeks.

XRP/USDT weekly chart

If XRP sustains an extended move above its three-year resistance of $1.35, it will validate the pattern and potentially rally to test the resistance at $1.96.

A move above this resistance will send XRP into the $2 range for the first time in six years.

The Relative Strength Index (RSI) is in the oversold region, indicating a price correction may occur. Meanwhile, the Awesome Oscillator (AO) has posted consecutive green bars above its neutral level, signaling rising bullish momentum.

A daily candlestick close below $0.74 will invalidate the bullish thesis and potentially send XRP to $0.38.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

-638676617987918356.png&w=1536&q=95)