XRP notes an almost 60% rally as volatility climbs to a 4-month high

- XRP observed its first major rally since February as the altcoin shot up by 59% to trade at $0.5.

- Bullishness surrounding the upcoming summary judgment has pushed XRP’s price up in the last two weeks.

- 4-month high volatility might lead to price swings resulting in XRP losing the $0.52 psychological support.

Ripple and the Securities and Exchange Commission (SEC) are getting closer to the end of their almost 2-year long lawsuit. On the back of that news, the cryptocurrency’s price has risen significantly, making it one of the best performers in the last few weeks but also opening doors to an equally significant price fall.

XRP makes a big jump

Up until mid-September, XRP was stuck within a sideways momentum that kept it below $0.38 for almost four straight months. However, since then, XRP’s price has been observing a consistent rise which also helped XRP breach its 18-month-long downtrend.

Despite multiple attempts, the downtrend line could not be flipped into support, but the 59% rally noted over the last three weeks sustained XRP’s presence above it.

In doing so, XRP also reclaimed the 50-day (red), 100-day (blue) and the 200-day (green) Simple Moving Average (SMA) as support. Of the three, the 200-day SMA holds the most important, as the last time it acted as support was back in December 2021.

The persisting bullishness goes back to the very lawsuit which was once the cause of XRP’s decline. As the lawsuit nears the summary judgment, scheduled for December this year, investors are getting optimistic about its win.

Now while this bullishness might last for a long while, the extremely volatile market might pose a threat to XRP’s price.

Price swings on the way?

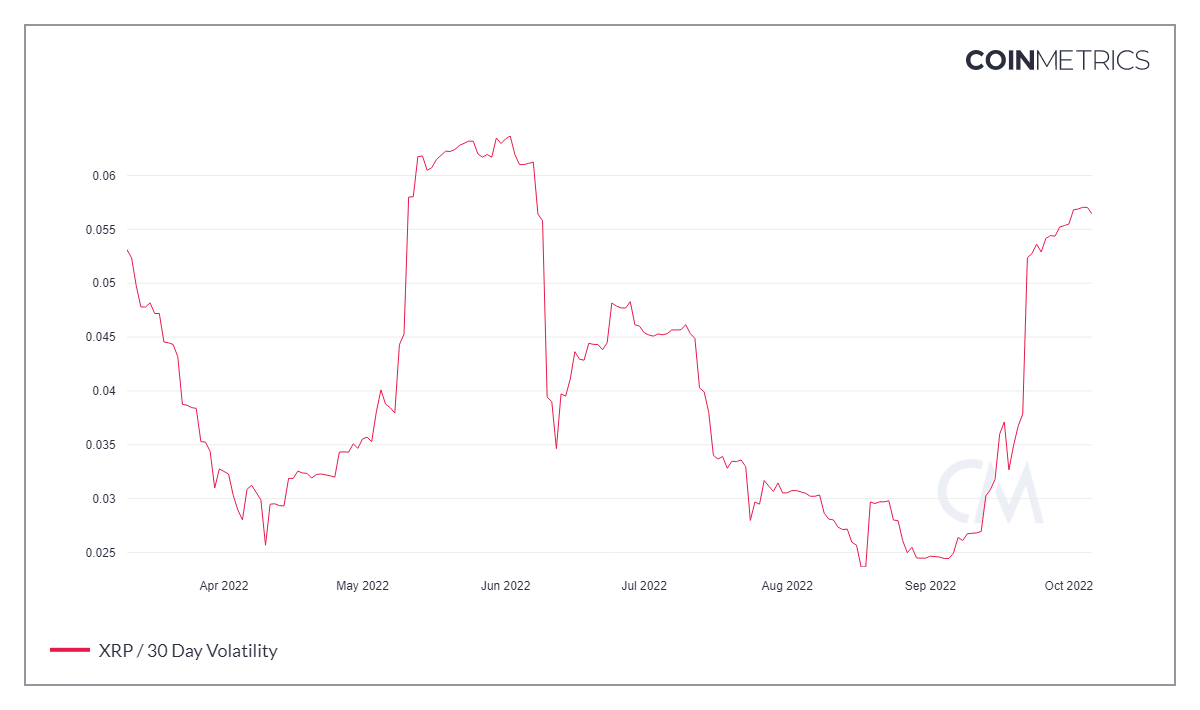

As visible on the chart, XRP’s recent price rise also triggered the volatility of its market, bringing it to a 4-month high.

XRP volatility

While the presence of the Average Directional Index (ADX) above 25.0 indicates that the uptrend has strength, the only major support XRP has is of the 200-day SMA. (ref. XRP price chart)

Since the other two SMAs lie way below the $0.38 support, a price swing could potentially cause a downfall toward this support. However, if investors’ support persists, this could be avoided, provided buying pressure is maintained.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.