XRP lawsuit: Victory edges toward Ripple after Judge Torres denies SEC motion

- Ripple lawsuit plaintiff, the SEC, filed a motion to seal the controversial Hinman speech documents.

- The regulator argued that redaction outweighs "public's right" to access documents that have "no relevance" to Court.

- Judge Analisa Torres denied the motion on May 16, marking a win for Ripple.

- XRP reacted with a 5% upswing, several technical indicators support the bullish outlook.

Ripple enjoys a new victory in the XRP lawsuit against the US Securities and Exchange Commission (SEC) after Judge Analisa Torres denied the regulator's motion to seal the Hinman documents.

Hinman Speech docs will not be sealed; p.5. Judge makes clear they should be open regardless of their impact in a decision. States it neither stifles SEC deliberation nor is the SEC's "prophylactic" concern it could be priveleged in the future convince.https://t.co/tCS5cpgsQO pic.twitter.com/73YXhZszNY

— WrathofKahneman (@WKahneman) May 16, 2023

For clarity: Hinman Speech Documents- The speech given by former SEC Corporation Finance Division Director William Hinman at the Yahoo Finance All Markets Summit in June 2018, where he reportedly stated that Ethereum (ETH) is not a security.

Also Read: Ripple Chief Legal Officer slams US SEC's argument against the payment giant

Ripple lawsuit to include Hinman Speech Documents as evidence

The US SEC filed a motion on December 22 asking the Court to seal the contentious Hinman Speech documents. The application was based on the regulator's argument that "its mission outweighed the public's right to access documents that have no relevance to the Court's summary judgment decision," among other reasons.

However, based on the latest court order, District Court Judge Analisa Torres has determined otherwise, ruling that "the documents are judicial documents subject to a strong presumption of public access." The decision is a clear win for Ripple and the entire XRP community in the ongoing legal tussle against the SEC.

As indicated in the excerpt, Judge Torres articulated that the Hinman Speech Documents "would reasonably tend to influence the Court's ruling on a motion.

Notably, this was not the only denied application by the SEC. According to the judge, the Court dismissed the regulator's claims that sealing the documents is necessary to preserve "openness and condor within the agency. To back this decision, Judge Torres explained, "The deliberative process privilege does not protect Hinman Speech Documents because they do not relate to an agency position, decision or policy."

Nevertheless, some of the SEC's applications passed, including where the agency asked the Court to redact the names and identities of the regulator's pundits and the XRP investor declarants. The agency also wanted the personal and financial data of defendants concealed.

In the same way, some of Ripple's motions were turned down. Among them references associating its revenues with XRP sales and the level of reimbursement offered to trading platforms, among others.

Ripple price turns bullish on the win

Considering the speech was an integral piece of evidence in the ongoing legal tussle between Ripple and the SEC on charges of securities laws violation, the Court admitting the Hinman Speech into evidence tips the odds in favor of the defendant.

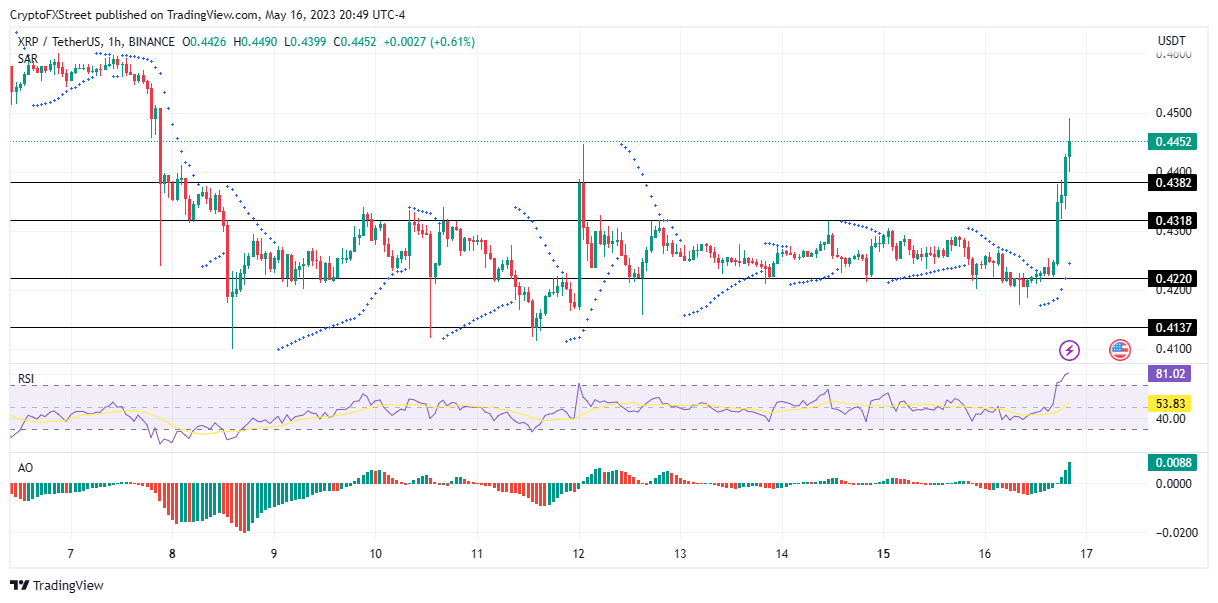

Accordingly, Ripple (XRP) price has spiked on this development, recording a daily rise of 5.35%, with a 40% increase in 24-hour trading volume, suggesting a return of investor enthusiasm. The remittance token has breached key hurdles, scaling a recovery rally above the $0.431 and $0.438 resistance levels to record an intra-day high of $0.449.

If investors sustain the bullish momentum, Ripple price could scale higher past the current market value of $0.445 to shatter the psychological $0.450 hurdle and reclaim the early May highs.

Several indicators supported this outlook, beginning with the Parabolic SAR, which had flipped below Ripple price, adding credence to the bullish outlook.

Also, the Relative Strength Index (RSI) and the Awesome Oscillator (AO) were both in the positive zone to support the upside.

XRP/USDT 1-hour chart

Conversely, profit-taking could easily kick especially as investors book profits after breaking even. This could trigger a selling spree that would see Ripple price lose most if not all the ground covered on May 17.

Remember, the RSI was high in the overbought zone at 81, suggesting a looming pullback. As such, XRP traders should brace for a correction in Ripple price.

The dire case would be a resumption of the May 16 lows around $0.420.

Also Read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Euphoria and the effects of an overheated market

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.