XRP investors discouraged by China’s economic outlook

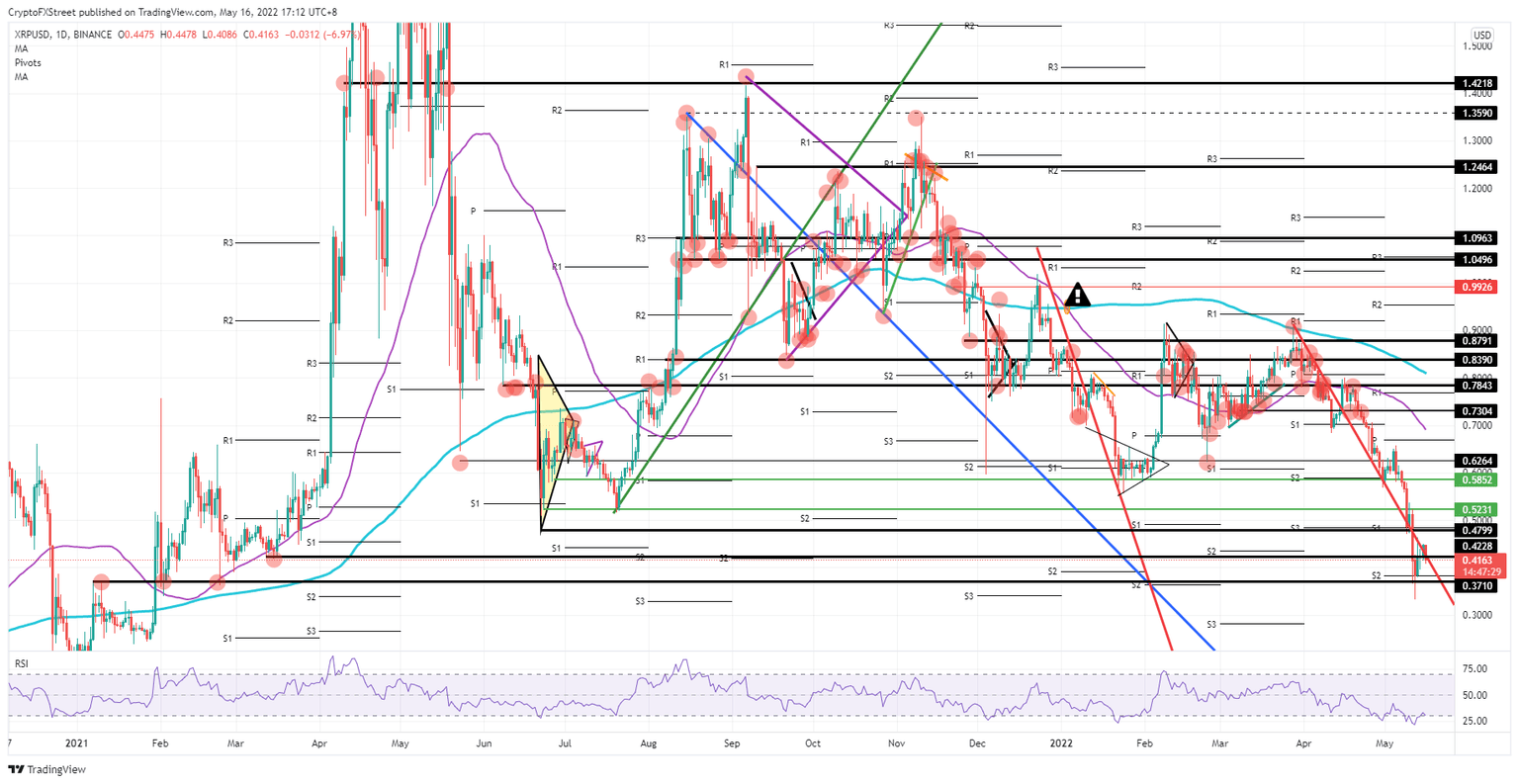

- Ripple price is on the cusp of dropping back below $0.40.

- XRP price appears to be in a false break above the red trendline.

- Expect to see another 20% drop for a test of the low at $0.3323.

Ripple (XRP) price saw bulls trying to get price action through the red descending trendline over the weekend, in an attempt to stop this downtrend that has been present since April. Although it looked like bulls were succeeding at first, a data dump out of China poured cold water on the plan. With lockdowns biting hard on economic data, investors did another round of reshuffling in their risk portfolio, and yet again, cryptocurrencies were amongst the casualties. Several opinion pieces over the weekend from central bankers made it clear that they will not step in to prop up the crypto sector to prevent a default, which further created uncertainty for market participants .

XRP price set to test and slide below $0.30

Ripple price is again bleeding, despite a recovery over the weekend, which looked to have done some patchwork, with XRP price trading up for three consecutive days and even breaking above the downtrend guideline (red descending trend line on the chart). The break above that trend line seemed to be too high an aspiration for bulls, given the weight of already very troubled geopolitical tail risks weighing. Additional geopolitical worries have since come from China reporting negative data on retail and industrial production, setting the tone in the early hours of trading this morning, and pushing investors a little more towards the exit from cryptocurrencies.

XRP price for now sees losses contained, with $0.4086 holding, but as the $0.4228 level breaks, expect to see more bearish flow as short-selling will happen around that red descending trend line. It will all boil down to the daily close and whether that close is either above or below the red descending trend line. Expect intraday price action to be a heavily fought affair with both bears and bulls engaging and seeing whipsawing moves across the trend line throughout the day. Seeing the broadness and weight of all the geopolitical uncertainties, without even mentioning the next round of supply chain issues that are on the horizon, from the delayed effect of Chinese lockdowns, more downturn for XRP price is expected, with a test towards $0.3323 and possibly a slip below $0.30.

XRP/USD daily chart

As said above, the close this evening will be critical for the rest of the trading week. A close above the trend line would set the scene for Tuesday’s trading, with $0.4799 providing a confirmation level for a test and break above. In such a scenario, XRP price could rally back up towards $0.5852 and book over 40% gains in the process.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.