XRP climbs as new tokens issued on Ripple’s XRP Ledger hit a new all-time high

- XRP trades above $0.53, gains over 1% on Thursday.

- Ripple’s XRP Ledger hit an all-time high in the number of tokens issued on the chain.

- XRP could gain nearly 5% and target the $0.5550 level.

Ripple (XRP) trades at $0.5312 at the time of writing. The native token of the XRP Ledger gained 1.05% on Thursday. Data from crypto intelligence tracker Santiment shows that Ripple hit a new all-time high in terms of a key metric — the number of tokens issued on the chain.

Daily Digest Market Movers: XRP Ledger notes massive spike in number of new tokens on the chain

- XRP Ledger hit an all-time high for the number of new tokens issued in a single day. That figure reached 213 on October 17. This marks a 200% increase from the previous record set in October 2021.

Daily new XRPL assets issued (XRP)

- The increase in the number of tokens issued can be attributed to the launch of First Ledger, a project that enables traders to trade tokens on the chain in a faster manner through Telegram.

.@First_Ledger broke XRP Ledger's ATH for new issued tokens per day, dwarfing the peak of the 2021 token craze by magnitudes. pic.twitter.com/g2pcneLnwT

— Vet ☠️ (@Vet_X0) October 24, 2024

- The protocol’s launch has pushed the number of tokens on the Ledger to a peak. Since then, it dropped to 12 on Thursday.

- A key market mover influencing XRP price is the Securities & Exchange Commission’s (SEC) appeal against the final ruling in the Ripple lawsuit.

- The payment remittance firm is set to submit Form C by the upcoming deadline of October 24. A failure to file the required document by midnight Eastern Standard Time would mean there will be no further oral arguments.

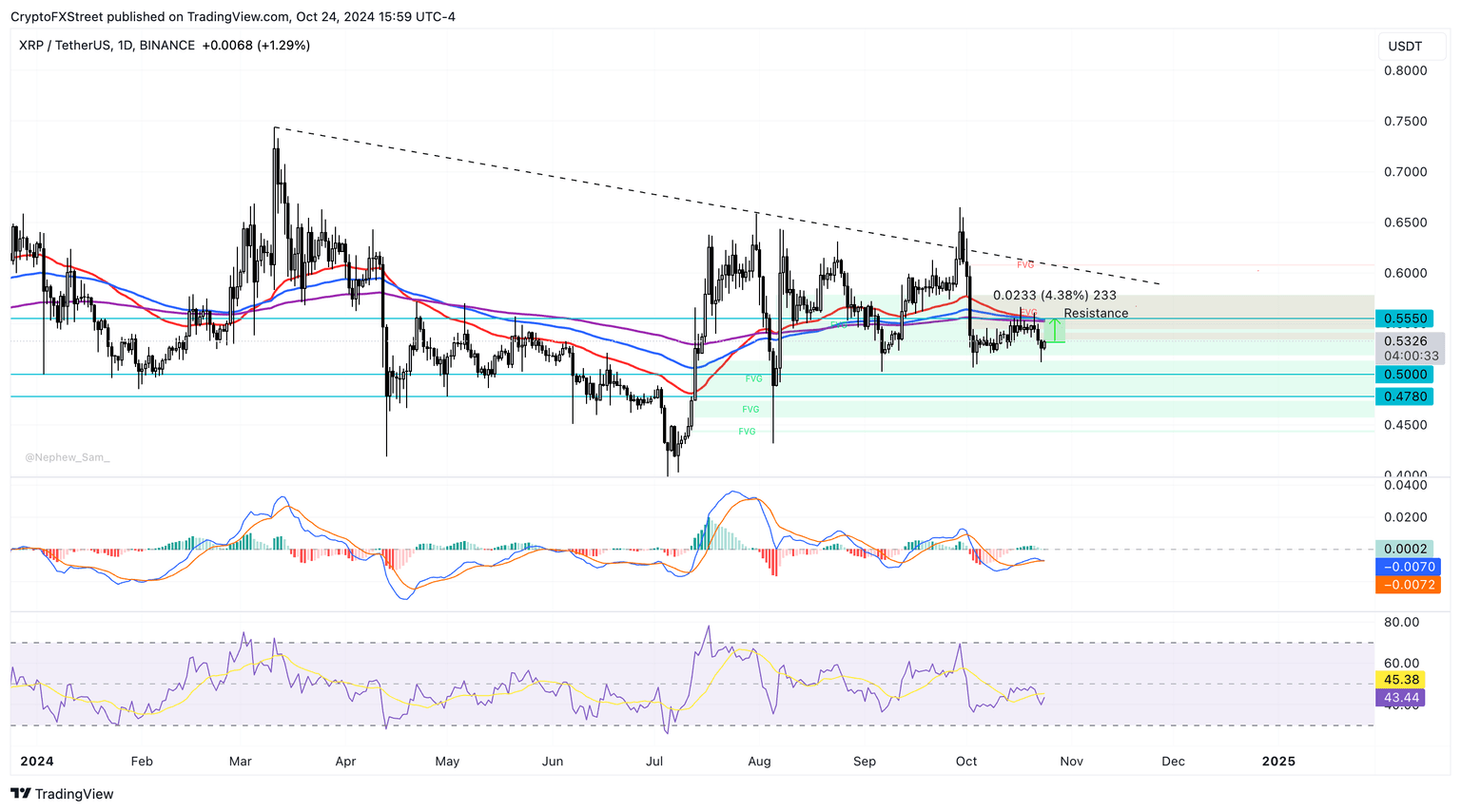

Technical analysis: XRP eyes 5% gain

XRP is in a downward trend since its peak of $0.7440 on March 11. Technical indicators, such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), signal the potential for gain in the altcoin’s price.

The green histogram bars on the MACD and the upward sloping RSI at 43, under the neutral level, support the thesis for XRP price gain.

The native token of the XRP Ledger could rally nearly 5% and test resistance at $0.5550, a level that coincides with the Exponential Moving Averages (EMAs).

XRP/USDT daily chart

A daily candlestick close under the psychologically important $0.5000 level could invalidate the bullish thesis. XRP might then sweep liquidity at $0.4780, a key support level for the altcoin.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B00.41.49%2C%252025%2520Oct%2C%25202024%5D-638653984978304580.png&w=1536&q=95)