XRP recovers from week-long decline following Ripple’s response to SEC motion

- Ripple filed a letter to the court to support its April 22 motion to strike new expert materials.

- The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

- XRP closed above $0.51 on Wednesday, beginning a mild recovery after a nearly ten-day decline.

Ripple (XRP) continues to recover on Friday from its almost ten-day decline, clinging to gains after closing above $0.51 on Wednesday.

In the legal battle between Ripple and the US Securities and Exchange Commission (SEC) – which is one of the key drivers of XRP price – both parties are clashing over the validity of the testimony of SEC’s Assistant Chief Accountant Andrea Fox. Ripple filed on Thursday a new letter supporting its motion to strike new expert materials as it considers Fox’s statements as expert testimony and argues that the regulator should have introduced expert testimony during the remedies discovery phase that has passed.

The SEC is expected to file its response by May 6, following which market participants expect a ruling from the court.

Daily Digest Market Movers: Ripple files letter to support striking expert materials

- The SEC included Assistant Chief Accountant Andrea Fox’s comments on Ripple’s financial statements in its filing. Ripple identified this as “new expert materials” and argued that this should have been introduced in the remedies discovery phase of the lawsuit, which has already ended.

- The SEC responded to Ripple arguing that the comments from Fox aren’t expert testimony, but “facts and some basic arithmetic.” Therefore, the SEC has asked the court to deny Ripple’s motion to strike new expert materials from the lawsuit.

- Ripple has filed a letter to support its motion on Thursday.

#XRPCommunity #SECGov v. #Ripple #XRP @Ripple has filed a letter in further support of its April 22, 2024 motion to strike new expert materials, and in reply to the SEC’s April 29, 2024 opposition to that motion to strike. pic.twitter.com/vXW1C22Oso

— James K. Filan (@FilanLaw) May 2, 2024

- In its letter, Ripple addresses why Fox’s statements amount to expert testimony, why they should have been presented in the previous phase of the lawsuit, and how the expert is relying on her accounting experience to analyze the firm’s financial statements.

- Irrespective of the fact whether Fox is an expert or a summary witness, the SEC was required to disclose it prior to the close of the remedies-discovery phase, Ripple’s letter reads.

- The SEC is expected to file a response by May 6, after which the court could rule on Ripple's penalties and fines for its institutional sales of XRP. The SEC has asked the court to impose $2 billion in fines, while the payment-remittance firm countered with a proposal of $10 million.

- The SEC originally took Ripple to court in late 2020, alleging that the firm had broken securities law with its sales of XRP. In July, the company scored a partial victory as a judge ruled that XRP sales on exchanges were not considered as securities. However, the legal battle continues regarding sales to institutional investors.

Technical analysis: XRP closes above $0.51 on Thursday, eyes further gains

Ripple ended its downward trend on Friday, April 19. Since then the altcoin has formed a higher high and a higher low, on the daily timeframe.

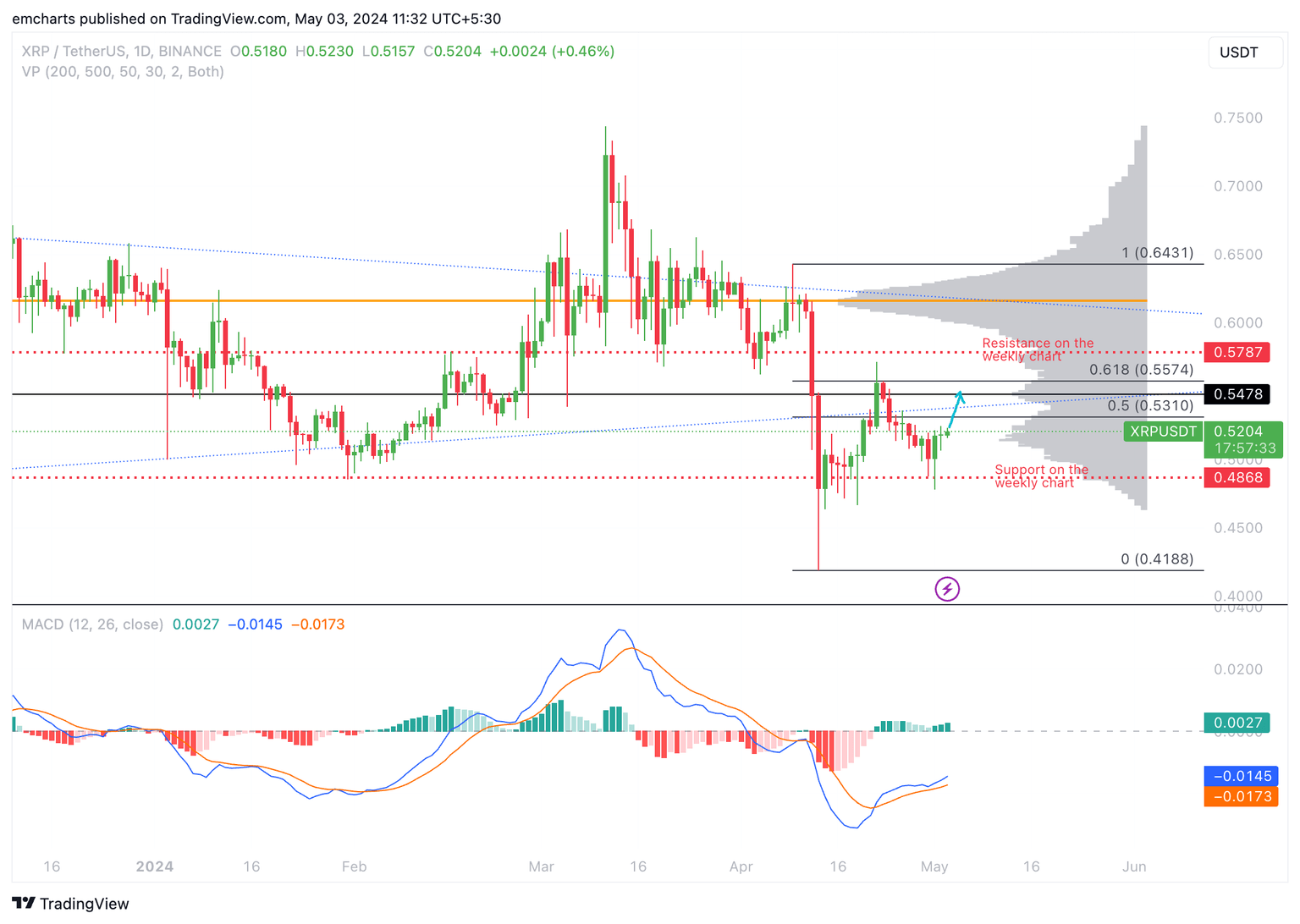

Ripple closed above $0.51 on Wednesday, a level that acted as sticky resistance for the altcoin. The climb above this level ended nearly ten days of decline. XRP is likely climbing towards $0.5478, a level at which a higher volume of XRP was traded, as seen on the Volume Profile indicator.

The Volume Profile indicator takes the total volume traded at a specific price level during the specified time period and helps traders identify price levels where the most volume of the asset was traded, helping determine key support and resistance levels.

The Point of Control (PoC) is at $0.6162, this represents the level at which the highest trade volume was recorded. In its uptrend, XRP is expected to gravitate towards this level.

XRP could add nearly 6% to its value, climbing to the target of $0.5458. Further up, XRP/USD faces immediate resistance at $0.5574, the 61.8% Fibonacci retracement of Ripple’s decline between April 9 ($0.6431) and April 13 ($0.4188), and $0.5787, key resistance on the weekly time frame.

XRP/USDT 1-day chart

On the other hand, a daily candlestick close below support on the weekly chart, at $0.4868, could invalidate the thesis of XRP price recovery. The altcoin could sweep April 13 low of $0.4188 in its correction.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.