XRP tests support, Bitwise files S-1 form with the SEC for first US-based Spot XRP ETF

- XRP loses 3% of its value on Wednesday, trading at $0.5881.

- Bitwise files S-1 registration with SEC, confirming its intention to register the first US-based Spot XRP ETF.

- XRP tests support at $0.5946, risks decline to a 50-day EMA at $0.5531.

Ripple (XRP) lost value on Wednesday even as asset management giant Bitwise affirms its intent to register the United States’ first Spot XRP ETF. Bitwise filed its S-1 registration, a crucial step in the process of registering a Spot crypto ETF with the Securities & Exchange Commission (SEC).

Daily Digest Market Movers: Bitwise takes XRP Spot ETF filing process forward on Wednesday

- XRP Spot ETF could debut in the US if asset manager Bitwise receives approval from the US SEC.

- The firm filed its S-1 registration, affirming its intent to launch the first Spot ETF for XRP Ledger’s native asset.

- S-1 filing is an initial registration form, considered a requirement by the regulator for securities that meet the proper criteria in the US. The filing is made before the securities product is approved and then listed on a national stock exchange.

- In an associated press release, Hunter Horsley, Bitwise CEO said,

“At Bitwise, we believe blockchains will usher in new, apolitical monetary assets and permissionless applications for the 21st century. It’s why for the past seven years we’ve helped investors access the opportunities in the space, and we’re excited to continue that work with our filing for a Bitwise XRP ETP.”

- XRP traders are digesting the news of the ETF, while they keep their eyes peeled for developments in the SEC vs. Ripple lawsuit.

- The lawsuit ended in August 2024, with a ruling which was considered a partial victory for both Ripple and the SEC. However, there is a likelihood that the regulator will appeal the ruling. This impacts XRP holders as the asset could lose its legal clarity.

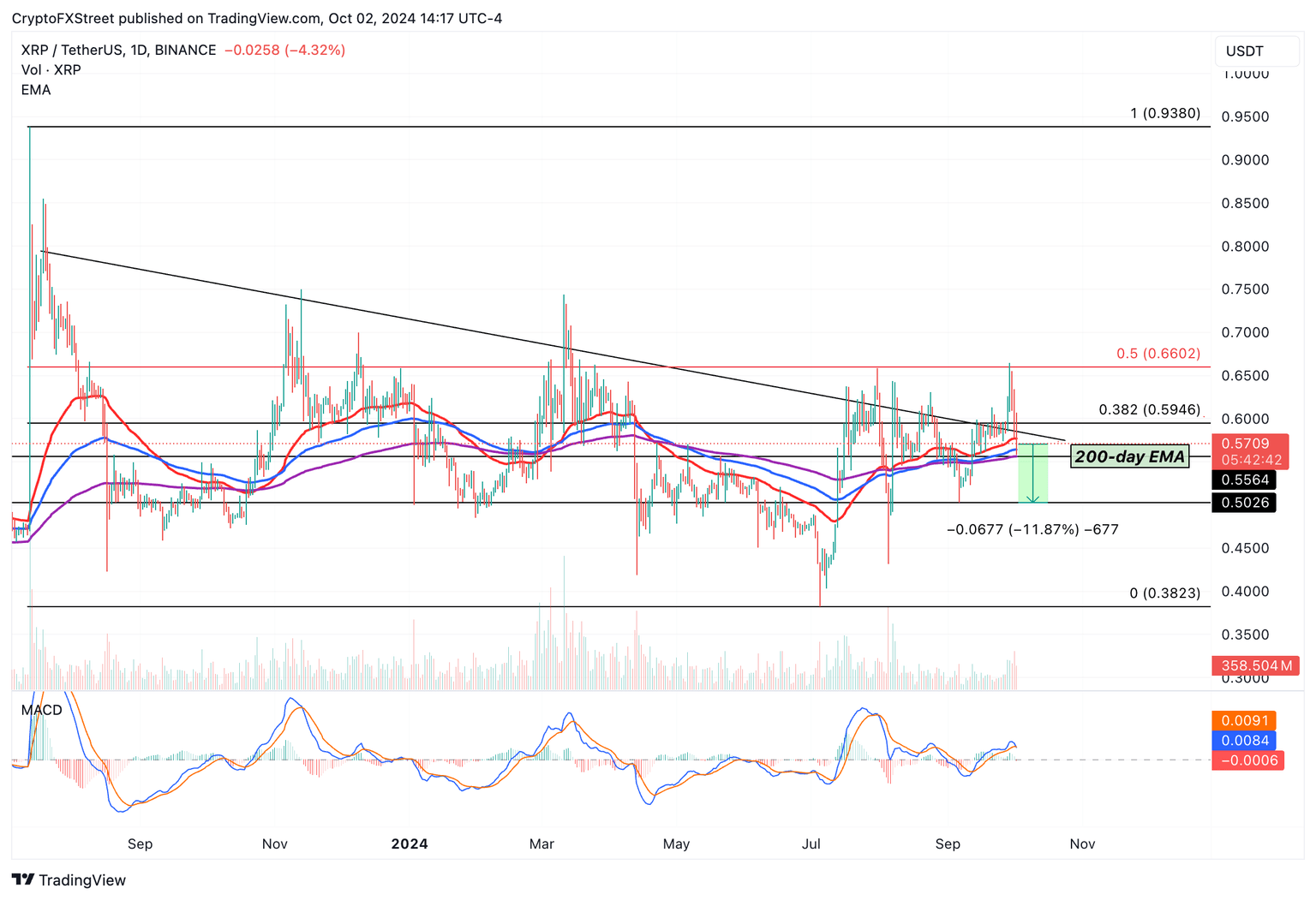

Technical analysis: XRP risks further decline

Ripple’s XRP is in a multi-month downward trend as seen in the XRP/USDT daily chart. The altcoin trades at $0.5709 after testing the $0.5946 support on Wednesday. The Moving Average Convergence Divergence (MACD) indicator shows that the XRP price trend likely has underlying negative momentum as the streak of green histogram bars ends.

The MACD line has crossed under the signal line, another sign of a likely trend reversal. XRP could sweep liquidity at the 200-day Exponential Moving Average (EMA) at $0.5564 and extend its decline by 11.9% to $0.5026, the September 6 low for XRP.

XRP/USDT daily chart

A daily candlestick close above support at $0.5946 could invalidate the bearish thesis. XRP could attempt a rally to $0.6602, the 50% Fibonacci retracement of the decline from the July 2023 top of $0.9380 to the July 2024 low.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.