XRP crypto price news today Elliott Wave technical analysis [Video]

![XRP crypto price news today Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/cryptocurrenciesusd_XtraLarge.jpg)

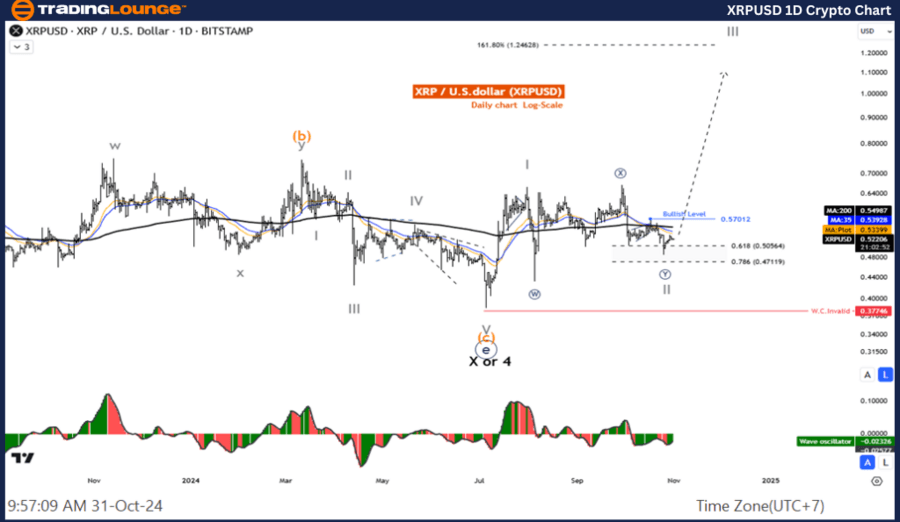

Elliott Wave Analysis TradingLounge.

XRP/ U.S. dollar(XRPUSD).

XRP/USD Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Double Corrective.

Position: Wave ((Y)).

Direction next higher degrees: Wave II of Impulse.

Wave cancel invalid level:

Details: Wave II is likely to be completed and the price will likely rise in wave III.

XRP/ U.S. dollar(XRPUSD)Trading Strategy:

The correction in wave II seems to be over so we focus on the five-wave rally of wave III and The price action remains in an uptrend, and we are looking for a re-entry into the trend.

XRP/ U.S. dollar(XRPUSD)Technical Indicators: The price is below the MA200 indicating a downtrend, The Wave Oscillator is a Bearish Momentum.

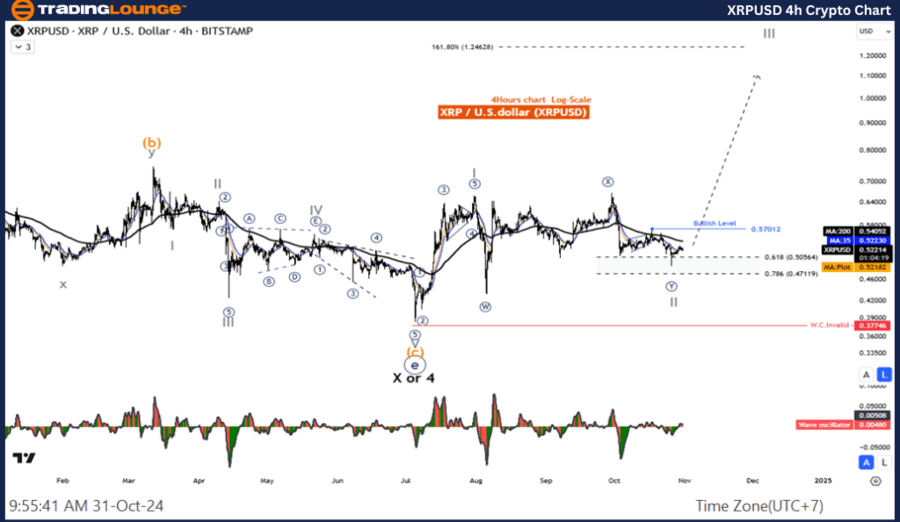

XRP/ U.S. dollar(XRPUSD).

XRP/USD Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Double Corrective.

Position: Wave ((Y)).

Direction next higher degrees: Wave II of Impulse.

Wave cancel invalid level:

Details: Wave II is likely to be completed and the price will likely rise in wave III.

XRP/ U.S. dollar(XRPUSD)Trading Strategy:

The correction in wave II seems to be over so we focus on the five-wave rally of wave III and The price action remains in an uptrend, and we are looking for a re-entry into the trend.

XRP/ U.S. dollar(XRPUSD)Technical Indicators: The price is below the MA200 indicating a downtrend, The Wave Oscillator is a Bearish Momentum.

Technical analyst: Kittiampon Somboonsod.

XRP/USD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.