Could XRP ETF approval shape potential 2025 rally?

- XRP gains 32% after the tariff-triggered crash to $1.6142, trading above $2.1000 on Tuesday.

- The SEC could vote to dismiss the case against Ripple after Paul Atkins officially assumes his role as agency Chair.

- Multiple XRP ETF applications’ deadlines loom, with all eyes set on incoming chair Paul Atkins.

- A drop in the derivatives’ open interest suggests traders are treading cautiously amid an uncertain macroeconomic environment.

Ripple (XRP) flaunted a bullish outlook, trading at $2.1505 at the time of writing on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move, eyeing $3.0000 psychological level. Multiple XRP ETF applications' deadlines are approaching, with eyes turning to the incoming Securities and Exchange Commission (SEC) Chair Paul Atkins.

XRP bulls hold steady amid speculation over the SEC vote

The XRP community eagerly awaits the Securities and Exchange Commission (SEC) vote to dismiss the case against Ripple. In a recent comment, Ripple CEO Brad Garlinghouse said that the company had reached an agreement with the agency’s staff. He added that protocol demands that the staff make recommendations to the commission, which is expected to vote on the matter.

The Senate confirmed President Trump’s nominee, Paul Atkins, as SEC Chair on April 9, potentially setting the groundwork for a crypto-friendly regulatory environment in the US.

At the same time, the SEC and Ripple jointly filed a request to suspend an imminent appeal in the lawsuit on Thursday. In other words, Ripple is unlikely to file a brief related to the appeal this Wednesday.

Experts and crypto lawyers weighing in on the matter said that the SEC could delay the vote to dismiss the case until Atkins assumes his role as SEC Chair. According to CryptoAmerica host Eleanor Terrett, the new chair could be sworn in over the next few days.

“Paul Atkins hasn’t taken his seat at the SEC yet. There are a few procedural steps before he can officially start, including President Trump signing off on his appointment and the formal swearing in. This could happen any time over the next few days,” Terrett explained.

XRP ETF deadlines loom

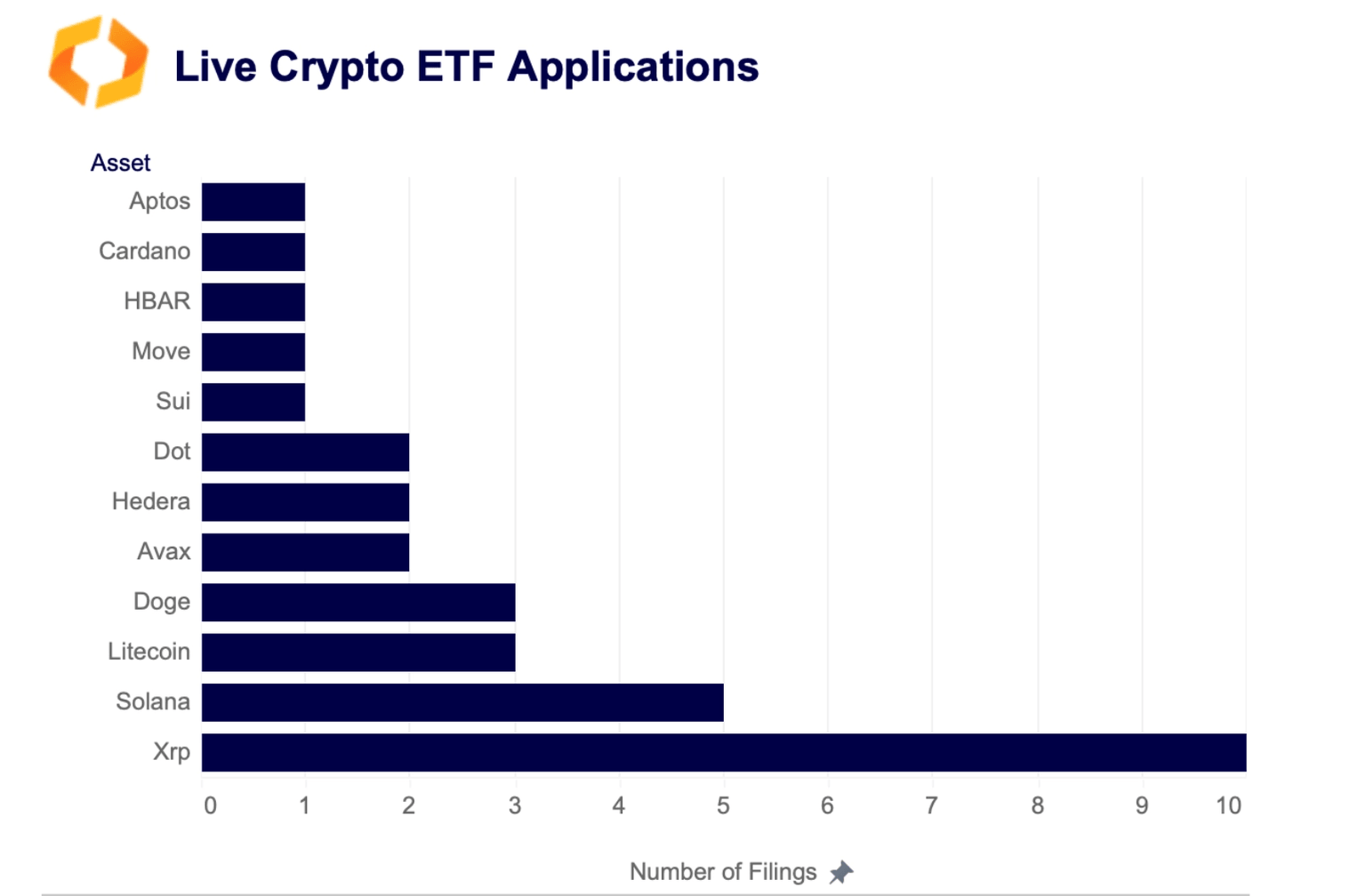

The incoming SEC Chair could have his plate full upon his accession to office, with pressing deadlines demanding his attention. Multiple asset managers have filed crypto-related ETFs, including XRP.

Crypto ETF applications | Source: Kaiko Research

According to Kaiko Research, the SEC confirmed XRP ETF applications in February and set the initial deadline as May 22.

“May 22 is an important date to watch in light of the recent ETF approval of a 2x XRP ETF from Teucrium, as the SEC must respond to Grayscale’s XRP spot filing by then.”

Can XRP rally to $3?

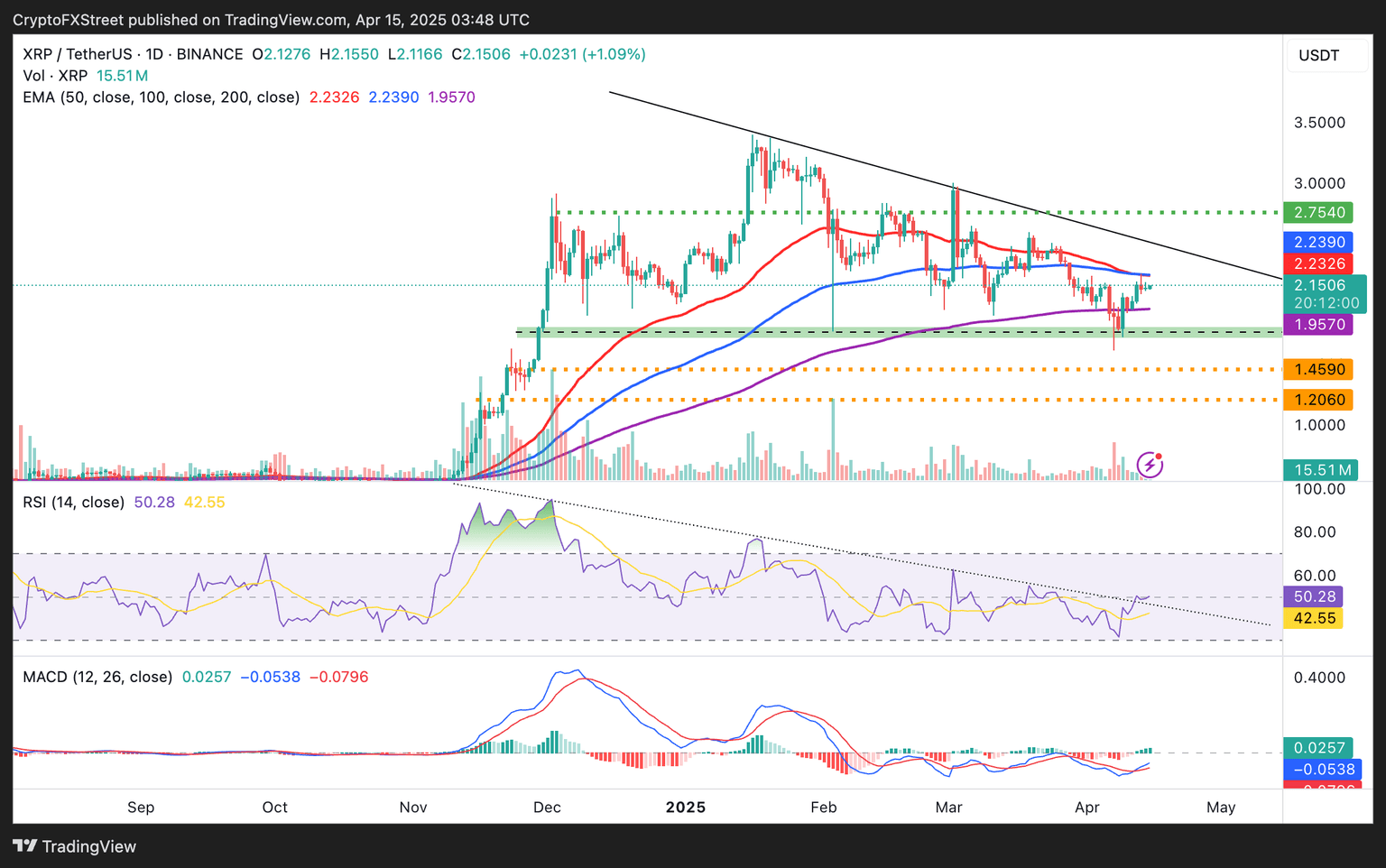

At the time of writing, XRP price firmly held onto support above the 200-day Exponential Moving Average (EMA), assuring traders of improving sentiment for both macro factors and fundamentals.

The Relative Strength Index (RSI) indicator’s breach of the descending trendline reinforces the bullish grip. As the RSI moves higher above the midline at 50, more traders will likely consider exposure to XRP. Besides, a buy signal from the Moving Average Convergence Divergence (MACD) indicator aligns with the bullish outlook.

XRP is required to break the confluence resistance at $2.2390 formed by the 50-day EMA and the 200-day EMA. This could make the token more attractive to investors, providing bullish momentum to breach previously tested resistance at $2.5000 and subsequently boost XRP toward its psychological resistance at $3.0000.

XRP daily chart

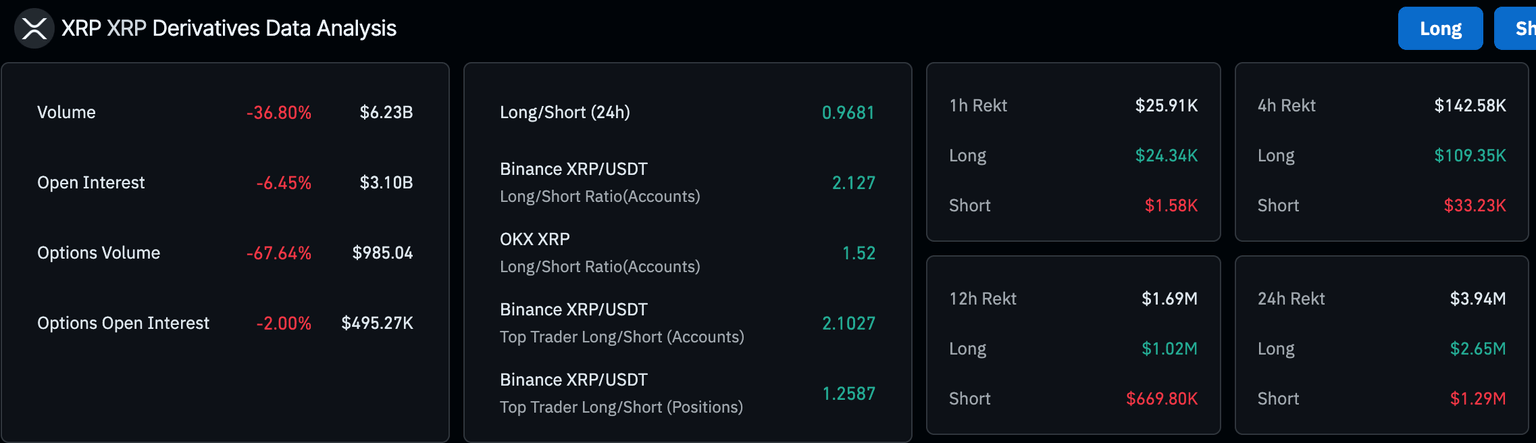

Despite the bullish spot market, Coinglass data highlights a worrisome situation: the derivatives’ open interest dropped by 6.45% to $3.1 billion in the last 24 hours. A negative long-to-short ratio of 0.9681 implies traders are leaning bearish in the short term. This could explain higher long position liquidations at $2.65 million compared to short position liquidations at $1.29 million.

XRP derivatives data | Source| Coinglass

Therefore, traders must tread carefully and be aware of all possible outcomes. Trade war tensions have cooled, but global markets are not out of the woods yet, especially with President Trump consistently assuring the world that no country is off the hook from his tariffs. A 90-day tariff pause is underway, with negotiations expected to take place, allowing countries to strike deals with the US.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren