- XRP price congestion continues, extending its length to ten days.

- Trade opportunities for bulls and bears are now present.

- Further downside pressure remains strong.

XRP price continues to consolidate in a relatively tight trading range between $0.58 and $0.62. However, the time spent in this sideways movement creates confusing and difficult trading conditions, especially on a time-based chart like Japanese candlesticks.

XRP price action develops trade setups for the long and short sides of the market

XRP price could see some explosive moves soon – the question is where the breakout will occur and in which direction. From the perspective of a Japanese candlestick chart, that can be a difficult task even within the Ichimoku Kinko Hyo system. However, Point and Figure charting clears much of the ‘noise’ and provides a clearer vision for the future.

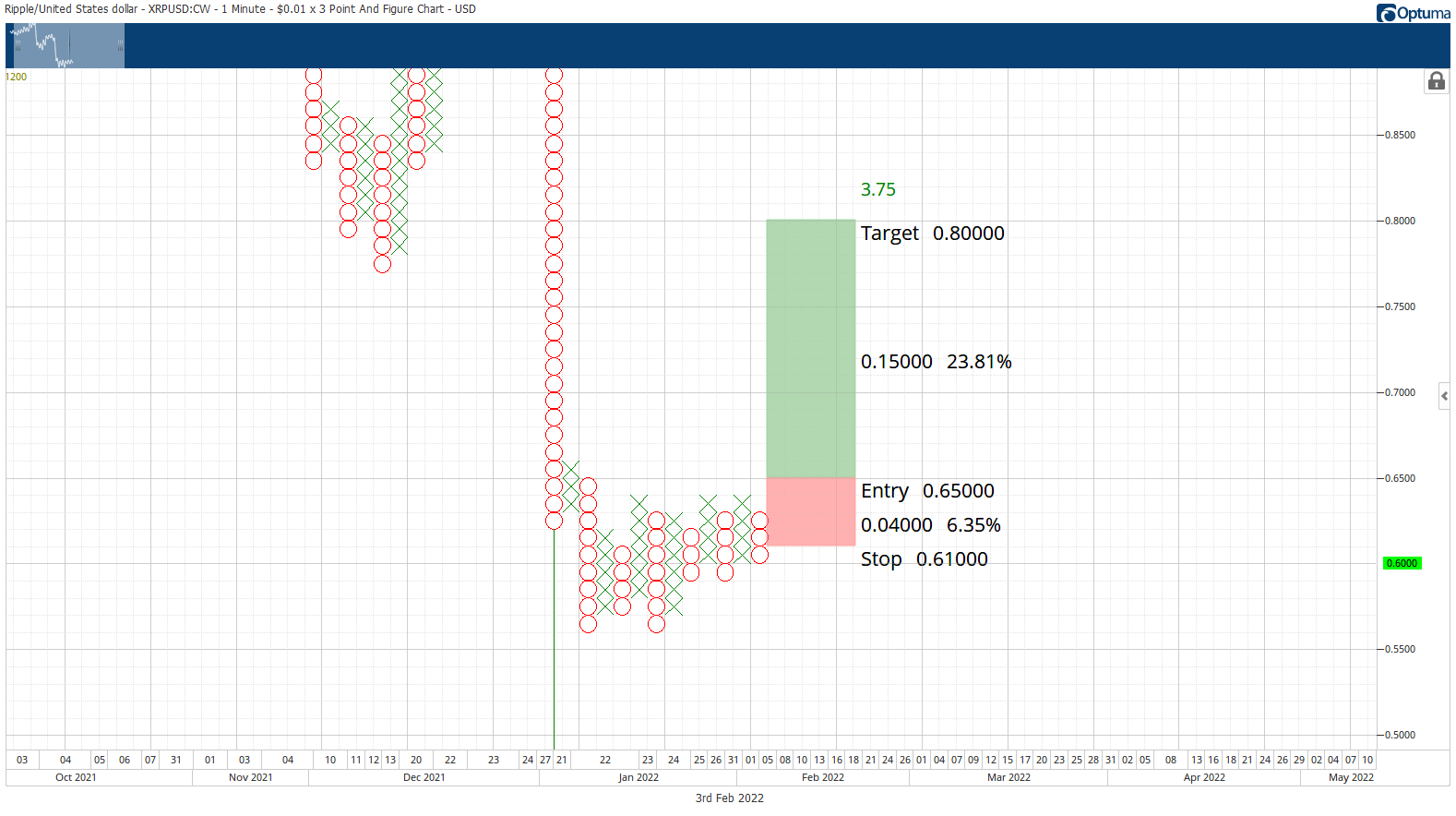

On the long side of the market, the hypothetical setup is a buy stop order at $0.65, a stop loss at $0.61, and a profit target at $0.80. The entry is based on the breakout above a triple-top pattern that would develop at $0.64. It could also be interpreted as a split quadruple-top breakout.

XRP/USD $0.01/3-box Reversal Point and Figure Chart

XRP/USD $0.01/3-box Reversal Point and Figure Chart

The long entry represents a 3.75:1 reward/risk with an implied profit target of nearly 24% from the entry. Because trades rarely reach their full profit target potential, a two to three-box trailing stop would help protect any implied profit. The trade is invalidated if the current O-column moves to $0.57.

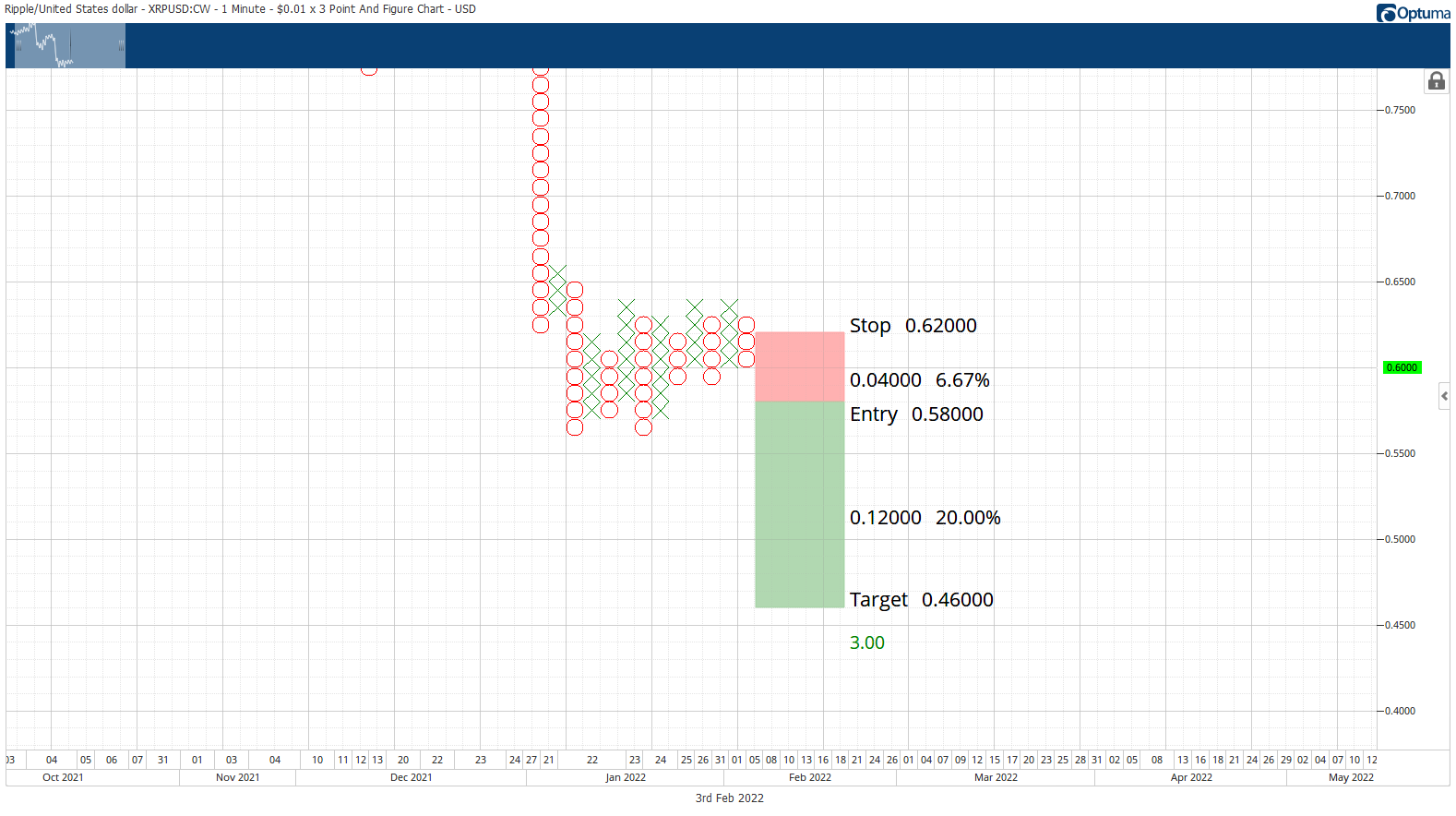

The theoretical short setup is a sell stop order at $0.58, a stop loss at $0.62, and a profit target at $0.46. The entry is based on a triple-bottom breakout that simultaneously confirms a breakout below a bear flag.

XRP/USD $0.013-box Reversal Point and Figure Chart

XRP/USD $0.013-box Reversal Point and Figure Chart

While the profit target identified is at $0.46, any drop from the present value area would likely face firm support and buying pressure at the psychological and technical price level of $0.50. A two-box trailing stop would help protect any profit made post entry. The XRP price short setup has the least profit potential compared to the long setup.

The short setup is invalidated if a new X-column forms and moves up to $0.67.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.