XRP begins short squeeze as bear trap to return Ripple to $1

- XRP price action develops an effective bear trap.

- Short sellers and weak hands will experience some significant pain as XRP rallies.

- Extremely bullish Point and Figure pattern present a 6:1 reward/risk setup.

XRP price has experienced some major selling over the past six trading days. Sellers have promptly sold off Ripple upon hitting the $1 level, pushing XRP lower by as much as 20%. However, the bearish price action has developed into a powerful buying opportunity.

XRP price to rally more than 30% to the $1 value area

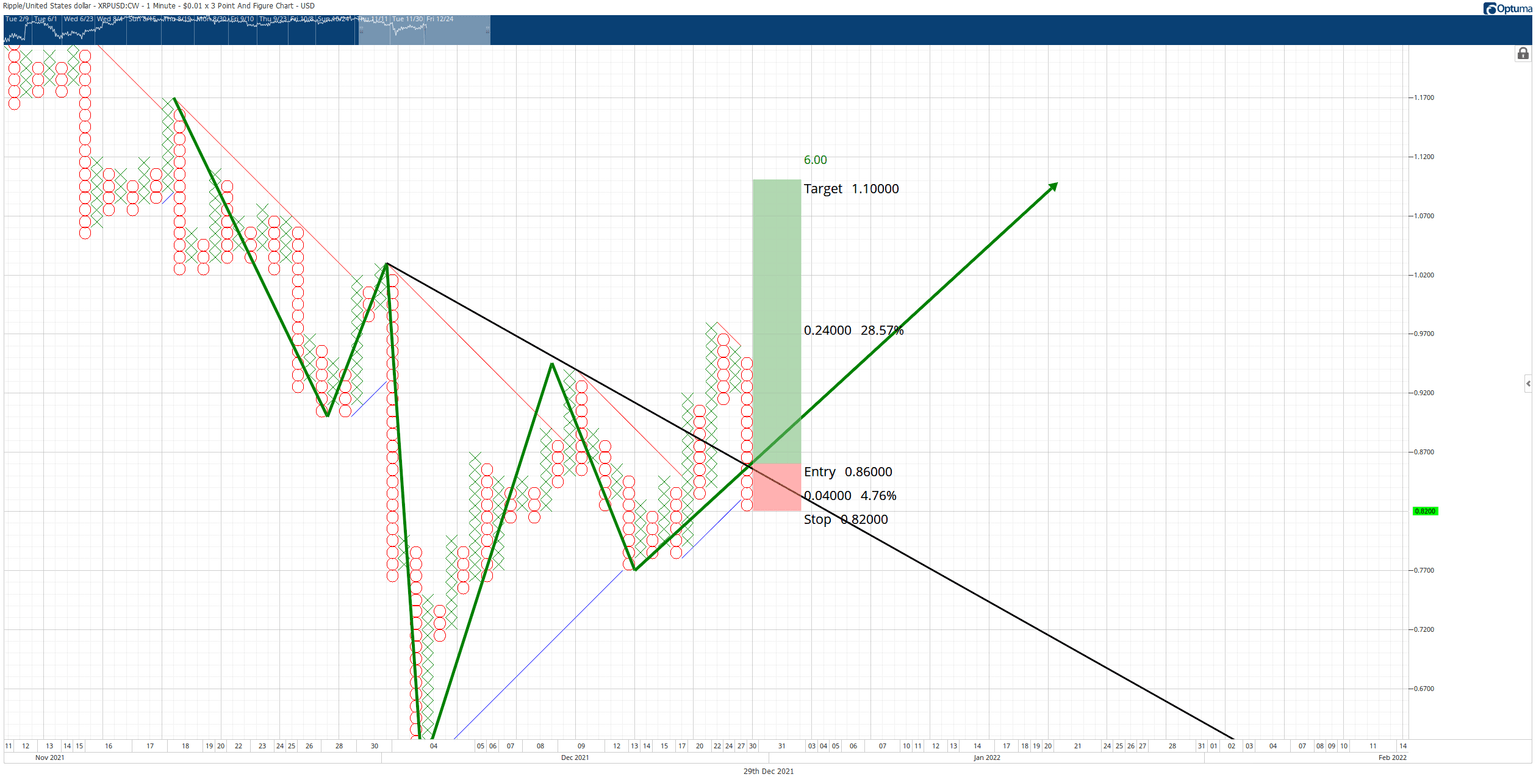

XRP price is currently testing the neckline breakout from a previous head-and-shoulders pattern on the $0.01/3-box reversal Point and Figure chart. The Point and Figure pattern that has developed is a Spike Pattern. The Spike Pattern is an aggressive reversal strategy with an entry immediately on the 3-box reversal of the current O-column.

The theoretical trade setup for XRP price is a buy stop order at $0.86, a 4-box stop loss at $0.82, and a profit target at $1.10. This trade setup represents a 6:1 reward for the risk. In addition, a two to three-box trailing stop would help protect any implied profit post entry.

The buy stop order is at $0.86 at the time of publication, but the current O-column could move lower. If that occurs, then the entry and the stop loss also move lower. For example, if XRP price moves three more Os lower to $0.79, the buy stop order would shift to $0.82 and the stop loss to $0.79. The profit target remains the same.

XRP/USDT $0.01/3-box Reversal Point and Figure Chart

There is no invalidation setup for the theoretical long trade setup. By their very nature, Spike Patterns have no known low or high until a reversal occurs. Diligent traders should anticipate resistance or momentum slowing when XRP price retraces roughly 50% of the O-column.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.