XMR/USD ignores the hard fork activated on Monero network

- Monero developers activated a hard form on the blockchain.

- XMR/USD is moving inside the range with bearish bias.

The developers of the privacy-focused cryptocurrency Monero confirmed that the hard fork was successfully implemented on block 1978433.

Its main feature was the activation of the new RandomX algorithm, which replaced the previous Proof-of-Work algorithm of CryptoNight R. Now mining operations can be effectively carried out on video cards and processors. The developers are sure, that this step can increase the level of decentralization of the Monero network, as well as remove FPGA and ASIC devices from the network.

Hidden mining was one of Monero's most known issues. The transition to RandomX is designed to improve the situation.

Monero's technical picture

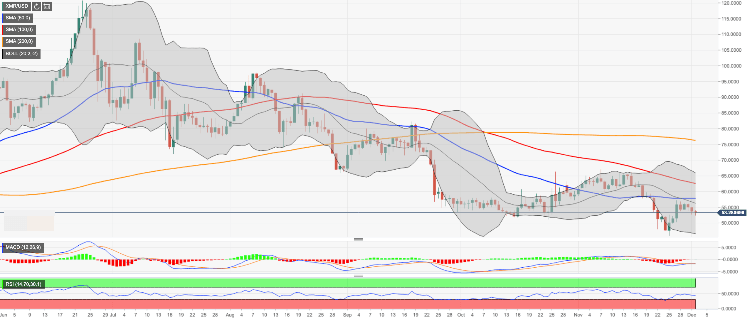

At the time of writing, XMR/USD is changing hands at $53.29. Now the 13th largest digital asset with the current market value of $922 million has stayed unchanged on a day-to-day basis. Monero hit the bottom at $0.45.91 on November 25; however, the recovery stopped short of $58.00. This resistance reinforced by SMA50 (Simple Moving Average) daily has been limiting the upside in the end of November.

On the downside, the support is created by psychological $50.00 followed by the lower line of the daily Bollinger Band at $46.80.

XMR/USD, the daily chart

Author

Tanya Abrosimova

Independent Analyst