XLM price targets a rebound towards $0.70 after defending critical support level

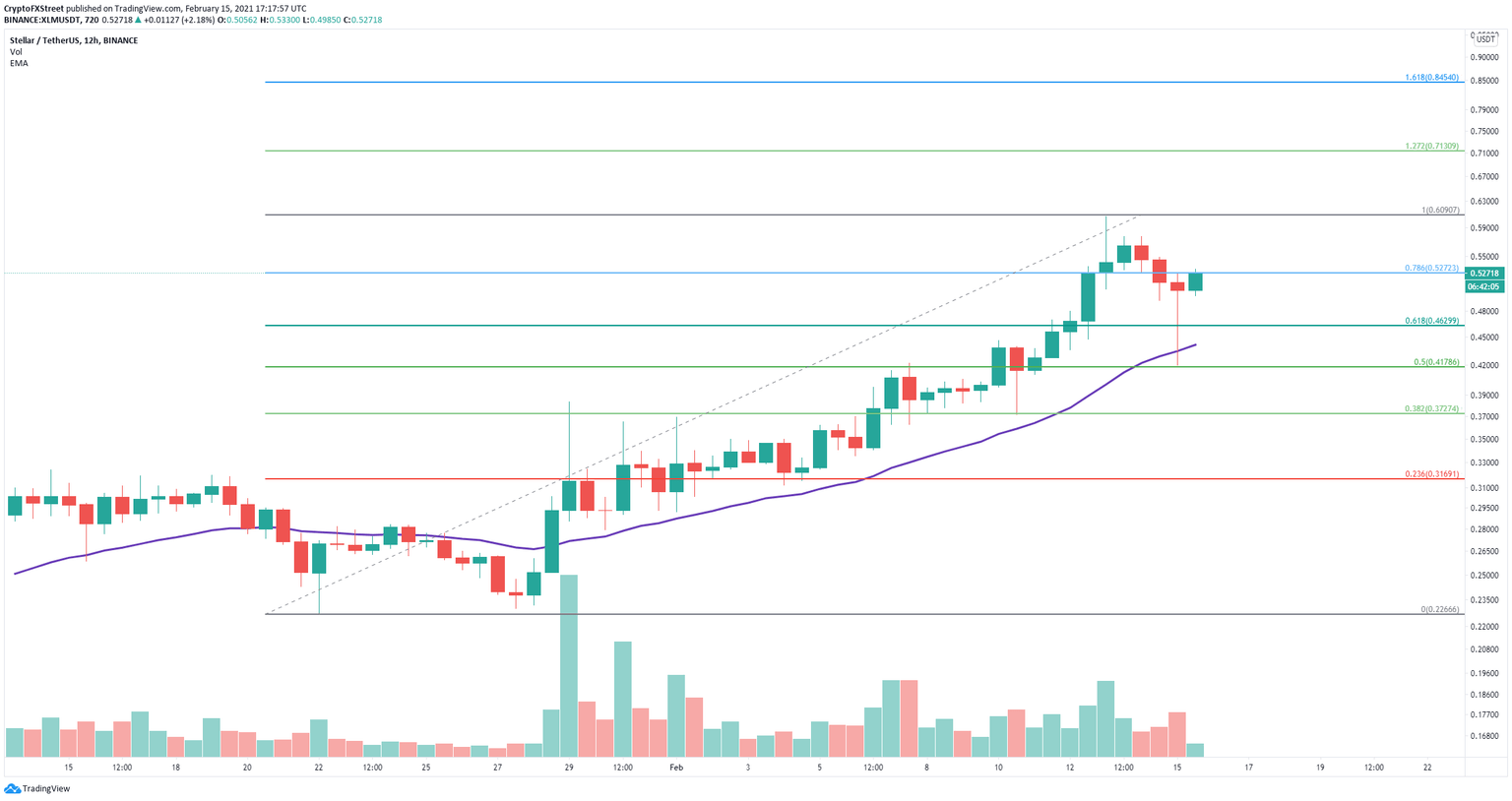

- XLM price has been trading above the 26-EMA on the 12-hour chart for the past three weeks.

- Once again, the bulls have defended this point and aim for a significant rebound.

- A key indicator has presented a sell signal on the daily chart, increasing selling pressure.

Stellar climbed above the 26-EMA on the 12-hour chart on January 28 and hasn’t lost the support level since then. In the past 24 hours, the entire cryptocurrency market suffered a massive sell-off, but XLM bulls managed to hold the 26-EMA once again, with a significant 27% rebound.

XLM price on its way to $0.70 again as it faces no barriers

On the 12-hour chart, every time XLM price touched the 26-EMA or was close to it, it had a significant rebound in the next 24 hours. Once again, XLM touched the 26-EMA but managed to rebound strongly.

XLM/USD 12-hour chart

The only significant resistance level is the previous high of $0.606. A breakout above this point can quickly push XLM price up to $0.71 at the 127.2% Fibonacci level. In the long-term, XLM can even climb towards $0.845 at the 161.8% fib level.

XLM/USD daily chart

However, on the daily chart, the TD Sequential indicator has just presented a sell signal that had a lot of continuation with the most recent sell-off. XLM price touched $0.462, the 61.8% level, and $0.41, the 50% fib level. Both of these two levels can be revisited again if the bearish momentum continues.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.