XLM price skyrockets nearly 100%, enjoys passive gains from XRP win in the SEC vs. Ripple lawsuit

- XLM price made the most of the XRP rally as the altcoin shot up by 103% initially before falling back down to a 60% increase.

- Being a payment processor akin to Ripple, Stellar is also observing increased investor interest, with trading volume exploding by 2000% in a day.

- Stellar was recently speculated to also be selected to facilitate the Blockchain Aspect of the Federal Reserve’s FedNow Payment System.

Catching a stray bullet is common in the crypto space as cryptocurrencies observe a decline every now and then due to some other reason. Fortunately for Stellar, this did not bring the altcoin excessive losses but instead unprecedented gains, significantly more than any other digital asset other than Ripple (XRP) today.

XLM price hits 14-month high

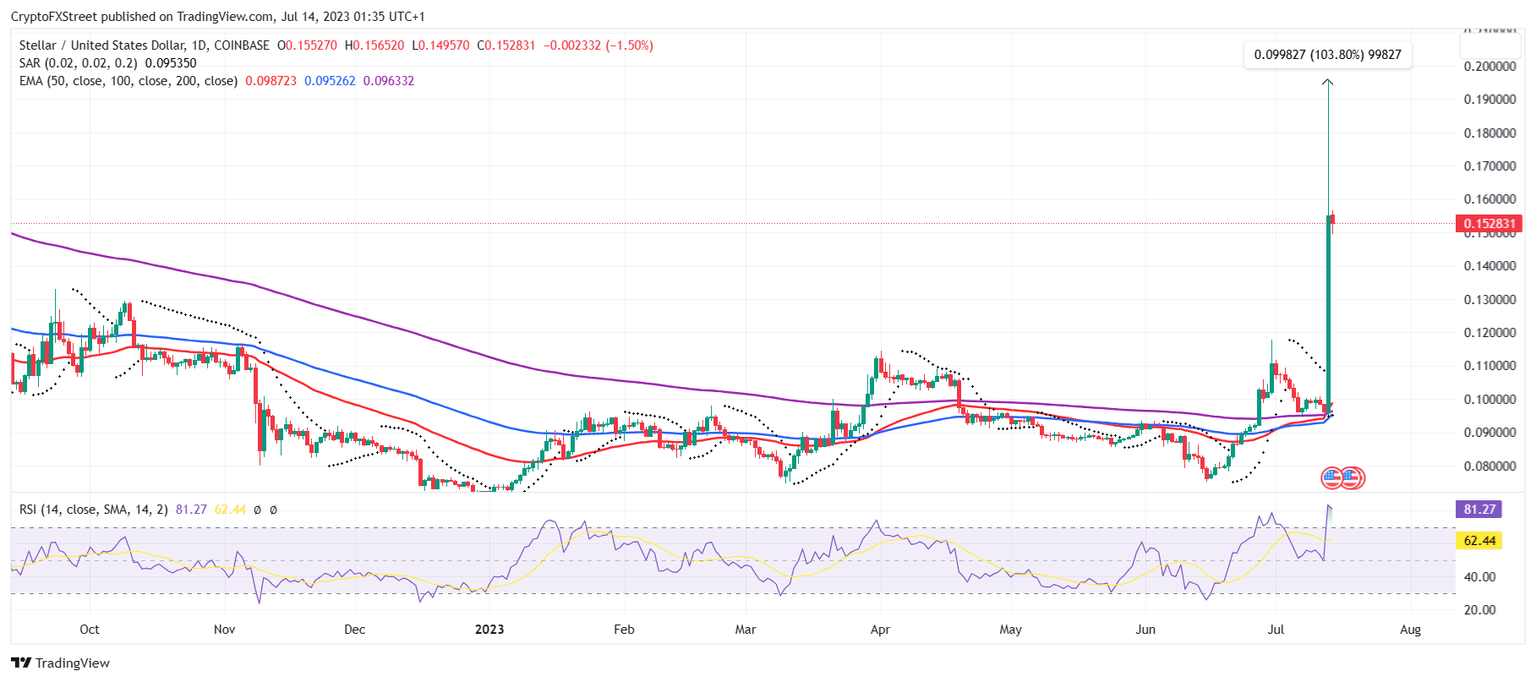

XLM price could be seen trading at $0.152 after enjoying a more than 60% rise in the last 24 hours. The altcoin was among the crypto tokens that noted gains on the back of Ripple’s win in the SEC vs. Ripple lawsuit, where the Judge declared that XRP was not a security and that it did not violate any Securities law when being sold to the public, and that it only did so when it was sold to institutional investors.

XLM/USD 1-day chart

This sent XRP price soaring, and behind it went many other cryptocurrencies which collectively added $72 billion to the crypto market in a day. However, apart from XRP, the one altcoin to witness the highest rally was XLM which is the native token of Stellar Lumens, a protocol similar to Ripple, known for low-cost cross-border transfers.

At the time of writing, XLM price hit a 14-month high and was trading even higher during the intra-day trading on Thursday when it shot up by more than 103%. Consequently, the investors’ activity also observed an increase, albeit exceptionally massive. The total volume traded in 24 hours in the case of XLM ranges from around $40 million to $44 million. However, over the past day, this volume hit a high of $982 million, which marks a 2,034% increase in a day.

Stellar Lumens 24-hour trading volume

A lot of this growth can also be attributed to Stellar Lumens recently being named as the potential facilitator of the Blockchain Aspect of the FedNow Payment System. FedNow is an instant payments service developed by the Federal Reserve said to combine conventional banking with decentralized finance.

If the service proceeds with Stellar Lumens as the blockchain facilitator, XLM price is set to observe further gains.

Read more - XRP naysayers miss out on 70% gains after Ripple Labs and SEC share joint victory

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B06.33.05%2C%252014%2520Jul%2C%25202023%5D-638248934203711040.png&w=1536&q=95)