XLM Price Prediction: Stellar will skyrocket by 70% if it breaks above critical resistance

- Stellar Development Fund invests $5 million in Wyre, a crypto payments company.

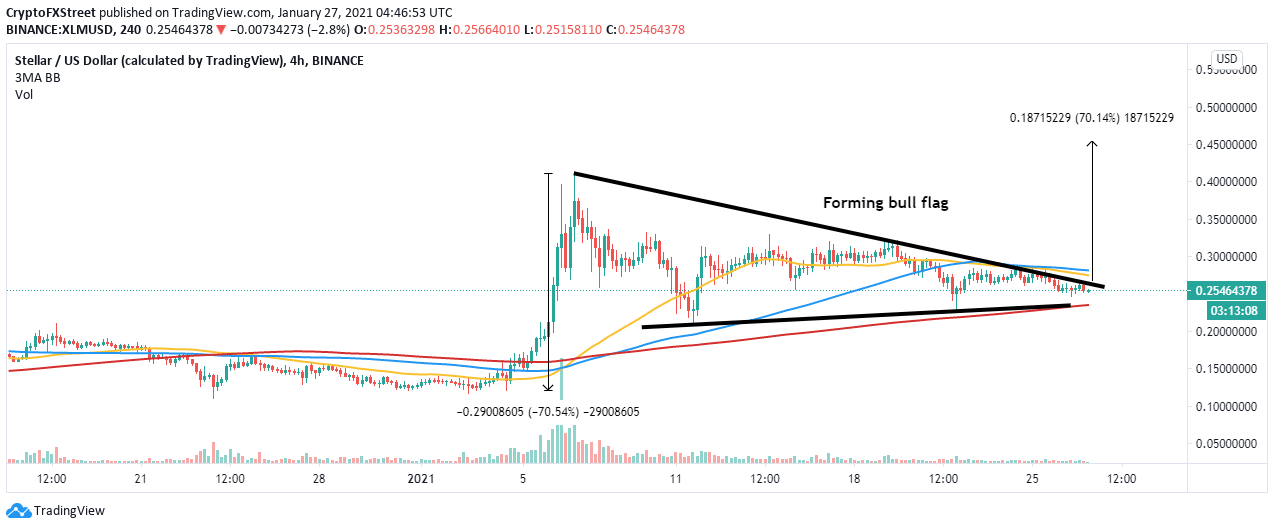

- Stellar is grinding closer to a forming bull flag pattern breakout, eyeing $0.46.

- A break under the 200 SMA on the 4-hour chart could force XLM to abandon the bullish outlook.

Stellar price is trading sideways due to the consolidation that followed a breakdown from 2021 highs around $0.4. On the downside, support has been established around $0.2, giving the bulls some semblance of stability and control. A bull flag pattern appears to be forming on the 4-hour chart, revealing that Stellar is nearing a possible 70% upswing.

Stellar foundation goes $5 million deep in Wyre

A popular cryptocurrency payment API company, Wyre is the beneficiary of a $5 million investment from the Stellar Development Fund (SDF). Wyre is known for providing cutting-edge payment APIs. Stellar plans to take advantage of the progress Wyre has made to expand its current payment corridors as well as develop new ones.

Since its inception in 2013, Wyre has processed more than $5 billion in transfers, and Stellar is keen on tapping into this success to ensure that its crypto-to-fiat on-ramps are expanded. Some of these products include pairing with USD, euro, and the GBP.

Stellar prepares for a massive upswing

Stellar is trading at $0.25 at the time of writing. A bull flag pattern on the 4-hour chart could see XLM assume an uptrend extending 70% above the breakout point. Support at the 200 Simple Moving Average is crucial to retaining the uptrend.

Note that a bull flag is a technical pattern interpreted as bullish. It represents a period of consolidation after an asset grows incredibly before hitting a barrier.

The pattern prepares the bulls for taking over and points towards continuing the preceding trend with a precise target, like the 70% breakout to $0.46. The bullish narrative will be validated if XLM closes the day above the 50 SMA.

XLM/USD 4-hour chart

As mentioned, the 200 SMA presents formidable support. However, if the price makes a daily candlestick close under it, Stellar may abandon the expected upswing. Losses on the downside are likely to explore former support areas at $0.2 and $0.15.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren