XLM Price Prediction: Stellar will return to $0.18

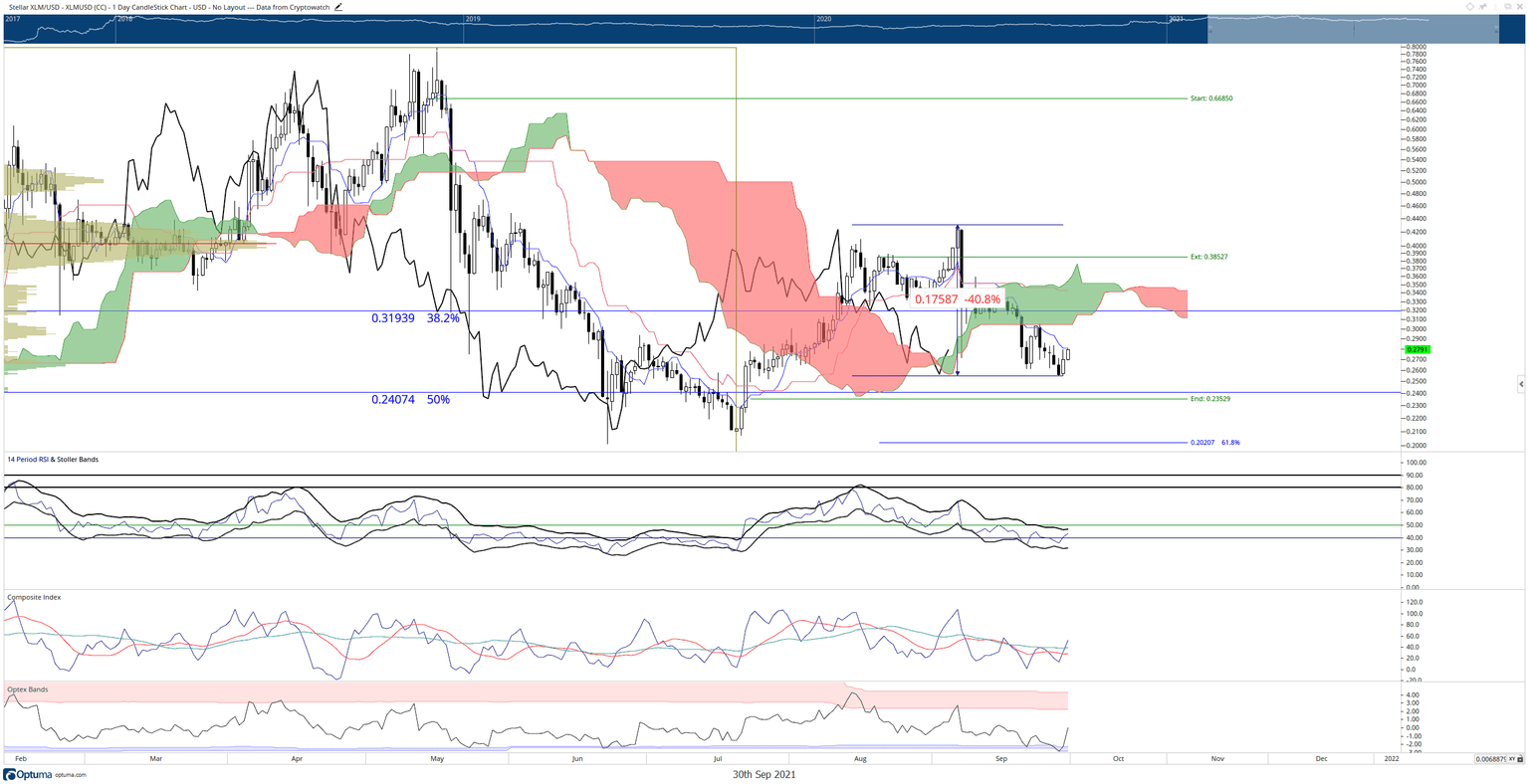

- XLM price bounces higher for a 10% gain but is halted, again, against the Tenkan-Sen at $0.28

- Hidden bearish divergence suggests downside pressure remains.

- Traders who are long have a difficult road to convert XLM into a bull market.

XLM price recently experienced one of the most bearish events within the Ichimoku system: the Chikou Span crossing and closing below the Cloud. This resulted in some initial solid defense by buyers who have propelled XLM over 10% higher. However, buyers have yet to show any follow-through and risk a continuation move lower.

XLM price bounces and gives hope to longs but fail to capitalize on gains

XLM price is a mixed bag of emotions. First, an extremely bearish event occurred when the Chikou Span closed below the Cloud. Then, an incredibly supportive response by buyers, the Chikou Span back was propelled back up and into the Cloud and generated a 10% gain. However, a further rise was halted against and the market has yet to see any conviction by buyers.

Traders will likely observe a swift sell-off towards the $0.18 level if sellers breach the weekly swing lows at $0.25. Supporting analysis that suggests a breach of the weekly low can be observe in the higher highs printed in the Composite Index while XLM price printed lower highs – hidden bearish divergence. Hidden bearish divergence is a warning that the prior, broader, downtrend is likely to continue.

XLM/USDT Daily Ichimoku Chart

Invalidating the current bearish outlook requires buyers to overcome a series of obstacles. First, XLM price needs to build structural support by closing above Senkou Span B and the 38.2% Fibonacci retracement at $0.32. Second, the close ultimately needs to be above the Cloud with the Chikou Span above the candlesticks – this can only occur at $0.42 between today and October 3rd or at $0.35 by October 5th.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.