XLM Price Prediction: Stellar remains vulnerable whilst below 21-DMA

- XLM/USD is back in red on Saturday, still capped below 21-DMA.

- Only a daily closing above 21-DMA could negate the downside bias.

- Stellar price sees immediate support at $0.2286 amid bearish RSI.

Stellar Lumens (XLM/USD) is posting small losses so far this Saturday, holding onto the $0.2400 level amid a dour mood witnessed across the crypto market.

XLM price has been on a steady decline since June 29 peak at $0.3012, where a death cross was confirmed on the daily sticks. At the press time, the altcoin is trading just above the $0.2400 barrier, having reversed Friday’s recovery gains.

XLM/USD: Downside potential remains intact amid bearish technical setup

XLM/USD: Daily chart

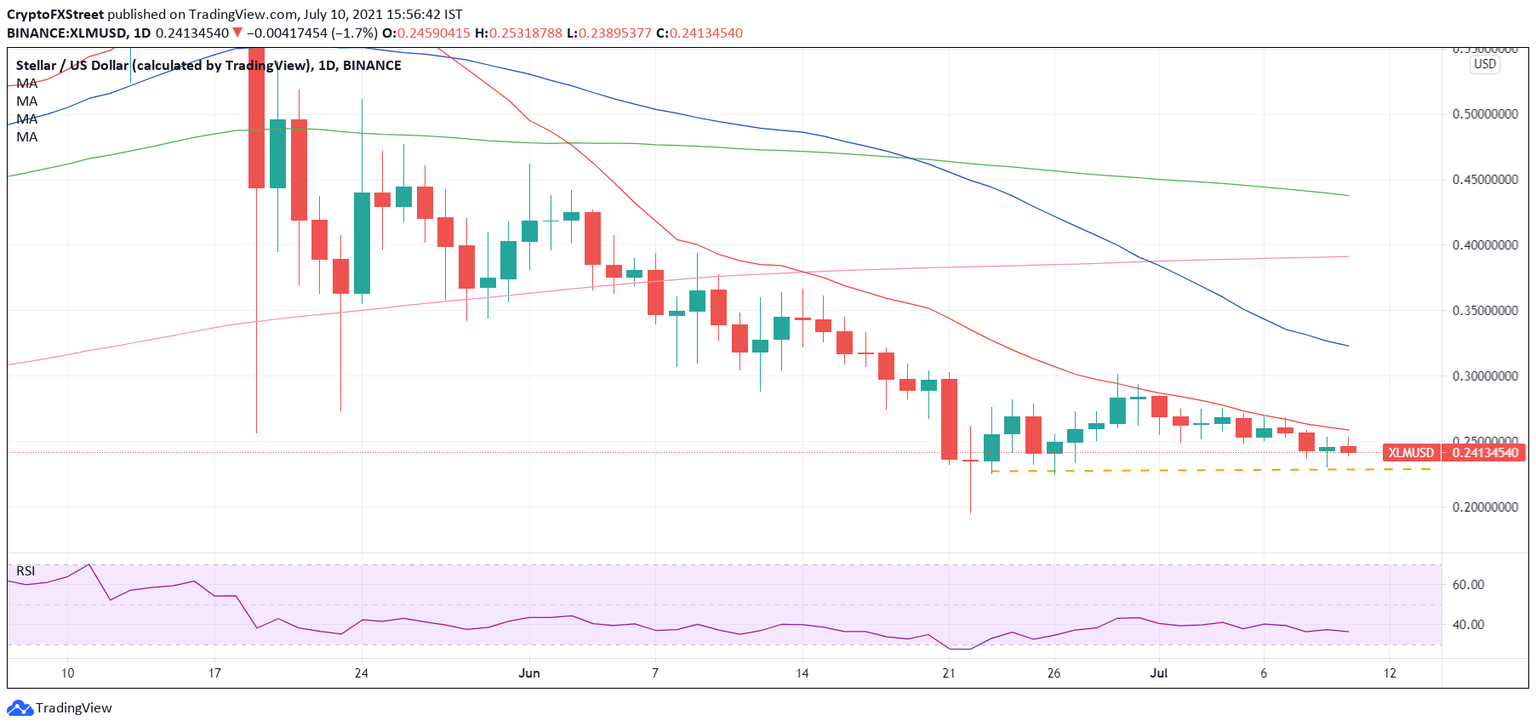

As observed on the daily chart, XLM/USD has returned to the red zone after facing rejection once again just below the critical short-term resistance of the 21-Daily Moving Average (DMA), now at $0.2587.

Note that XLM price has been tagging beneath the 21-DMA barrier since the May 19 flash crash.

Therefore, unless the XLM bulls seek a sustained break above the latter, the bearish bias is likely to remain intact going forward.

The 14-day relative strength index (RSI) also helps justify the downbeat momentum, as it inches lower towards the oversold region while trending continuously below the 50.00 level.

The immediate cushion is offered at the horizontal dashed trendline connecting previous lows at around $0.2286.

If the selling pressure intensifies below the last, the bears could then target the June 22 low of $0.1952.

Alternatively, daily closing above the 21-DMA hurdle could trigger a fresh advance towards $0.30.

Further up, the bearish 50-DMA resistance $0.3229 could keep the upside attempts in check.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.