XLM Price Prediction: Stellar prepares for 40% climb

- XLM price is traversing a falling wedge pattern, hinting at a bullish breakout.

- A decisive close above $0.393 will confirm the start of a new uptrend.

- If Stellar breaks below the $0.315 support barrier, it will invalidate the bullish thesis.

XLM price is showing signs of a breakout from a bullish pattern that could kick-start a massive upswing. However, Stellar needs to clear significant barriers before it embarks on the journey. Failure to do so will delay the rally and, in some cases, even invalidate the bullish thesis.

XLM price awaits a trigger

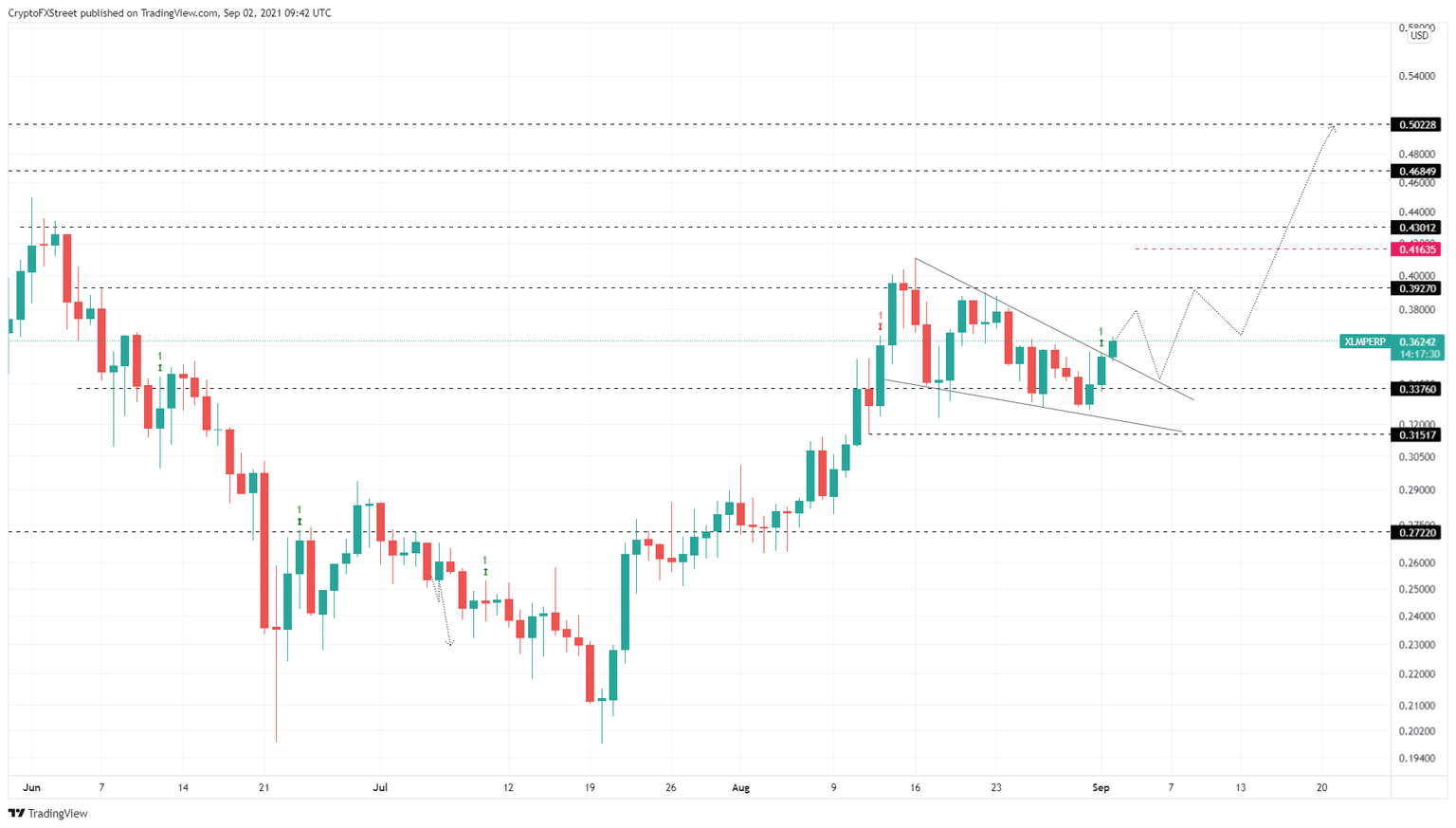

XLM price has set up roughly three higher highs and four lower lows since August 13. Drawing a trend line that connects these swing points reveals the formation of a falling wedge pattern. This technical setup has a bullish bias and forecasts a 17% upswing, obtained by measuring the distance between the first swing high and low. Adding this distance to the breakout point at $0.354 reveals a target of $0.416.

However, a significant chunk of resistance lies around $0.393. Clearing this barrier will confirm the start of an uptrend and propel XLM to $0.416 or the resistance level at $0.430.

A decisive 4-hour candlestick close above $0.430 will open the path to $0.468, constituting a roughly 40% upswing from the current position.

XLM/USDT 4-hour chart

Regardless of the bullish outlook, if XLM price fails to hold above the rising wedge’s upper trend line, it may indicate that the current breakout was a fake upswing. In such case, Stellar might retrace to retest the lower trend line of the falling wedge or the support level at $0.338.

While the buyers are likely to make a comeback at $0.338, failing to hold above $0.315 will disprove the bullish thesis.

This move might also trigger a 13% crash to $0.272.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.