XLM Price Prediction: Stellar poised for a 60% upswing

- XLM price is consolidating inside a bull flag pattern after the recent market crash.

- The Tom DeMarket Sequential indicator has flashed a buy signal hinting at a reversal of bearish momentum.

- A decisive close above the flag at $0.47 opens the possibility of a 60% bull rally.

XLM price is recovering after dropping nearly 42% from February 22 to 23. Regardless of the short-term bearish pressure, both technical and on-chain indicators suggest that bulls will push Stellar higher.

XLM price needs to blast through stiff resistance

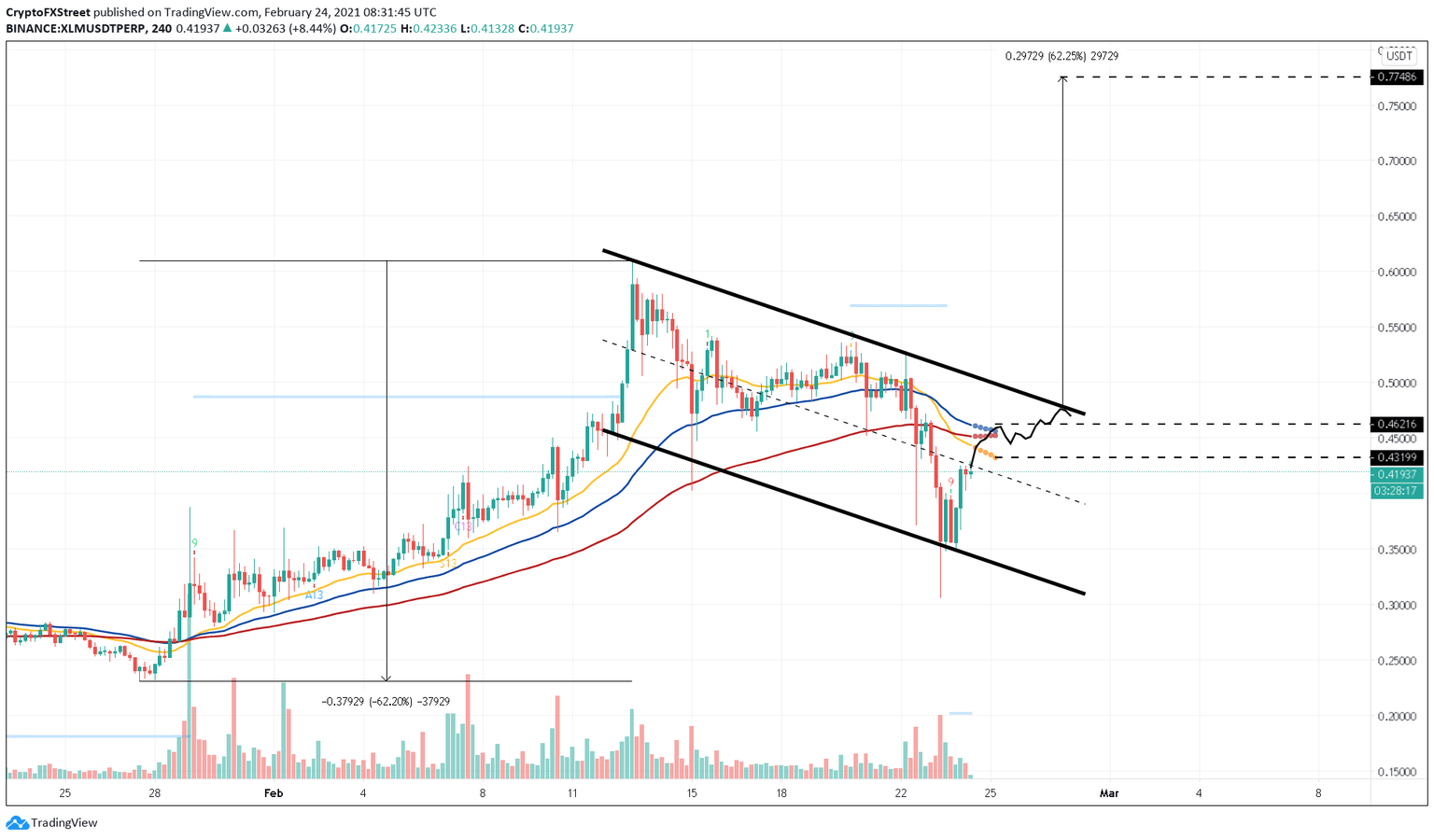

XLM price action witnessed from late January to-date has resulted in the formation of a bull flag pattern. The initial 165% upswing from $0.23 to $0.60 created the “flag pole,” while the consolidation from $0.60 to $0.34 via a series of lower highs and lower lows has formed the “flag.”

This setup forecasts a 60% surge, which is determined by measuring the flag pole’s length and adding it to the breakout point at $0.47. If validated by an increase in buying pressure, XLM price could rise to $0.77.

The Tom DeMark (TD) Sequential indicator adds credence to the optimistic outlook. This technical index presented a buy signal on XLM’s 4-hour chart, anticipating a one to four candlesticks upswing.

XLM/USDT 4-hour chart

In addition to the technicals, on-chain metrics are also painting a bullish scenario for XLM price.

For example, Stellar’s on-chain volume saw a 47% increase on February 22. This metric rose another 15% from $2.8 billion to $3.2 billion in the next two days, showing healthy network activity.

In the meantime, XLM price dropped, creating a bullish divergence against its on-chain volume.

XLM on-chain volume chart

The recent 32% upswing in development activity fuels the bullish narrative as well. Investors tend to see an increase in this metric as a buy signal since it usually leads to a protocol update, product launch, or some sort of important announcement.

When considering the technical and on-chain metrics previously evaluated, it seems like Stellar price is poised for an upswing.

XLM developer activity chart

Regardless, investors should note the presence of a cluster of resistance barriers ranging from $0.43 to $0.46, formed by the short, mid, and long-length exponential moving averages (EMA). Rejection at this cluster could delay the bull flag’s breakout.

But if XLM price slices through the support barrier at $0.35, it would invalidate the bullish thesis and trigger another sell-off.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.