XLM Price Prediction: Stellar kick-starts a 12% descent

- XLM price is consolidating, awaiting a massive volatile move to the downside.

- The bearish thesis will be confirmed if Stellar closes below the midpoint of the range at $0.250.

- However, a swift breach of the range high at $0.303 will invalidate the bearish thesis.

XLM price has been trying to slice through a critical resistance level over five times in the past ten days but has failed to do so. The recent pullback is a result of rejection at the same barrier.

The correction will extend if Stellar shatters a key support floor.

XLM price at a make-or-break moment

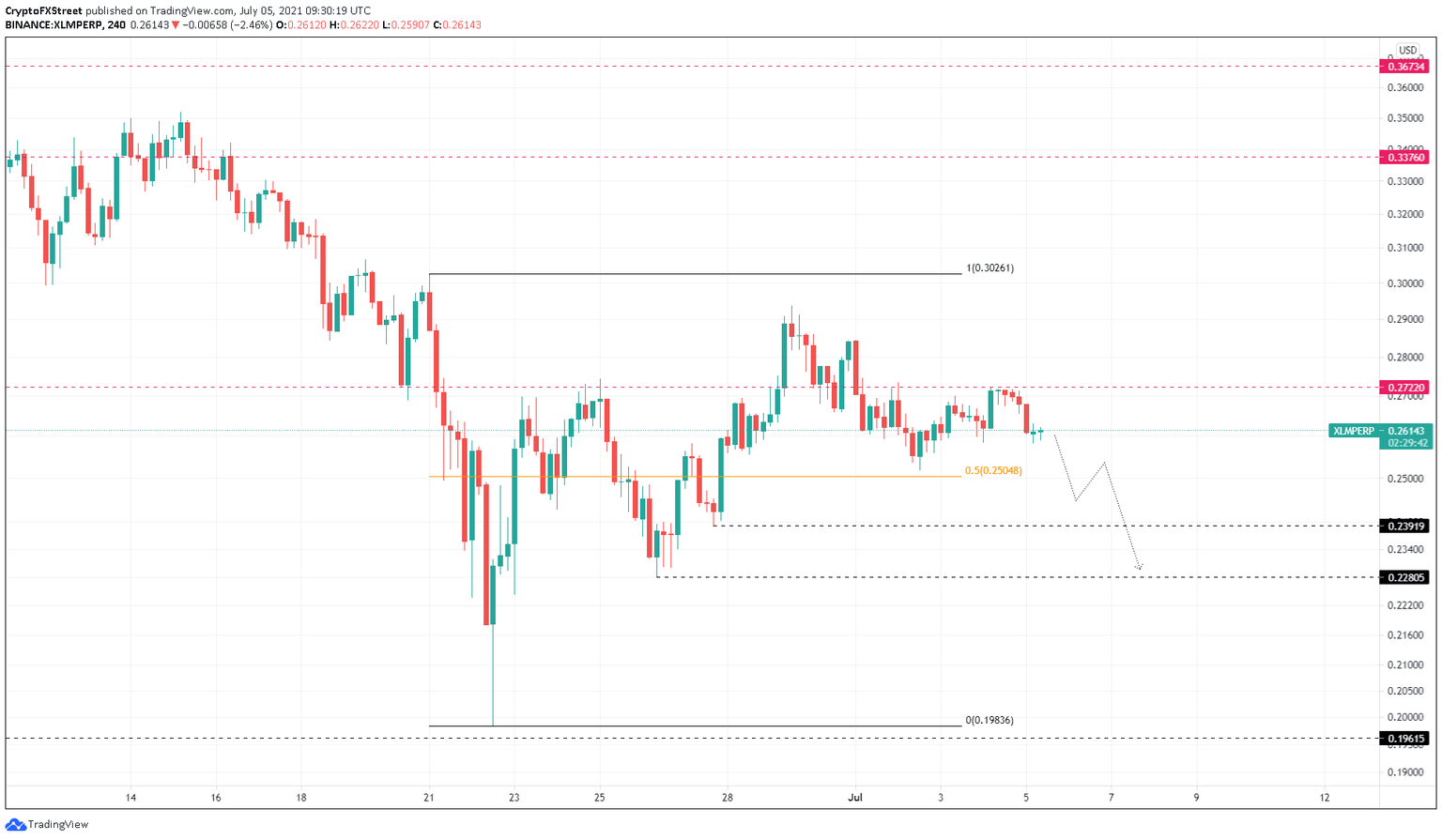

XLM price set a swing low at $0.198 on June 22 and rallied roughly 37% before encountering a resistance level at $0.272 on June 24. Since then, Stellar took three jabs but failed each time, including the most recent rejection on July 4.

XLM price has dropped nearly 5% since the last rejection and might continue to plummet if investors continue to book profits. A confirmation of this downswing will arrive if Stellar produces a decisive 4-hour candlestick close below the 50% Fibonacci retracement level at $0.250.

If this were to happen, the remittance token would likely tumble to the immediate support level at $0.239, which is roughly a 12% sell-off from $0.272.

In a highly bearish case, the drop might extend to the subsequent demand floor at $0.229.

XLM/USDT 4-hour chart

On the flip side, things might improve for XLM price if it bounces off the range’s mid-point at $0.250 and rallies past the immediate resistance level at $0.272.

A decisive 4-hour candlestick close above the range high at $0.303 would invalidate the bearish thesis. Although unlikely, if the buying pressure persists, Stellar could tag the supply barrier at $0.338.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.