XLM Price Prediction: Stellar gets ready for 125% upsurge to record highs

- Stellar has settled above former crucial resistance at $0.465, currently the immediate support.

- Closing the day above the key levels will set XLM on a trajectory to all-time highs.

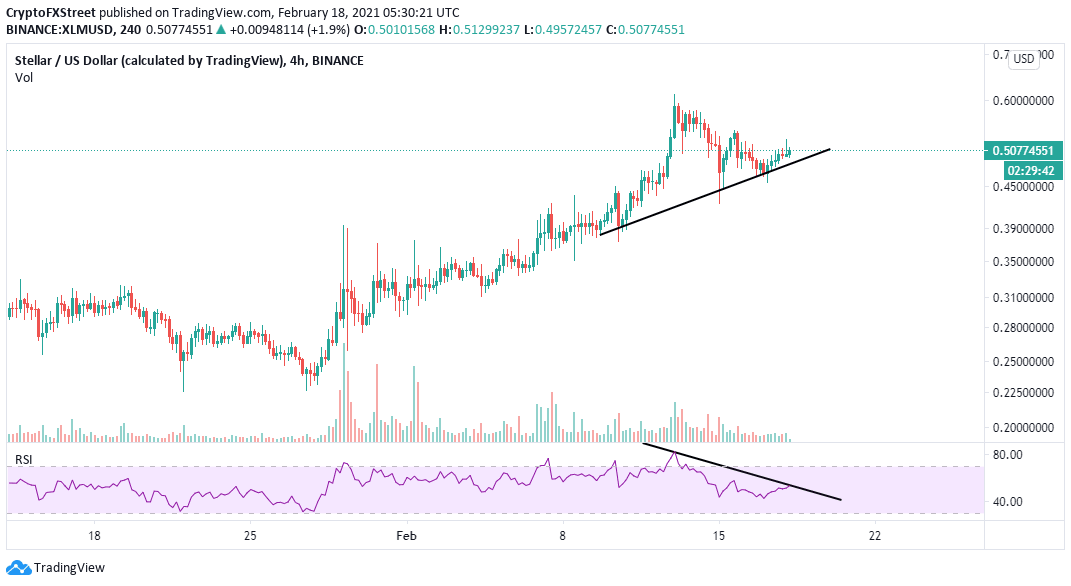

- The RSI's negative divergence suggests that a correction could be in the cards.

Stellar appears to have cooled off the rally after breaking above the crucial April 2018 hurdle at $0.465. A multi-year high has recently been established at $0.61, but bulls lost steam. The bulls aim to hold above the resistance turned support at $0.465 and plan for another attack mission to the record highs of $1.05.

Stellar is only 125% to the all-time high

The progress XLM has made in the ongoing bull run is tremendous, making the remaining journey to $1.05 a near-term goal. The cross-border token is dancing at $0.5 amid the push by the bulls to secure higher support.

The Moving Average Convergence Divergence (MACD), a trend direction indicator, shows that Stellar is generally moving upward despite the current snarl-up. This technical indicator is used to correctly identify positions where traders can enter or exit the market. Currently, the wide divergence made by the MACD line (blue) above the signal line hints at the bullish outlook remaining intact.

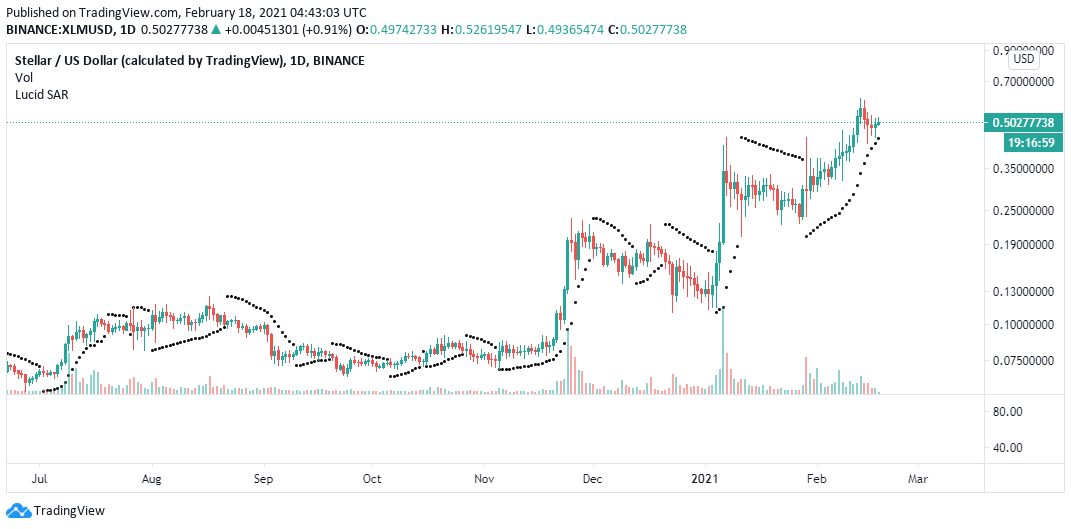

XLM/USD weekly chart

The Parabolic SAR points confirm buyers are in control. This indicator shows that the trend is bullish when the parabolas (dots) are below the price. Moreover, closing the day above $0.5 will add credence to the bullish momentum and perhaps call out more buyers to join the market.

XLM/USD daily chart

Looking at the other side of the fence

The Relative Strength Index (RSI) has a negative divergence on the 4-hour chart. A bearish divergence occurs when an asset's price is generally trending upwards while the RSSI moves downwards.

XLM/USD 4-hour chart

The negative divergence could mean that Stellar is nearing a tipping point, and correction will come into play. The trend reversal will be confirmed when the price breaks below the trendline or crucial support such as $0.5 and $0.465.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren