XLM Price Prediction: Stellar consolidates ahead of a 30% move

- XLM price has been trading sideways for the past 24 hours and it’s on the verge of a breakout.

- The digital asset is currently in a no-trade zone until it experiences a clear breakout or breakdown.

XLM price trades at $0.291 at the time of writing after a healthy consolidation after hitting a 2021-top at $0.411. There is a high chance that XLM is about to see a massive breakout or breakdown within the next 24 hours.

XLM price on the verge of a massive move within 24 hours

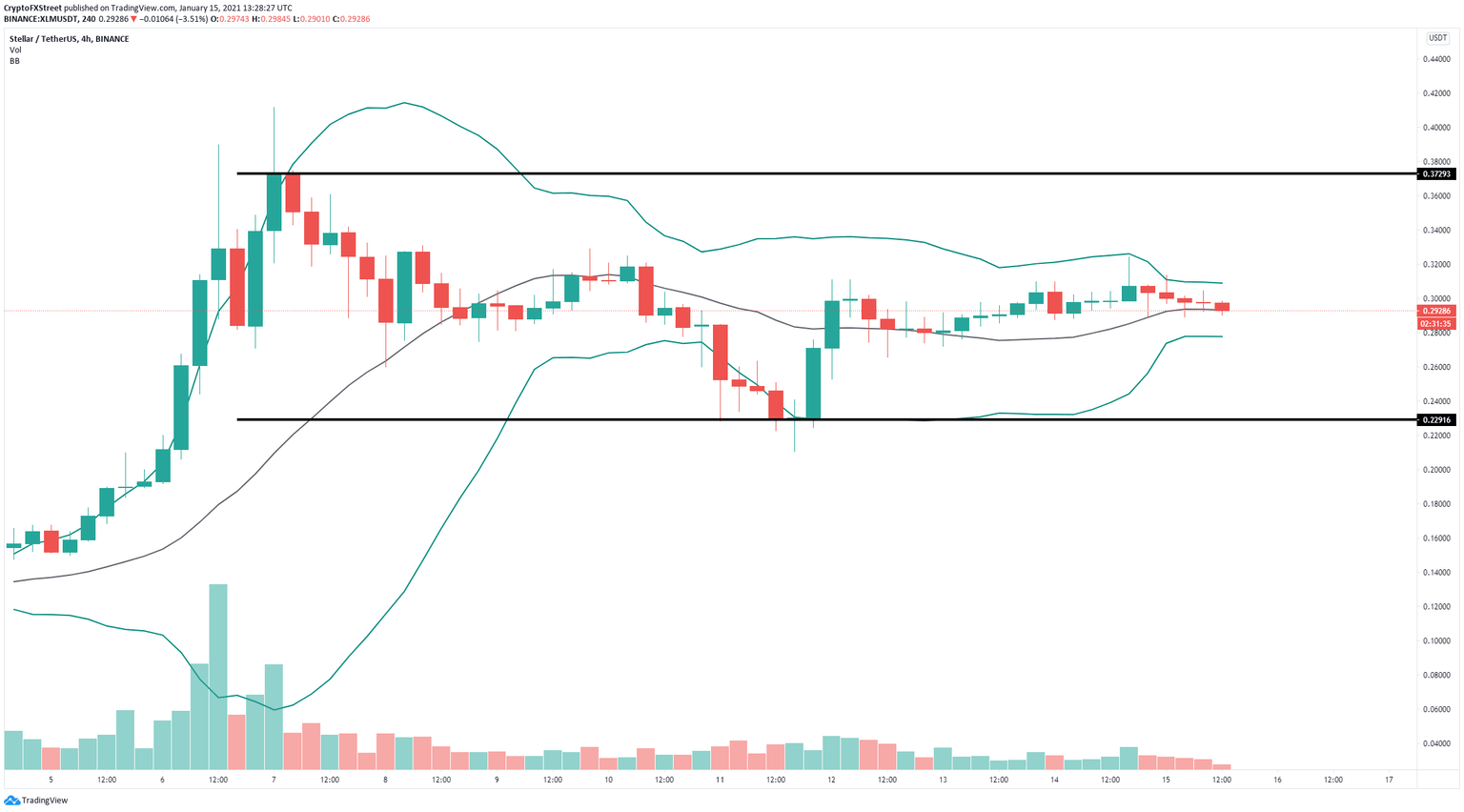

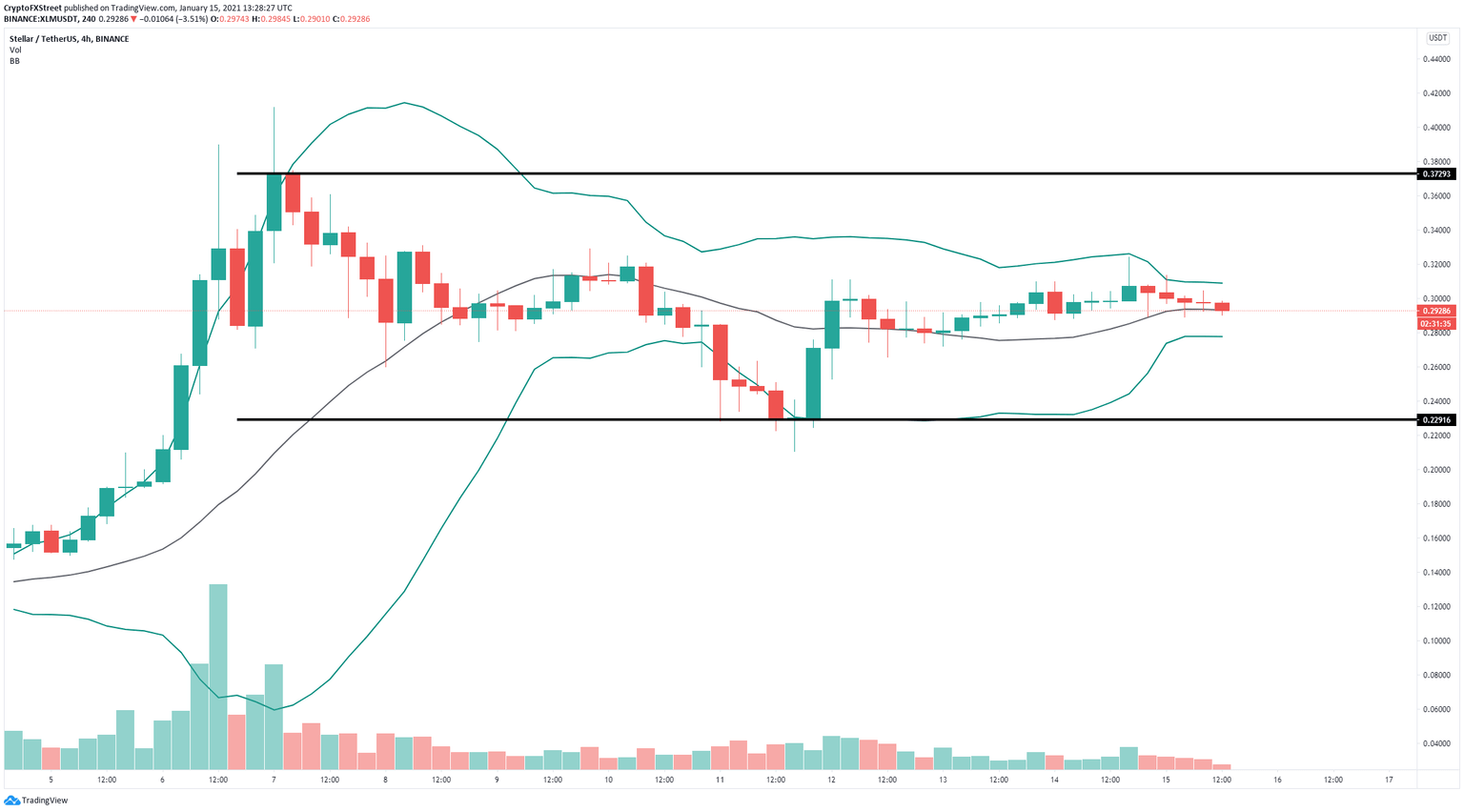

On the 4-hour chart, the Bollinger Bands have squeezed significantly over the past five hours, which indicates XLM price is on the verge of a massive explosion. This is considered a no-trade zone as long as XLM remains inside the bands.

XLM/USD 4-hour chart

Additionally, the trading volume of Stellar has significantly declined since January 6, which is also an indication of an upcoming big move. The overall trend for XLM is bullish, which means a breakout is more likely and can quickly drive XLM price towards $0.37. A 4-hour candlestick close above the upper Bollinger band at $0.31 will be a bullish breakout.

XLM Social Volume

Furthermore, as we stated in our last article about XLM, the digital asset was poised for a correction on January 7 after its social volume peaked. This number has cooled off notably, which indicates the pullback is over and Stellar price can rise again.

XLM/USD 4-hour chart

However, anything is possible and a candlestick close below the lower Bollinger Band at $0.278 would be notable and likely to push XLM price down to $0.23. Losing this level would be devastating as there is very little support on the way down until $0.12.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B14.25.47%2C%252015%2520Jan%2C%25202021%5D-637463141196871530.png&w=1536&q=95)