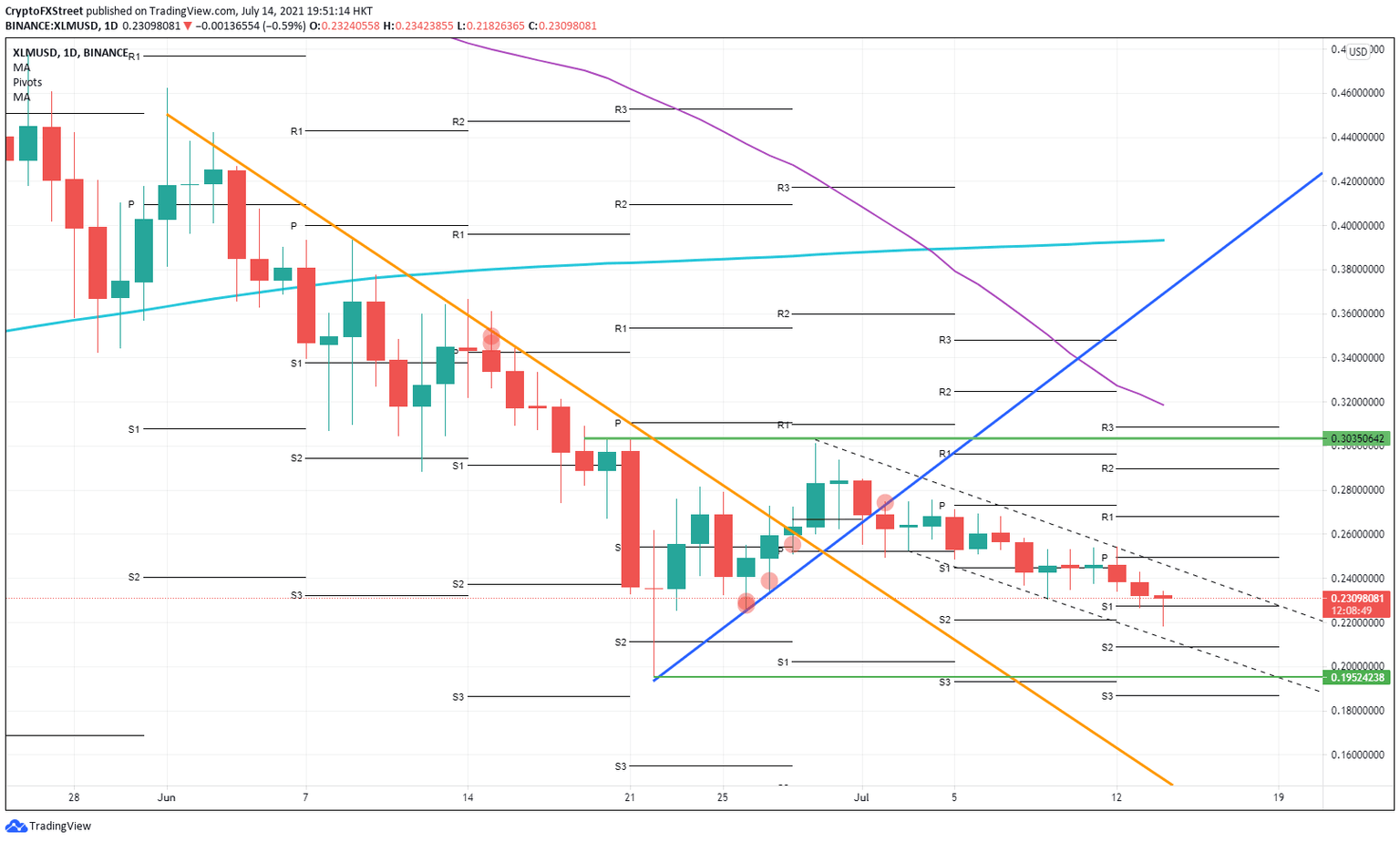

XLM Price Prediction: Stellar caught in downtrend to $0.195

- XLM price is in a consecutive three-day losing streak.

- Tops and lows are getting lower in tandem.

- More downside is expected for Stellar as no real support now is present until $0.195.

XLM price tried to make a recovery this past weekend. On Sunday, buyers got caught up in what looked like a false breakout to the upside, and as of Monday, sellers are dictating the price action in Stellar with the confirmation of a short-term trend channel to the downside.

XLM price under heavy selling pressure

Not only is XLM price on the chopping block, but other major cryptocurrencies as well. As of Monday, Stellar price action confirmed that it is in a downward channel and does not look likely to break out anytime soon. The highs are coming in lower every day, and lows are getting lower by the day with sellers are very much dictating XLM price action.

Today, the monthly S1 support pivot got taken out at $0.228. Further to the downside, XLM price is supported by S2 support at $0.209, which falls in line for the moment with the lower leg of the trend channel. Historically, this support has proven to be very thin.

XLM sellers will go for the full squeeze against the buyers and push price action to $0.195, which aligns with the low from June 22. That level looks to have more support with S3 support levels from the previous month and this month just below.

Expect short sellers to ride out this trade to the tick. Sellers are that much in control, and with current sentiment in the crypto space, that acts as a tailwind in their favor.

Buyers will be awaiting the completion of that trend channel toward $0.195 before getting in long. If XLM price can then break out of the descending trend channel, a retest would be possible in the coming months toward $0.3035.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.