- XLM price got rejected several times from a crucial resistance level at $0.34.

- TD Sequential indicator has presented a sell signal on the 12-hour chart.

- The social volume of Stellar has increased again, which often leads to a correction.

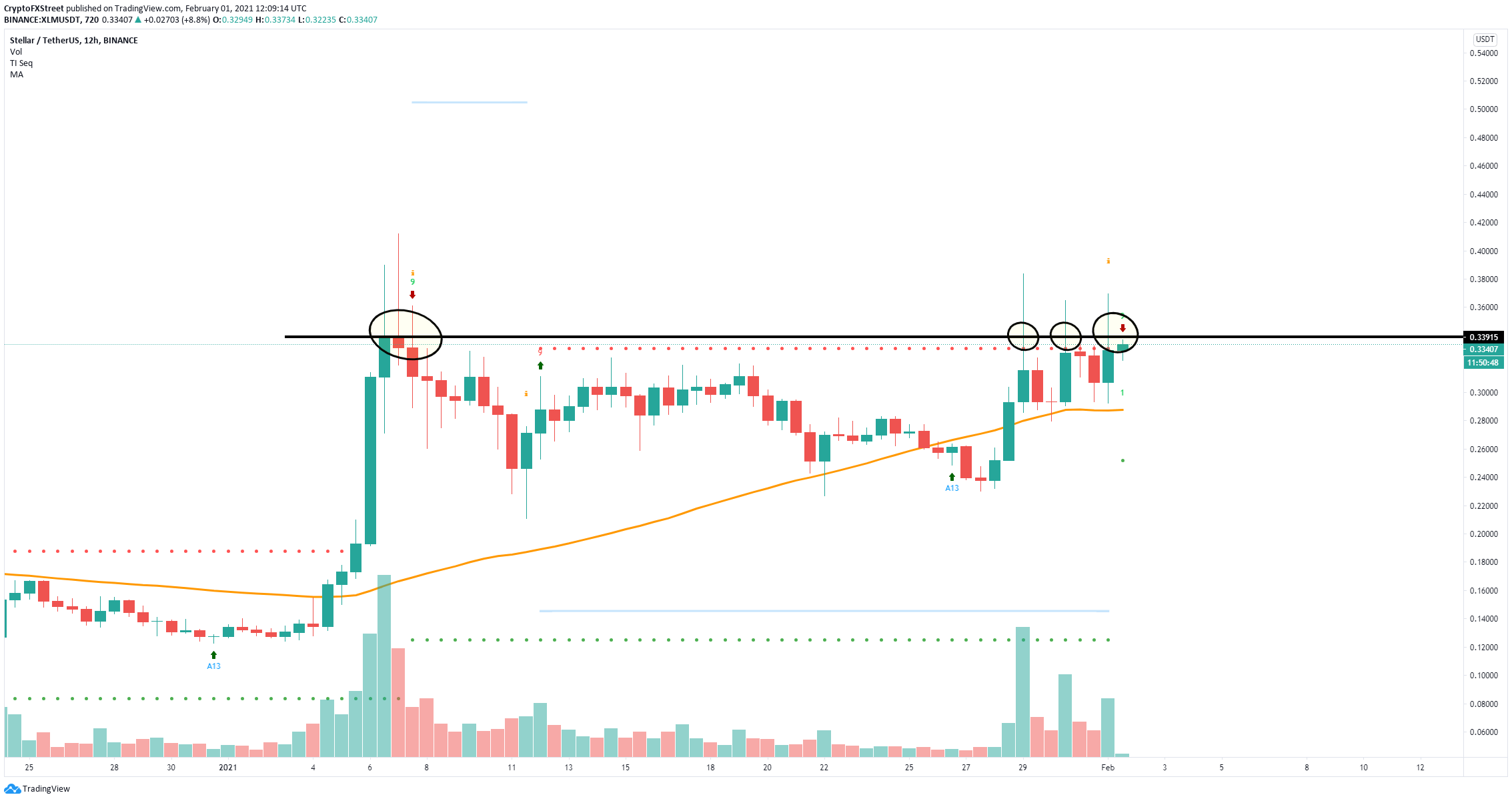

On January 7, XLM price peaked at $0.411 but had a major correction down to $0.21 in the next week. On January 28, the digital asset tried to climb above $0.34 unsuccessfully, closing below there. XLM attempted to crack this resistance level in the following days, again, failing to do so.

Another rejection from $0.34 will lead XLM price down to $0.28

On the 12-hour chart, XLM price has not managed to close above $0.34 in the past month, making this resistance level crucial. Additionally, the TD Sequential indicator has just presented a sell signal which indicates XLM price is most likely going to see another pullback.

XLM/USD 12-hour chart

The 50-SMA located at $0.287 will be the next price target for the bears. Additionally, the social volume of Stellar, which measures the number of mentions of the asset across different social media channels, has seen a significant spike again which often indicates a pullback is underway.

XLM Social Volume

On the other hand, if XLM bulls can finally manage to crack the $0.34 resistance level, XLM price can quickly climb towards the last 2021-high at $0.411 and higher to $0.45 as there are no other barriers on its way.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[13.10.04,%2001%20Feb,%202021]-637477783584891887.png)