XLM price breaks below key support as bears return

- Stellar price action sees bulls losing control over the 38.2% Fibonacci level at $0.34.

- XLM price breaks $0.31 on the downside and could see an acceleration in the Stellar sell-off.

- The double bottom at $0.29 is the only support stopping bears from completing the swing trade.

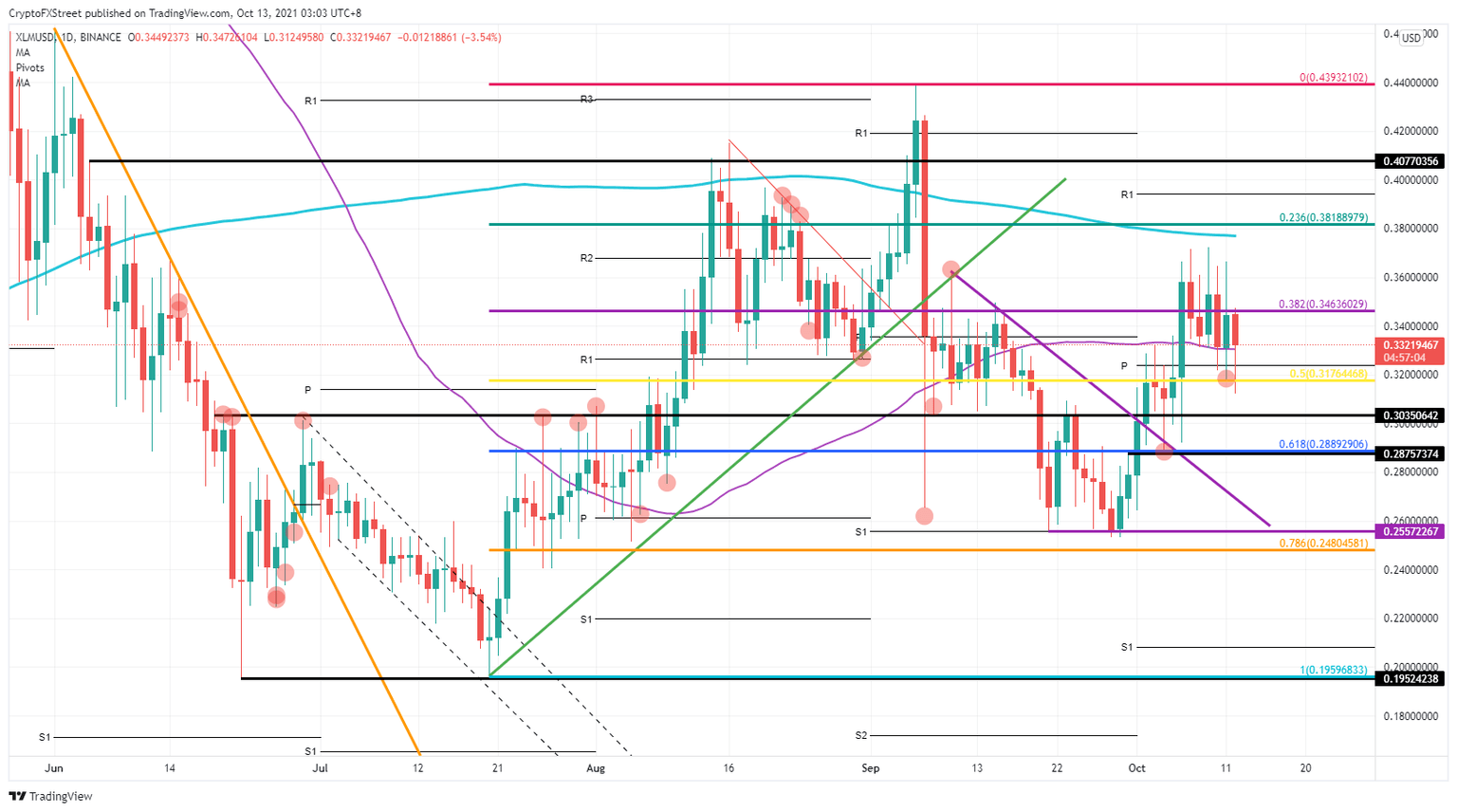

Since the end of September, Stellar (XLM) price action has been on an uptrend, with bulls getting capped just below the 200-day Simple Moving Average (SMA) at $0.37. Price action started to fade quickly on Monday, with the body of the candle not being able to get above the 38.2% Fibonacci level at $0.35. Bears in Stellar broke below the 50% Fibonacci level at $0.31 and tried to target $0.29, which is the 61.8% Fibonacci level.

XLM price to complete retracement to $0.20

Stellar price action got rejected on Tuesday at the 38.2% Fibonacci level around $0.34, which made bulls fade out of XLM. In that rejection, bears saw their opportunity to take out the monthly pivot level and go for a break below the 50% Fibonacci level at $0.31. With this breach, many red flags will be raised, and bulls will want to lock in their profits that have been built up since the beginning of October.

XLM price sees the 55-day SMA holding some importance, but bears broke through it since Sunday. On the downside, bears face quite a few supports, with $0.30 that originates from June 20 and $0.29, which is the 61.8% Fibonacci level in the retracement. Certainly, that last one also holds some short-term importance as the break of September 30 and the rebound on October 4.

XLM/USD daily chart

Stellar bears will want to try and complete the Fibonacci retracement toward $0.20, but that might be a bridge too far as bulls will want to defend their entries at $0.25. At that level, the S1 support from September falls in line.

In case bulls get a little hand from some favorable tailwinds, expect them to reclaim $0.34. Another leg higher would see a test on the 200-day SMA and $0.38. Should XLM price action see even more buyers adding volume to the rally, a retest of $0.44 could be in the cards.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.