XLM Price Analysis: Stellar explodes 200% and faces a potential correction

- XLM price is up by more than 200% since January 3 as XRP loses strength.

- It seems that XRP holders are eying up XLM as a potential investment option.

Cryptocurrency enthusiasts have always debated which coin was better, XLM or XRP. Both have a shared history and founders but there are significant differences like the ownership of coins. After the SEC sued Ripple, it seems that many XRP investors have switched their attention towards XLM as a potential alternative.

XLM price faces short-term correction after massive rally

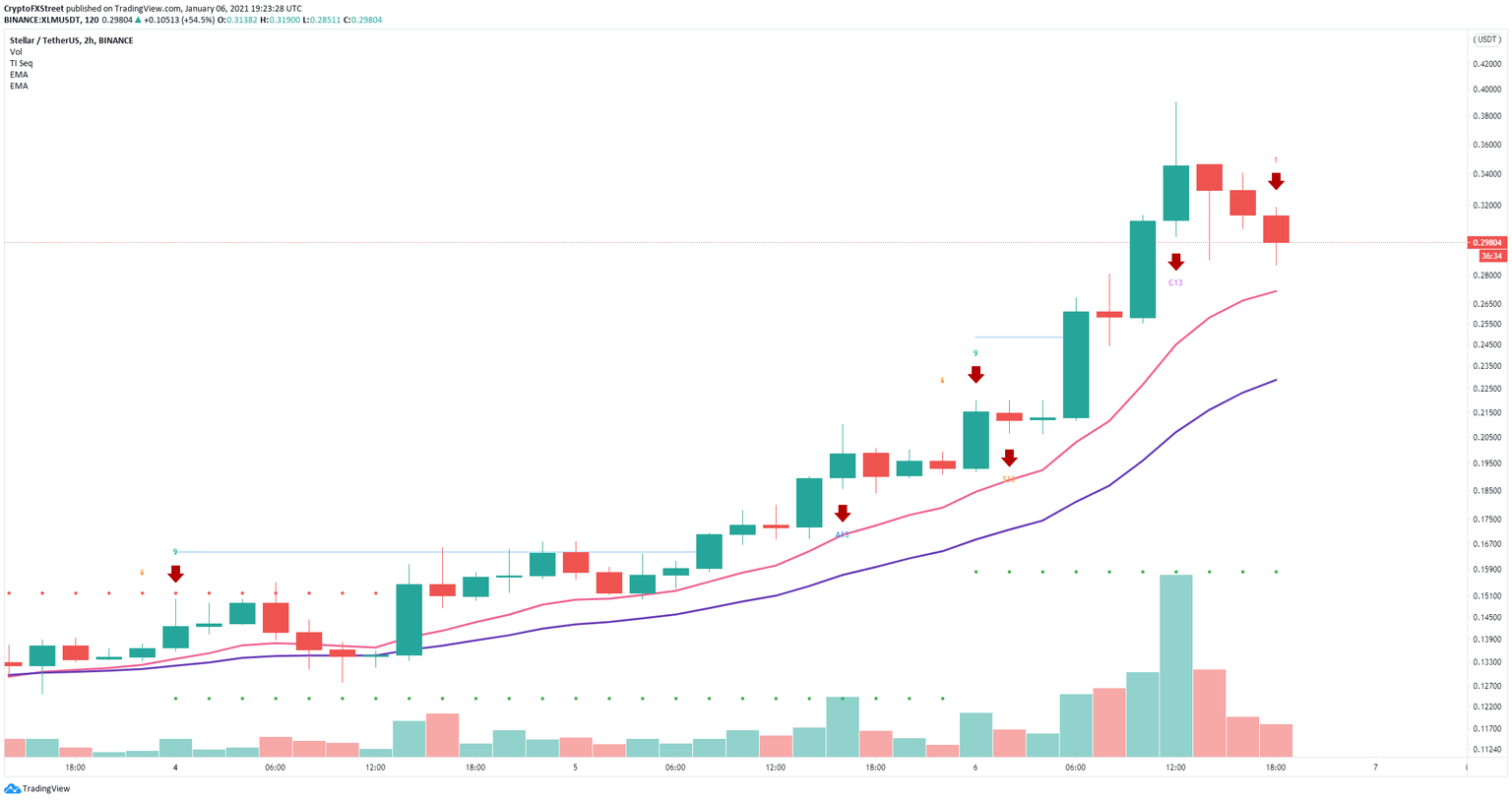

After a 200% rally towards $0.39, XLM seems to be slowing down and faces a potential correction. On the 2-hour chart, the TD Sequential indicator has just presented a sell signal.

XLM/USD 2-hour chart

The validation of this signal can quickly push XLM down to the 26-EMA at $0.231 if the 12-EMA at $0.27 is broken. Below that level XLM can find support at around $0.205 and $0.18.

However, if the bulls can defend the 12-EMA at $0.27, they will face very little support to the upside. XLM price can quickly climb back towards the high of $0.39 and above hitting the psychological level at $0.40

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.