- XLM price remains a leader in the cryptocurrency space, but its price action lags its peers.

- Daily price action remains below the Cloud and has yet to return to any lengthily period inside the Cloud.

- XLM upside potential significantly outweighs any near-term corrective move.

XLM price action has certainly been a disappointment to its supporters. Considering that cryptocurrencies like Dogecoin-killer Shiba Inu have rallied over 60% and Bitcoin itself over 20%, it is easy to see why XLM bulls are frustrated. The frustration is even stronger when you consider that XLM hasn’t made a new all-time high since January 3rd, 2018.

XLM price is laggard amongst its peers – and that represents an opportunity

XLM price appears to be stuck. But, in many ways, its price action indicates what you would likely see in a small-cap or micro-cap biotech stock that is slowly being accumulated – frustrating in the near term but bullish for the future. The accumulation will eventually break out and generate some substantial gains for XLM.

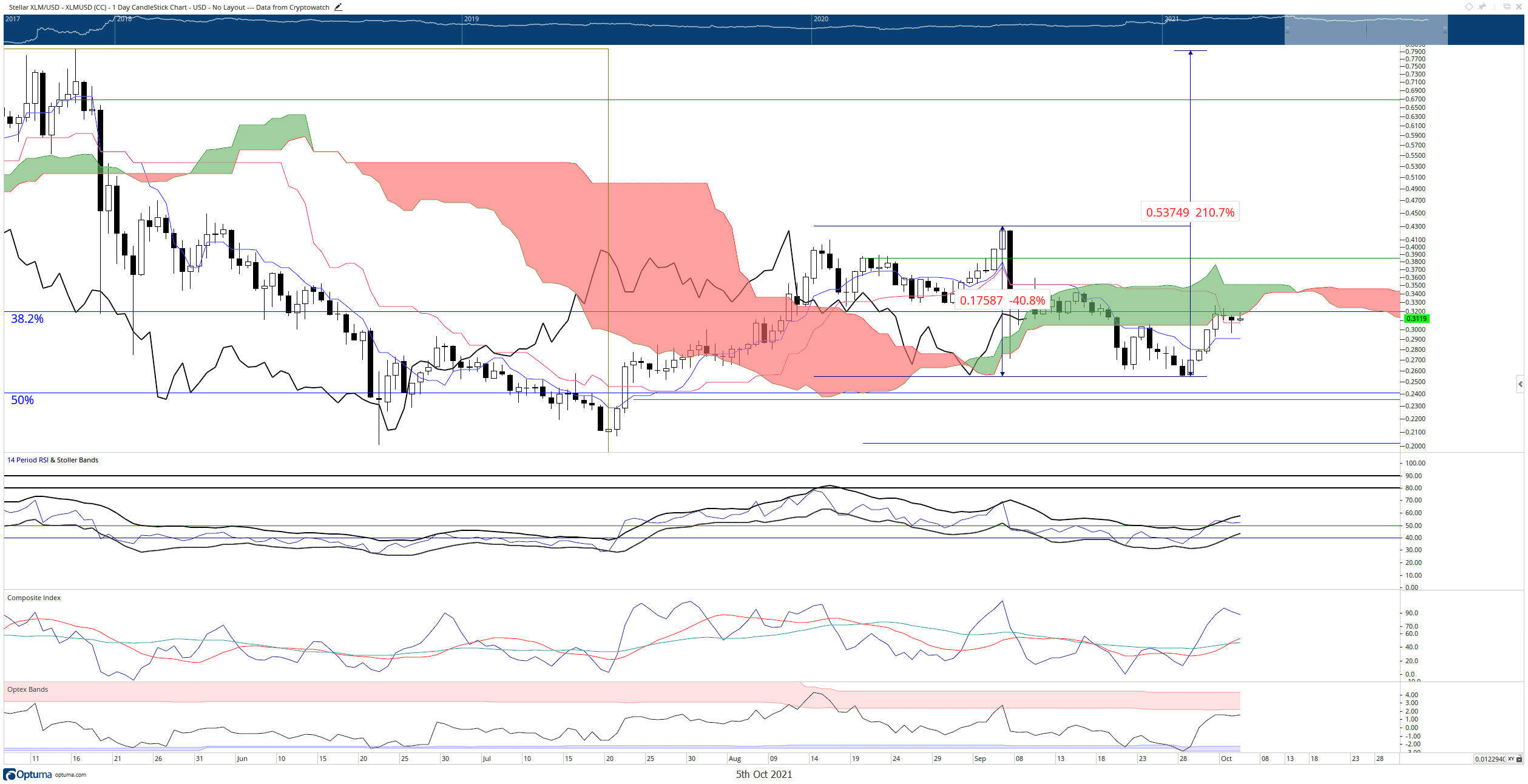

From a technical perspective, XLM needs to close above the Cloud with the Chikou Span above the candlesticks (ideally, also above the Cloud). This can occur if XLM price has a close at or above $0.35. From $0.35, a launching point could be established to propel XLM higher to at least the May 16th swing high at $0.79. Ideally, XLM would continue and finally catch up to the rest of the market and create new all-time highs above $0.92.

XLM/USDT Daily Ichimoku Chart

However, the bullish scenario may not have time to play out and could easily be invalidated. The Optex Bands are already trading at extremes, and there is some minor hidden bearish divergence between the XLM price candlestick chart and the Composite Index. Additionally, the first oversold condition in a bear market of 55 in the Relative Strength Index shows imminent weakness. These oscillator levels appear as XLM faces resistance against the bottom of the Cloud (Senkou Span B) – a warning that lower prices could occur at any time.

Like this article? Help us with some feedback by answering this survey:

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.