XAI price could fall 10% despite metaverse and gaming narratives gaining steam

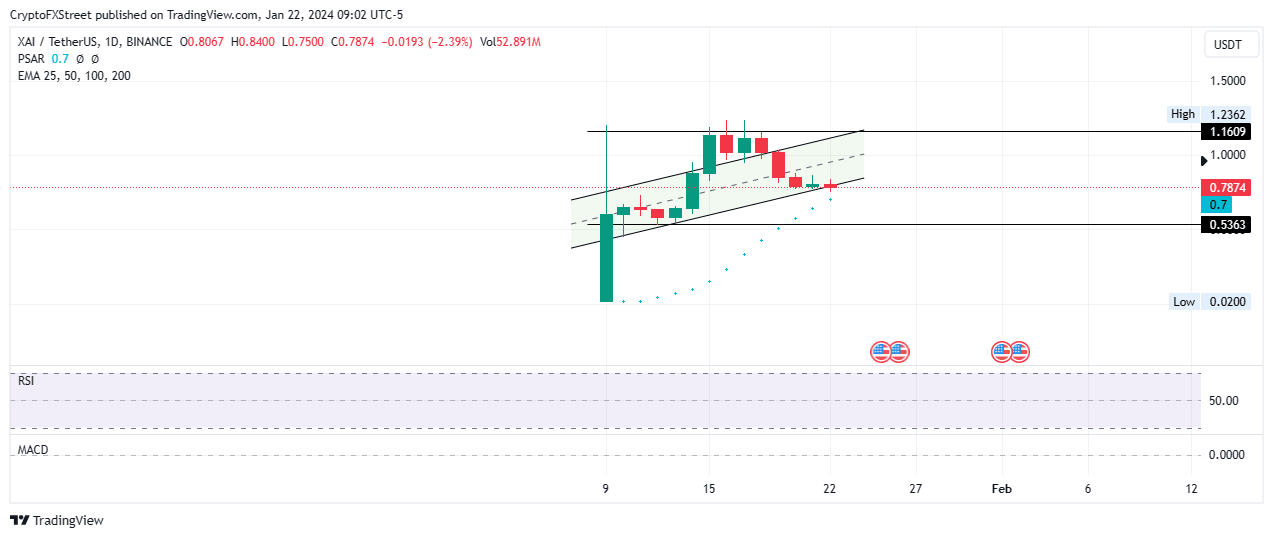

- XAI price tests lower boundary of ascending parallel channel amid growing gaming narrative.

- XAI could drop 10% to test the $0.70 psychological level despite multiple network integrations.

- The bearish thesis will be invalidated once the altcoin breaks above the $1.16 resistance level.

XAI (XAI) price has been consolidating within an ascending parallel channel for the past two weeks. The odds are inclined toward breaking this bullish technical formation as profit-booking intensifies. It comes despite the metaverse and gaming themes steadily gaining ground in the crypto space. The market is also reeling from the Bitcoin spot exchange-traded funds (ETFs) narrative and speculation on similar investment products for Ethereum (ETH).

Also Read: SEC lives up to the expectations as it delays spot ETH ETF; Ethereum price makes no move

XAI price sheds gains due to DWF Labs integration

XAI (XAI) price recorded over 10% in gains on January 17 off the back of integration with DWF Labs. Specifically, the digital asset market maker launched the sentry nodes on XAI Games, marking the world’s first Layer 3 (L3) solution for AAA (high budget or high profile) gaming.

We're happy to announce the launch of our sentry nodes on @XAI_GAMES, the world’s first Layer 3 solution for AAA gaming

— DWF Labs (@DWFLabs) January 17, 2024

As a part of our commitment to XAI's growth and our 2024 strategy to become an active participant in the creation of a more secure and decentralised gaming…

Meanwhile, the XAI ecosystem shows commitment to building on its mission to onboard the next billion gamers into Web3. It boasts additional integrations with Arbitrum (ARB), including ongoing plans to migrate Crypto Unicorns from the ARB chain to the XAI network.

CHAIN MIGRATION ✈️

— Crypto Unicorns (@crypto_unicorns) January 18, 2024

We’re thrilled to announce that we are migrating Crypto Unicorns to @XAI_GAMES!

All CU assets and gameplay logic will be moved over to this exciting L3, featuring quick, secure, and cheap transactions! pic.twitter.com/RtdOoVSuXm

Notably, XAI is an orbit L3 chain built atop the Arbitrum ecosystem. Offchain Labs developed it to bring exceptional scalability with ultra-fast transactions. Gas is already very cheap on XAI, but as part of the expected partnership, all transactions related to Crypto Unicorns will be free.

XAI price outlook as network doubles down on Web 3 expansion

XAI price bullish outlook remains intact, for now, until such a time when the $0.53 support will be breached. The Parabolic Stop and Reverse (SAR) indicator shows this, trailing XAI price from below and providing support at $0.70.

Enhanced seller momentum could see the XAI Network price fall out from support provided by the ascending parallel channel with a possible 10% flop to the $0.70 psychological level.

In a worse case, XAI Network price could roll over to test the $0.53 critical support, nearly 30% below current levels.

XAI/USDT 1-day chart

On-chain metrics to support XAI price bearish outlook

Multiple on-chain metrics from Santiment support the bearish outlook. The volume of XAI tokens is dwindling, moving from a peak of 589.79 million around mid-January to the current 111.15 million. This represents an 81% drop in just about a week. This, backed by the subdued buying power of the XAI bulls, accentuates the bearish thesis.

The subjugation of the buying power is seen by the stagnating percentage of stablecoin total supply held by whales with over $5 million. Between January 20 and 22, this metric dropped from 51.71% to 51.57%, a 0.3% drop in under 48 hours.

XAI Santiment: Volume, Percentage of stablecoin total supply held by whales

Conversely, a resurgence by the bulls could see the XAI Network price push north to test the midline of the channel at the $1.00 psychological level. Further north, the gaming token could test the $1.16 resistance level, or in highly bullish cases, shatter this level and reclaim the range high of $1.23.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B19.25.28%2C%252022%2520Jan%2C%25202024%5D-638415447415771832.png&w=1536&q=95)