Wyckoff accumulation in Bitcoin reveals risk on sentiment ahead

Bitcoin has been in a down trend since November 2021. After a selling climax formed on 18 June 2022, a trading range has been unfolding between 18000-24000.

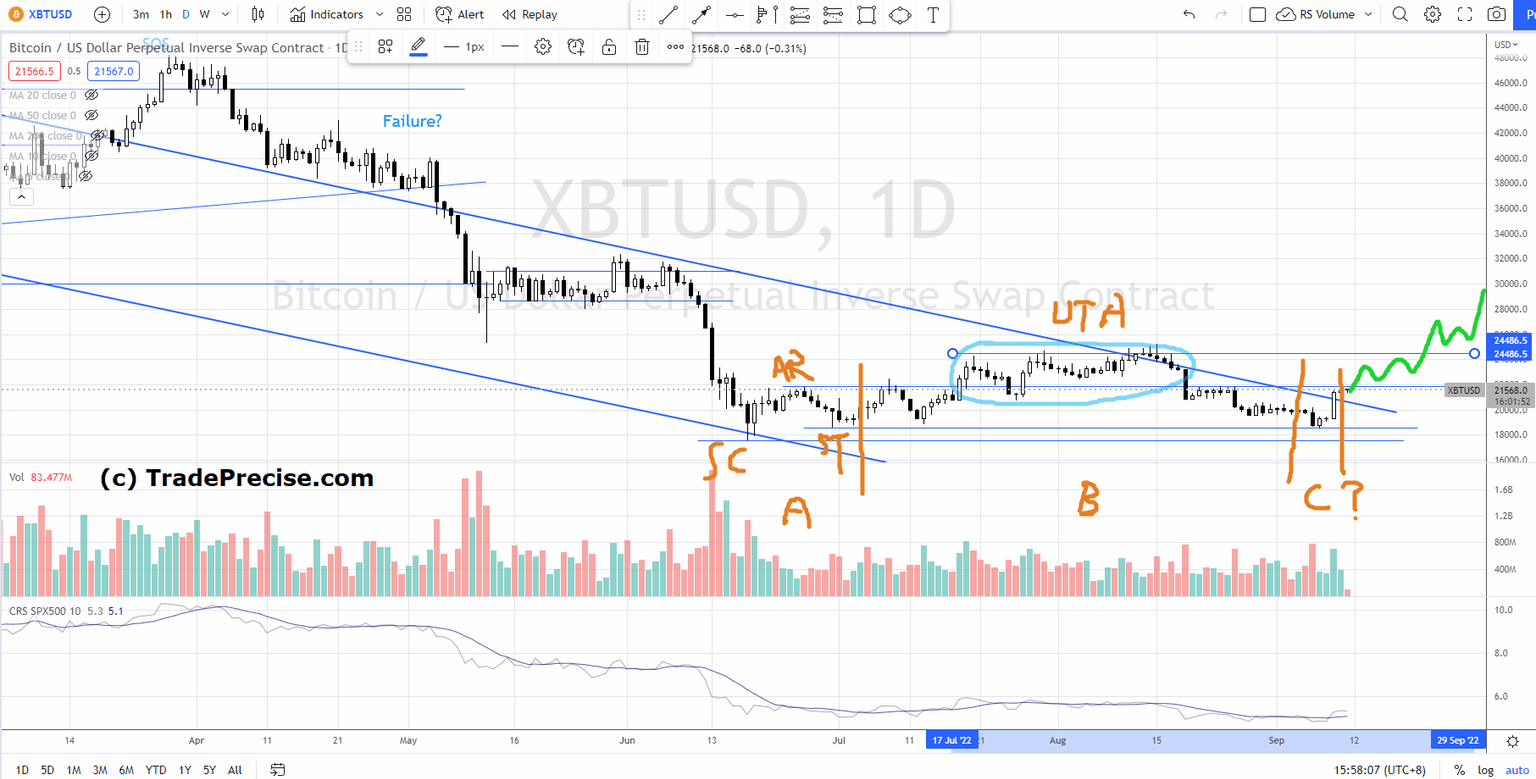

Despite the long-term bearish trend since late last year and the negative headlines against Bitcoin, the price action and the volume as reflected in the recent trading range since June 2022 show bullish characteristics as shown in the analysis using the Wyckoff trading method. Refer to the chart below.

After the selling climax (SC) followed by an automatic rally (AR) in June 2022, Bitcoin entered into a trading range between 18000-22000. The Wyckoff upthrust action showing commitment above the resistance 22000 for 1-month duration is considered strength in the structure, extended the upper trading range to 24000.

The grind down movement since 19 August 2022 showing shortening of the thrust to the downside suggested the selling momentum is exhausted. The spike of the volume on 6 September 2022 with limited movement to downside near 19000 signaled presences of demand at the support area, which is a constructive sign for the bullish scenario.

On 9 September 2022 Bitcoin up 10%, which was the best up day within the trading range formed since June 2022. This could mark a potential phase C in terms of Wyckoff phase analysis where a sign of strength rally could be expected to test the resistance at 24000.

The risk-on sentiment as shown in Bitcoin could further boost up the bullish scenario as explained in the video on how to determine the market bottom using the market internals. The recent market in S&P 500 is very similar to the bear market in 2011, as illustrated in the video below.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.