- MATIC price has breached a historical support level at $1.015 and hints at continuing this trend.

- This development opens the path for a 52% correction to $0.467 and fill the inefficiency present below.

- A three-day candlestick close above $1.750 will create a higher high and invalidate the bearish thesis for Polygon.

MATIC price stumbles its opportunity to bounce, catalyzing a bearish move. This development could cut Polygon’s market value in half.

MATIC price at risk of another crash

MATIC price created a range, extending from $0.745 to $2.435 as it rallied 227% between May 22 and 25. After a sweep of the range low on July 18, 2021, the altcoin rallied 370% and swept the range high on December 21, 2021.

A failure to sustain the momentum led to a 65% crash, which pushed MATIC price down to a crucial support level at $1.015. While a bounce here was likely, the bearish market conditions caused a breakdown of the said level.

As a result, MATIC price is open to crashing another 21% to retest the range low at $0.745. In some cases, if the selling pressure spikes quite a bit, there is a good chance that Polygon could stoop lower.

This downswing could allow market makers to fill the price inefficiency known as the fair value gap at $0.467, bringing the total downswing to 52%

MATIC/USDT 3-day chart

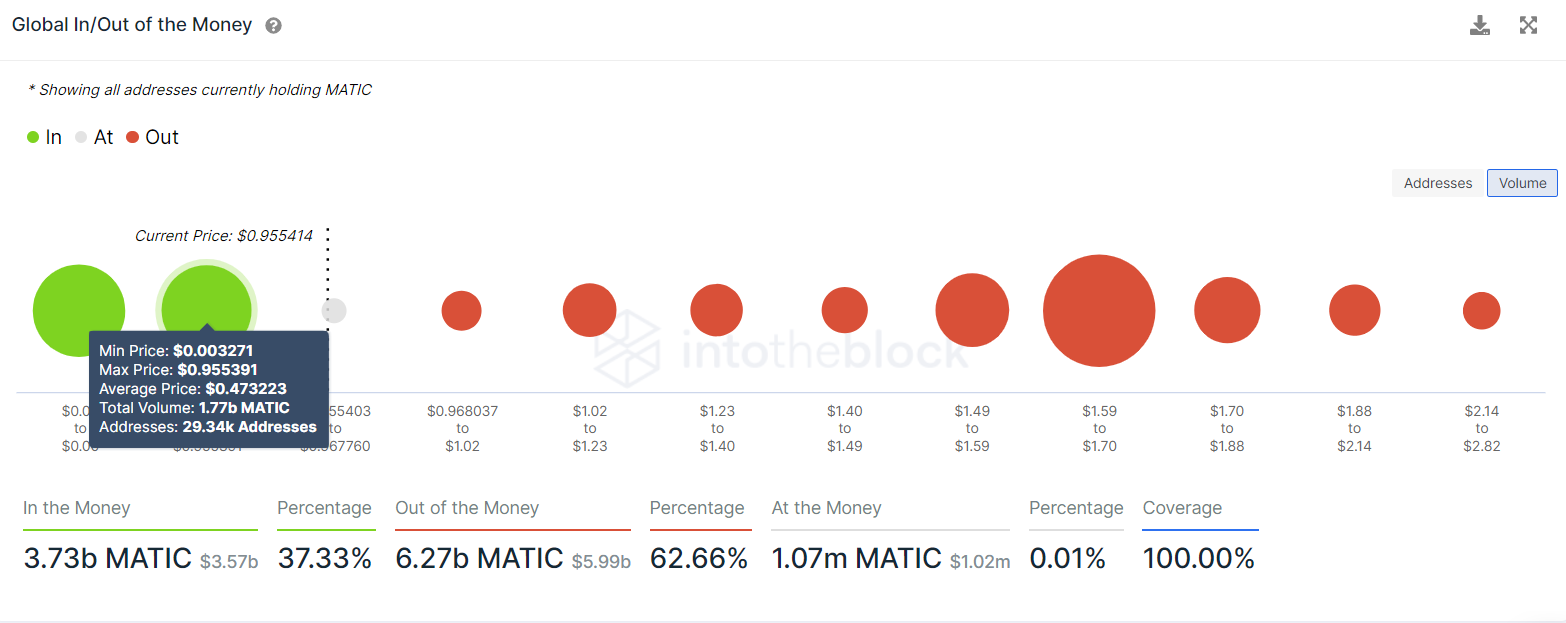

Surprisingly enough, IntoTheBlock’s Global In/Out of the Money (GIOM) model supports this bearish outlook. This index shows that roughly 30,000 addresses that purchased nearly 1.8 billion MATIC tokens at an average price of $0.473 are “Out of the Money.”

Therefore, a dip into this barrier is likely to be supported by these investors, who could decide to buy more, alleviating the selling pressure.

MATIC GIOM

Regardless of the extremely bearish outlook of the crypto market, a reversal or stabilization in Bitcoin price could push altcoins, including polygon higher.

In such a case, a three-day candlestick close above $1.75 will create a higher high and invalidate the bearish thesis for MATIC price. This move could open the path for a further ascent to retest the range high at $2.43.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON DAO powers $1.2B in USDT exchange inflows, igniting stablecoin activity and on-chain volume

TRON DAO facilitates $1.2 billion in USDT exchange inflows over the past seven days as on-chain volume hits $72 billion. An increase in USDT exchange inflows suggests that traders are either preparing to buy the dip or could be covering long positions.

Bitcoin could fall toward the $73,000 mark as tariffs hit the global market

Bitcoin price stabilizes around $76,000 at the time of writing on Wednesday after falling 3.59% the previous day. BTC could face volatility as US President Donald Trump announced tariffs go live on Wednesday, with China’s retaliatory duties on Thursday.

Top 3 gainers NEO, Plume and Story: NEO surges despite Trump's tariff firestorm as investors succumb to extreme fear

Cryptocurrencies are enduring progressive market carnage from the US President Donald Trump administration's incessant tariffs on its trade partners, with some selected altcoins like NEO, Plume and Story (IP) leading the bullish brigade on Wednesday.

Cardano Price Forecast: Bears aiming for a yearly low of $0.50 as on-chain data show increasing dormant wallet activity

Cardano (ADA) price hovers around $0.56 on Wednesday after falling 13% the previous week. Token Terminal data shows that ADA’s fee collection has constantly fallen in 2025, indicating lower blockchain usage and activity.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.