Worldcoin will increase WLD supply by up to 19% in the next six months

Digital identity project Worldcoin will increase the supply of its WLD token by as much as 19% over the next six months through a swathe of private sales to non-United States institutions.

In an April 23 blog post, Worldcoin shared that World Assets — a subsidiary of the Worldcoin Foundation in charge of token issuance — will sell up to 1.5 million WLD, about $8.2 million worth, every week through a series of “private placements to a select group of institutional trading firms” operating outside of the U.S.

Worldcoin will be increasing the supply of its WLD token over the next six months. Source: Worldcoin

“World Assets expects to sell between 0.5 million and 1.5 million WLD per week on average,” Worldcoin wrote. “The circulating supply of WLD will thus increase correspondingly.”

An increase of up to 1.5 million WLD tokens per week for six months equates to a supply increase of 36 million new tokens hitting the market — currently worth around $197 million, per CoinGecko data.

With a current circulating supply of 193 million WLD tokens, the private sales represent an 18.6% increase in the total available supply within the same time frame.

Worldcoin noted it would negotiate with individual trading firms — especially those engaged in competition with each other — to execute private placements as close to “prevailing [WLD] market prices” as possible, to help minimize potential price impact on the token.

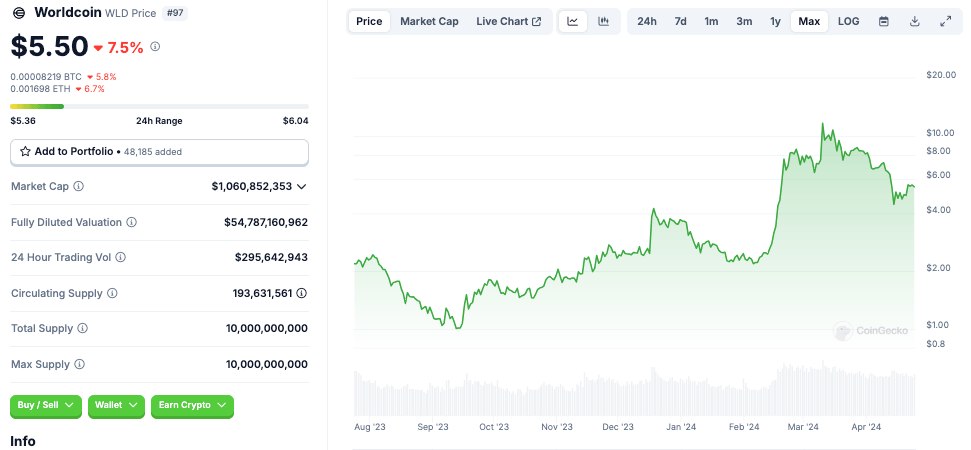

At current prices, Worldcoin touts a market capitalization of $1 billion. However, this pales in comparison to its fully diluted value (FDV) of $54.5 billion — its total value if all tokens were circulating.

Worldcoin is ranked as the 6th largest cryptocurrency by FDV. Source: Coingecko

Launched out of beta in July 2023, Worldcoin was founded by OpenAI CEO Sam Altman, current Wolrdcoin CEO Alex Blania, and Max Novendstern who also serves as the CEO of biometrics research firm Mana.

Worldcoin is a crypto-based digital identity project that markets itself as providing a solution to identity issues brought about by rapid developments in AI as well as ushering in a novel universal basic income model by way of its native WLD token.

Worldcoin users register their identity with the company’s “World App” by scanning their retinas at machines referred to by the company as “Orbs.” In exchange for their biometric data, users are paid around 25 Worldcoin — currently worth around $137.

Buoyed by a wider rally in the price of AI-linked crypto projects, Worldcoin soared 435% from a launch price of $2.17 on July 24 to a peak of $11.74 on March 10.

Worldcoin grew more than 450% in six months. Source: CoinGecko

However, its price has tumbled more than 53% from its all-time high in the last few weeks and is currently changing hands for $5.49.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.